Advance Auto Parts 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

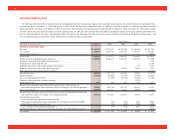

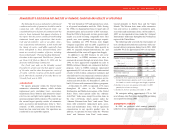

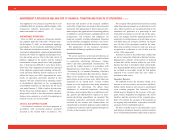

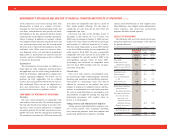

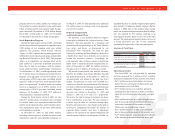

(1) Our fiscal year consists of 52 or 53 weeks ending on the

Saturday nearest to December 31. All fiscal years presented

are 52 weeks, with the exception of 2003, which consists of

53 weeks.

(2) The statement of operations data for each of the years presented

reflects the operating results of the wholesale distribution seg-

ment as discontinued operations.

(3) Represents restocking and handling fees associated with the

return of inventory as a result of our supply chain initiatives.

(4) Selling, general and administrative expenses exclude certain

charges disclosed separately and discussed in notes (5), (6),

(7), (8) and (9) below.

(5) Represents costs of relocating certain equipment held at facil-

ities closed as a result of our supply chain initiatives.

(6) Represents the devaluation of certain property held for sale,

including the $1.6 million charge taken in the first quarter of

2001 and a $10.7 million charge taken in the fourth quarter

of 2001.

(7) Represents expenses related primarily to lease costs associated

with 27 Advance Auto Parts stores identified to be closed at

December 29, 2001 as a result of the Discount Auto Parts, or

Discount, acquisition.

(8) Represents certain expenses related to, among other things,

overlapping administrative functions and store conversions as

a result of the Discount acquisition.

(9) Represents non-cash compensation expense related to stock

options granted to certain of our Team Members, including a

charge of $8.6 million in the fourth quarter of 2001 related to

variable provisions of our stock option plans that were in

place when we were a private company and eliminated in 2001.

(10) Shares outstanding for each of the years presented gives effect

to a 3-for-2 stock split effectuated by us in the form of a 50%

stock dividend distributed on September 23, 2005 and a 2-for-1

stock split effectuated by us in the form of a 100% stock

dividend distributed on January 2, 2004.

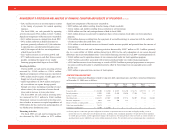

(11) Inventory turnover is calculated as cost of sales divided by the

average of beginning and ending inventories. The fiscal 2003

cost of sales excludes the effect of the 53rd week in the amount

of $34.3 million. The fiscal 2001 amounts were calculated

giving effect to the Discount retail net sales and number of

stores for the period from December 2, 2001 (the acquisition

date) through December 29, 2001.

(12) Inventory per store is calculated as ending inventory divided

by ending store count. Ending inventory used in this calculation

excludes certain inventory related to the wholesale distribution

segment with the exception of fiscal 2003 and fiscal 2004.

(13) Accounts payable to inventory ratio is calculated as ending

accounts payable divided by ending inventory. Beginning in

fiscal 2004, as a result of our new vendor financing program, we

aggregate financed vendor accounts payable with accounts

payable to calculate our accounts payable to inventory ratio.

(14) Net working capital is calculated by subtracting current liabil-

ities from current assets.

(15) Capital expenditures for 2001 exclude $34.1 million for

our November 2001 purchase of the Gallman, Mississippi

distribution facility from the lessor in connection with the

Discount acquisition.

(16) Net debt includes total debt and bank overdrafts, less cash and

cash equivalents.

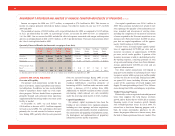

(17) Comparable store sales is calculated based on the change in

net sales starting once a store has been open for 13 complete

accounting periods (each period represents four weeks).

Relocations are included in comparable store sales from the

original date of opening. Stores acquired in the Discount

acquisition are included in the comparable sales calculation

beginning in December 2002, which was 13 complete

accounting periods after the acquisition date of November 28,

2001. We do not include net sales from the 36 Western Auto

retail stores in our comparable store calculation as a result of

their unique product offerings, including automotive service

and tires. In 2003, the comparable store sales calculation

included sales from our 53rd week compared to our first week

of operation in 2003 (the comparable calendar week). In

2004, as a result of the 53rd week in 2003, the comparable

store sales calculation excludes week one of sales from 2003.

(18) Closed stores in 2002 include 133 Discount and Advance

stores closed as part of the integration of Discount.

(19) Total store square footage excludes the square footage of the

Autopart International, or AI, stores.

(20) Average net sales per store is calculated as net sales divided

by the average of beginning and ending number of stores for

the respective period. The fiscal 2005 calculation excludes

the effect of the AI stores. The fiscal 2003 net sales exclude

the effect of the 53rd week in the amount of $63.0 million.

The fiscal 2001 amounts were calculated giving effect to the

Discount retail net sales and number of stores for the period

from December 2, 2001 (the acquisition date) through

December 29, 2001.

(21) Average net sales per square foot is calculated as net sales

divided by the average of the beginning and ending total store

square footage for the respective period. The fiscal 2005

calculation excludes the effect of the AI stores. The fiscal

2003 net sales exclude the effect of the 53rd week in the

amount of $63.0 million. The fiscal 2001 amounts were

calculated giving effect to the Discount retail net sales and

number of stores for the period from December 2, 2001 (the

acquisition date) through December 29, 2001.

SELECTED FINANCIAL DATA

(continued)

20