Advance Auto Parts 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Revenue Recognition and Trade Receivables

The Company recognizes merchandise revenue at

the point of sale to customers. The Company estab-

lishes reserves for returns and allowances at the time

of sale based on current sales levels and historical

return rates. The majority of sales are made for cash;

however, the Company extends credit to certain com-

mercial customers through a third-party provider of

private label credit cards. In August 2005, the

Company began using a new third party to process its

private label credit card transactions subsequent to

the sale of its existing credit card portfolio. Under the

new arrangement, receivables under the private label

credit card program are generally transferred to a new

third-party provider with no recourse. The Company

will continue to transfer a limited amount of receiv-

ables with recourse. The Company provides an

allowance for doubtful accounts on receivables sold

with recourse based upon factors related to credit risk

of specific customers, historical trends and other infor-

mation. Receivables sold with recourse are accounted

for as a secured borrowing. Receivables and the related

secured borrowings under the private label credit card

were $587 and $26,898 at December 31, 2005 and

January 1, 2005, respectively, and are included in

accounts receivable and other current liabilities,

respectively, in the accompanying consolidated

balance sheets.

Earnings Per Share of Common Stock

Basic earnings per share of common stock has

been computed based on the weighted-average number

of common shares outstanding during the period.

Diluted earnings per share of common stock reflects

the increase in the weighted-average number of

common shares outstanding assuming the exercise of

outstanding stock options, calculated on the treasury

stock method. There were 517, 510 and 89 antidilutive

options for the fiscal years ended December 31, 2005,

January 1, 2005 and January 3, 2004, respectively.

Stock Split

On August 10, 2005, the Company’s Board of

Directors declared a 3-for-2 stock split of the

Company’s common stock, effected as a 50% stock

dividend. The dividend was distributed on

September 23, 2005 to holders of record as of

September 9, 2005 and the Company’s stock began

trading on a post-split basis on September 26, 2005.

All share and per share amounts in the accompany-

ing consolidated financial statements have been

restated to reflect the effects of the stock split.

Accounting for Stock-Based Compensation

The Company has stock-based compensation plans

including fixed stock option plans, deferred stock

units and an employee stock purchase plan. As per-

mitted under Statement of Financial Accounting

Standard, or SFAS, No. 123, “Accounting for Stock-

Based Compensation,” the Company accounts for its

stock options using the intrinsic value method pre-

scribed in Accounting Principles Board, or APB,

Opinion No. 25, “Accounting for Stock Issued to

Employees,” or APB No. 25. Under APB No. 25,

compensation cost for stock options is measured as

the excess, if any, of the market price of the

Company’s common stock at the measurement date

over the exercise price. Accordingly, the Company

has not recognized compensation expense on the

issuance of its fixed options as the exercise price

equaled the fair market value of the underlying stock

on the grant date. In addition, the Company has not

recognized compensation expense under APB No. 25

for its employee stock purchase plan since it is a plan

that qualifies under Section 423 of the Internal

Revenue Code of 1986, as amended. The issuance of

deferred stock units results in compensation expense

as discussed in the Equity Stock-Based Compensation

footnote (Note 20).

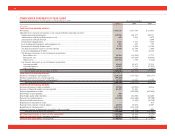

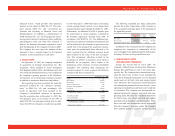

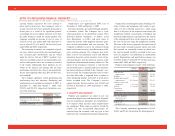

As required by SFAS No. 148, “Accounting for

Stock-Based Compensation–Transition and Dis-

closure an amendment of FASB Statement No. 123,”

the following table reflects the impact on net income

and earnings per share as if the Company had adopt-

ed the fair value method of recognizing stock-based

compensation costs as prescribed by SFAS No. 123.

2005 2004 2003

Net income, as reported ......... $234,725 $187,988 $124,935

Add: Total stock-based

employee compensation

expense included in

reported net income,

net of related tax effects.... 225 304 —

Deduct: Total stock-based

employee compensation

expense determined

under fair value based

method for all awards,

net of related tax effects.... (9,622) (5,977) (4,636)

Pro forma net income ............ $225,328 $182,315 $120,299

Net income per share:

Basic, as reported................... $ 2.17 $ 1.70 $ 1.14

Basic, pro forma .................... 2.08 1.64 1.10

Diluted, as reported................ 2.13 1.66 1.11

Diluted, pro forma.................. 2.04 1.61 1.07

Advance Auto Parts

I

Annual Report 2005

I

41