Advance Auto Parts 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advance Auto Parts

I

Annual Report 2005

I

31

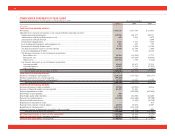

under our vendor supply agreements nor are our open pur-

chase orders for goods and services binding agreements.

Accordingly, we have excluded open purchase orders from

this table. The purchase obligations consist of the amount of

fuel required to be purchased by us under our fixed price fuel

supply agreement and certain commitments for training and

development. These agreements expire in May 2006 and

March 2008, respectively.

(2) Primarily includes employee benefits accruals, restructuring

and closed store liabilities and deferred income taxes for

which no contractual payment schedule exists.

(3) Represents contingent portion of AI purchase price payable

no later than April 1, 2006 based upon AI satisfying certain

earnings before interest, taxes, depreciation and amortization

targets met through December 31, 2005.

LONG-TERM DEBT

Senior Credit Facility. Our senior credit facility

provides for a tranche A term loan and a tranche B

term loan. During fiscal 2004, we used proceeds

from these term loans to refinance our tranche D and

E term loans and revolver under our previous facility.

Additionally, this new senior credit facility provides

for a $100 million delayed draw term loan, which was

available exclusively for stock buybacks under our

stock repurchase program, and a $200.0 million

revolving facility, or the revolver (which provides for

the issuance of letters of credit with a sub limit of

$70.0 million). In conjunction with the fiscal 2004

refinancing, we wrote-off deferred financing costs

related to the previous term loans in accordance with

EITF Issue No. 96-19, “Debtor’s Accounting for a

Modification or Exchange of Debt Instruments.” The

write-off of these costs combined with additional

costs required to establish the new facility resulted in

a loss on extinguishment of debt of $2.8 million

in the accompanying consolidated statements of

operations for the year ended January 1, 2005. Earlier

during fiscal 2004, we made $105.0 million of repay-

ments on our previous senior credit facility prior to

their scheduled maturity. In conjunction with these

partial repayments, we wrote-off $0.4 million, which

is also classified as a loss on extinguishment of debt

in the accompanying consolidated statement of

operations for the year ended January 1, 2005.

At December 31, 2005, our senior credit facility

consisted of (1) a tranche A term loan facility with a

balance of $170.0 million, a tranche B term loan

facility with a balance of $168.3 million, a delayed

draw term loan with a balance of $100.0 million and

(2) a $200.0 million revolving credit facility (includ-

ing a letter of credit sub facility) (of which $145.4

million was available as a result of $54.6 million in

letters of credit outstanding). The senior credit

facility is jointly and severally guaranteed by all of

our domestic subsidiaries and is secured by all of our

assets and the assets of our existing and future

domestic subsidiaries.

The tranche A term loan currently requires sched-

uled repayments of $7.5 million on March 31, 2006

and quarterly thereafter through December 31, 2006,

$10.0 million on March 31, 2007 and quarterly

thereafter through December 31, 2007, $12.5 million

on March 31, 2008 and quarterly thereafter through

June 30, 2009 and $25.0 million due at maturity on

September 30, 2009. The tranche B term loan cur-

rently requires scheduled repayments of $0.4 million

on March 31, 2006 and quarterly thereafter, with a

final payment of $160.7 million due at maturity on

September 30, 2010. The delayed draw term loan

currently requires scheduled repayments of 0.25% of

the aggregate principal amount outstanding on

March 31, 2006 and quarterly thereafter, with a final

payment due at maturity on September 30, 2010. The

revolver expires on September 30, 2009.

The interest rates on the tranche A and B term

loans, the delayed draw term loan and the revolver are

based, at our option, on an adjusted LIBOR rate, plus

a margin, or an alternate base rate, plus a margin. The

current margin for the tranche A term loan and

revolver is 1.25% and 0.25% per annum for the

adjusted LIBOR and alternate base rate borrowings,

respectively. The current margin for the tranche B

term loan and the delayed draw term loan is 1.50%

and 0.50% per annum for the adjusted LIBOR and

alternate base rate borrowings, respectively.

Additionally, a commitment fee of 0.25% per annum

is charged on the unused portion of the revolver,

payable in arrears.

In March 2005 we entered into three interest rate

swap agreements on an aggregate of $175 million of

debt under our senior credit facility. Through the

first swap we fixed our LIBOR rate at 4.153% on

$50 million of debt for a term of 48 months, expir-

ing March 2009. Through the second swap we fixed

our LIBOR rate at 4.255% on $75 million of debt for

a term of 60 months, expiring February 2010. In

March 2006, the third swap will fix our LIBOR rate

at 4.6125% on $50 million of debt for a term of 54

months, expiring in September 2010.

Additionally, we had entered into two additional

interest rate swap agreements in March 2003 to limit

our cash flow risk on variable rate debt. The first

swap allows the Company to fix its LIBOR rate at

2.269% on $75 million of debt for a term of 36

months, expiring in March 2006. The second swap,

which fixed our LIBOR rate at 1.79% on $50 million

of debt, expired in March 2005.