Advance Auto Parts 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

program allows us to reduce further our working cap-

ital invested in current inventory levels and finance

future inventory growth. Our capacity under this pro-

gram increased $50 million to $150 million during

fiscal 2005. At December 31, 2005, $119.4 million

was payable to the bank by us under this program.

Stock Repurchase Program

During the third quarter of fiscal 2005, our Board

of Directors authorized a program to repurchase up to

$300 million of our common stock plus related

expenses. The program, which became effective

August 15, 2005, replaced the remaining portion of a

$200 million stock repurchase program authorized by

our Board of Directors in fiscal 2004. The program

allows us to repurchase our common stock on the

open market or in privately negotiated transactions

from time to time in accordance with the require-

ments of the Securities and Exchange Commission.

As of December 31, 2005, we had repurchased a total

of 1.5 million shares of common stock under the new

program, at an aggregate cost of $59.5 million, or an

average price of $38.84 per share, excluding related

expenses. Under our previous stock repurchase pro-

gram, we repurchased 7.0 million shares of common

stock at an aggregate cost of $189.2 million, or an

average price of $26.91 per share, excluding related

expenses. At December 31, 2005, $0.9 million of

stock repurchases remained unsettled.

During the third quarter of fiscal 2005, we also

retired 7.1 million shares of common stock, of which

0.1 million shares were repurchased under the $300

million stock repurchase plan, and 7.0 million shares

were repurchased under our previous $200 million

stock repurchase program.

At December 31, 2005, we had $240.5 million,

excluding related expenses, available for future stock

repurchases under the stock repurchase program. As

of March 13, 2006, we had repurchased an additional

0.4 million shares of common stock at an aggregate

cost of $18.7 million.

Deferred Compensation

and Postretirement Plans

We maintain a non-qualified deferred compen-

sation plan established for certain of our key Team

Members. This plan provides for a minimum and

maximum deferral percentage of the Team Member

base salary and bonus, as determined by our

Retirement Plan Committee. We fund the plan

liability by remitting the Team Members’ deferrals to

a Rabbi Trust where these deferrals are invested in

certain life insurance contracts. Accordingly, the

cash surrender value on these contracts is held in the

Rabbi Trust to fund the deferred compensation lia-

bility. At December 31, 2005, the liability related to

this plan was $2.7 million, all of which is current.

We provide certain health care and life insurance

benefits for eligible retired Team Members through

our postretirement plan. At December 31, 2005, our

accrued benefit cost related to this plan was $16.3

million. The plan has no assets and is funded on a

cash basis as benefits are paid/incurred. The discount

rate that we utilize for determining our postretirement

benefit obligation is actuarially determined. The

discount rate utilized at December 31, 2005 and

January 1, 2005 was 5.5% and 5.75%, respectively.

We reserve the right to change or terminate the bene-

fits or contributions at any time. We also continue to

evaluate ways in which we can better manage these

benefits and control costs. Any changes in the plan or

revisions to assumptions that affect the amount of

expected future benefits may have a significant

impact on the amount of the reported obligation and

annual expense. Effective second quarter of 2004, we

amended the plan to exclude outpatient prescription

drug benefits to Medicare eligible retirees effective

January 1, 2006. Due to this negative plan amend-

ment, our accumulated postretirement benefit obliga-

tion was reduced by $7.6 million, resulting in an

unrecognized negative prior service cost in the same

amount. The unrecognized negative prior service cost

is being amortized over the 13-year estimated

remaining life expectancy of the plan participants.

Analysis of Cash Flows

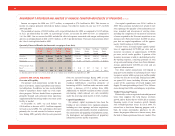

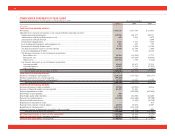

Fiscal Year

(in millions) 2005 2004 2003

Cash flows from operating activities.... $325.2 $263.7 $355.9

Cash flows from investing activities..... (302.8) (166.8) (85.5)

Cash flows from financing activities .... (37.9) (52.1) (272.8)

Net (decrease) increase in cash and

cash equivalents................................ $ (15.5) $ 44.8 $ (2.4)

Operating Activities

For fiscal 2005, net cash provided by operating

activities increased $61.5 million to $325.2 million.

Significant components of this increase consisted of:

• $61.8 million increase from higher net income

before the non-cash impact of depreciation and

amortization over fiscal 2004;

• $37.8 million increase in cash flow, primarily

resulting from the reduction in trade receivables

upon the sale of our private label credit card port-

folio;

• $42.8 million decrease as a result of higher inven-

tory levels needed for our Northeast distribution

center and expansion of the number of stores

which carry an extended mix of parts;

• $25.7 million increase in other assets primarily

due to timing in the payment of our monthly rent;

• $15.9 million increase in accounts payable reflective

of the increase in inventory discussed above; and

Advance Auto Parts

I

Annual Report 2005

I

29