Advance Auto Parts 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

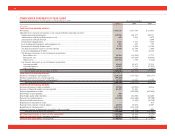

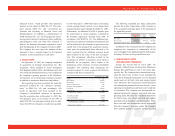

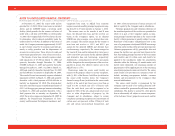

7. RECEIVABLES:

Receivables consist of the following:

December 31, January 1,

2005 2005

Trade ................................................... $13,733 $ 34,654

Vendor................................................. 63,161 60,097

Installment .......................................... 5,622 7,506

Insurance recovery.............................. 13,629 5,877

Other ................................................... 3,230 1,938

Total receivables ................................. 99,375 110,072

Less: Allowance

for doubtful accounts ..................... (4,686) (8,103)

Receivables, net .................................. $94,689 $101,969

In August 2005, the Company began using a new

third party provider to process its private label credit

card transactions related to its commercial business.

In conjunction with this transition, the Company sold

the credit card portfolio for proceeds totaling

$33,904. Accordingly, the Company’s previously

recorded receivable balance recognized under SFAS

No. 140, “Accounting for Transfers and Servicing of

Financial Assets,” of $34,684 and the corresponding

allowance for doubtful accounts of $2,580 were

reduced to zero. Additionally, the Company repaid its

borrowings previously secured by these trade receiv-

ables; the overall impact was a benefit of $1,800

recorded as a reduction of bad debt expense.

8. INVENTORIES, NET:

Inventories are stated at the lower of cost or market,

cost being determined using the last-in, first-out

(“LIFO”) method for approximately 93% and 92% of

inventories at December 31, 2005 and January 1,

2005, respectively. Under the LIFO method, the

Company’s cost of sales reflects the costs of the most

currently purchased inventories while the inventory

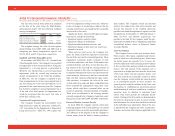

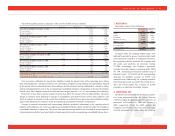

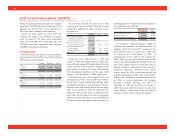

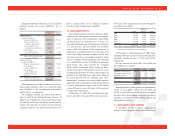

The following table presents a summary of the activity for both of these liabilities:

Severance Relocation Other Exit Costs Total

Closed Store Liabilities, December 28, 2002........................ $ — $ — $ 8,892 $ 8,892

New provisions ......................................................................... — — 1,190 1,190

Change in estimates.................................................................. — — 1,522 1,522

Reserves utilized ...................................................................... — — (5,197) (5,197)

Closed Store Liabilities, January 3, 2004 ............................. — — 6,407 6,407

New provisions ......................................................................... — — 1,141 1,141

Change in estimates.................................................................. — — 580 580

Reserves utilized ...................................................................... — — (3,541) (3,541)

Closed Store Liabilities, January 1, 2005 ............................. — — 4,587 4,587

New provisions ......................................................................... — — 2,345 2,345

Change in estimates.................................................................. — — 465 465

Reserves utilized ...................................................................... — — (3,890) (3,890)

Closed Store Liabilities, December 31, 2005........................ $ — $ — $ 3,507 $ 3,507

Restructuring Liabilities, December 28, 2002 ..................... 1,652 25 2,626 4,303

Change in estimates.................................................................. — — (1,178) (1,178)

Reserves utilized ...................................................................... (1,598) (25) (452) (2,075)

Restructuring Liabilities, January 3, 2004........................... 54 — 996 1,050

Change in estimates.................................................................. — — (86) (86)

Reserves utilized ...................................................................... (54) — (486) (540)

Restructuring Liabilities, January 1, 2005........................... — — 424 424

Change in estimates.................................................................. — — 132 132

Reserves utilized ...................................................................... — — (249) (249)

Restructuring Liabilities, December 31, 2005 ..................... $ — $ — $ 307 $ 307

Total Closed Store and

Restructuring Liabilities at December 31, 2005 ............. $ — $ — $ 3,814 $ 3,814

New provisions established for closed store liabilities include the present value of the remaining lease obliga-

tions and management’s estimate of future costs of insurance, property tax and common area maintenance reduced

by the present value of estimated revenues from subleases and lease buyouts and are established by a charge to selling,

general and administrative costs in the accompanying consolidated statements of operations at the time the facilities

actually close. The Company currently uses discount rates ranging from 4.5% to 7.8% for estimating these liabilities.

From time to time these estimates require revisions that affect the amount of the recorded liability. The above

change in estimates relate primarily to changes in assumptions associated with the revenue from subleases. The

effect of changes in estimates for the closed store liabilities is netted with new provisions and included in selling,

general and administrative expenses in the accompanying consolidated statements of operations.

Changes in estimates associated with restructuring liabilities resulted in adjustments to the carrying value of

property and equipment, net on the accompanying consolidated balance sheets and did not affect the Company’s

consolidated statement of operations. The closed store and restructuring liabilities are recorded in accrued expenses

(current portion) and other long-term liabilities (long-term portion) in the accompanying consolidated balance sheets.

Advance Auto Parts

I

Annual Report 2005

I

47