Advance Auto Parts 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• $20.2 million increase in accrued expenses related

to the timing of payments for normal operating

expenses.

For fiscal 2004, net cash provided by operating

activities decreased $92.2 million to $263.7 million.

Significant components of this decrease consisted of:

• $63.1 million increase in earnings from fiscal 2003;

• $47.2 million reduction in deferred income tax

provision, primarily reflective of (1) the reduction

in operating loss carryforwards from prior years

and (2) the impact of the loss on extinguishment

of debt from fiscal 2003;

• $22.8 million increase in inventory growth; and

• $77.9 million decrease in cash flow from accounts

payable, excluding the impact of our vendor

financing program which began in fiscal 2004.

Investing Activities

For fiscal 2005, net cash used in investing activities

increased by $136.0 million to $302.8 million.

Significant components of this increase consisted of:

• $99.3 million used to acquire AI and Lappen Auto

Supply, net of cash acquired; and

• capital expenditures of $36.4 million used prima-

rily to accelerate our square footage growth

through new stores (including ownership of select-

ed new stores), the acquisition of certain leased

stores and an increase in store relocations.

For fiscal 2004, net cash used in investing activi-

ties increased by $81.3 million to $166.8 million.

The primary increase in cash used in investing activ-

ities related to an increase in capital expenditures of

$50.0 million for the construction and preparation of

our Northeastern distribution center.

Financing Activities

For fiscal 2005, net cash used in financing activi-

ties decreased by $14.2 million to $37.9 million.

30

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

Significant components of this decrease consisted of:

• $40.9 million cash inflow resulting from the timing of bank overdrafts;

• $161.2 million cash outflow resulting from a reduction in net borrowings;

• $105.0 million used for early extinguishment of debt in fiscal 2004;

• $44.8 million decrease in cash used to repurchase shares of our common stock under our stock repurchase

program;

• $32.6 million decrease resulting from the repayment of secured borrowings in connection with the reduction

of trade receivables discussed above; and

• $13.8 million in cash from the increase in financed vendor accounts payable and proceeds from the exercise of

stock options.

For fiscal 2004, net cash used in financing activities decreased by $220.7 million to $52.1 million, primarily

due to a cash outflow of $406.4 million during fiscal 2003 for the early redemption of our senior discount

debentures and senior subordinated notes. Cash used for financing activities in fiscal 2004 consisted primarily of:

• $146.4 million used to repurchase shares of our common stock under our stock repurchase program;

• a $56.9 million cash inflow associated with inventory purchased under our vendor financing program;

• a $25.0 million increase in net borrowings as a result of $105.0 million in principal prepayments on our previ-

ous senior credit facility prior to scheduled maturity, offset by borrowings from our amended senior credit

facility; and

• $20.5 million in proceeds from exercises of stock options.

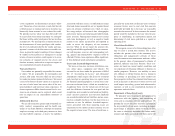

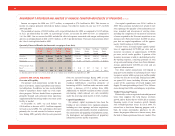

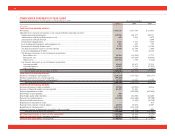

CONTRACTUAL OBLIGATIONS

Our future contractual obligations related to long-term debt, operating leases and other contractual obligations

at December 31, 2005 were as follows:

Fiscal Fiscal Fiscal Fiscal Fiscal

Contractual Obligations Total 2006 2007 2008 2009 2010 Thereafter

(in thousands)

Long-term debt ........................................... $ 438,800 $ 32,760 $ 32,093 $ 63,450 $ 52,771 $257,573 $ 153

Interest payments........................................ 81,001 11,808 23,460 20,606 17,306 7,818 3

Letters of credit .......................................... 54,579 54,579 — — — — —

Operating leases ......................................... 1,648,238 217,047 194,900 177,156 156,907 135,624 766,604

Purchase obligations(1)................................. 2,014 1,389 500 125 — — —

Financed vendor accounts payable ............. 119,351 — — — — — —

Other long-term liabilities(2) ........................ 74,874 — — — — — —

Contingent consideration(3) ......................... $ 12,500 $ 12,500 $ — $ — $ — $ — $ —

(1) For the purposes of this table, purchase obligations are defined as agreements that are enforceable and legally binding, a term of

greater than one year and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum

or variable price provisions; and the approximate timing of the transaction. Our open purchase orders are based on current inventory or

operational needs and are fulfilled by our vendors within short periods of time. We currently do not have minimum purchase commitments