Advance Auto Parts 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

leased premises and include options to renew.

Management expects that, in the normal course of

business, leases that expire will be renewed or

replaced by other leases.

Hedge Activities

The Company has entered into interest rate swap

agreements to limit its cash flow risk on its variable

rate debt. In March 2005 the Company entered into

three interest rate swap agreements on an aggregate

of $175,000 of debt under its senior credit facility.

The detail for the individual swaps is as follows:

• The first swap fixed the Company’s LIBOR rate at

4.153% on $50,000 of debt for a term of 48 months,

expiring in March 2009.

• The second swap fixed the Company’s LIBOR rate

at 4.255% on $75,000 of debt for a term of 60

months, expiring in February 2010.

• Beginning in March 2006, the third swap will fix

the Company’s LIBOR rate at 4.6125% on $50,000

of debt for a term of 54 months, expiring in

September 2010.

Additionally, the Company entered into two inter-

est rate swap agreements in March 2003 to limit its

cash flow risk on an aggregate of $125,000 of its vari-

able rate debt. The first swap allows the Company to

fix its LIBOR rate at 2.269% on $75,000 of debt for

a term of 36 months, expiring in March 2006. The

second swap, which fixed the Company’s LIBOR rate

at 1.79% on $50,000 of variable rate debt, expired in

March 2005.

In accordance with SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” or

SFAS No. 133, the fair value of these hedges is

recorded as an asset or liability in the accompanying

consolidated balance sheets at December 31, 2005

and January 1, 2005, respectively. The Company uses

the “matched terms” accounting method as provided

by Derivative Implementation Group Issue No. G9,

“Assuming No Ineffectiveness When Critical Terms

of the Hedging Instrument and the Hedge Transaction

Match in a Cash Flow Hedge,” for the interest rate

swaps. Accordingly, the Company has matched the

critical terms of each hedge instrument to the hedged

debt. Therefore, the Company has recorded all adjust-

ments to the fair value of the hedge instruments in

accumulated other comprehensive income through

the maturity date of the applicable hedge arrange-

ment. The fair value at December 31, 2005 was an

unrecognized gain of $3,090 on the swaps. Any

amounts received or paid under these hedges will be

recorded in the statement of operations as earned or

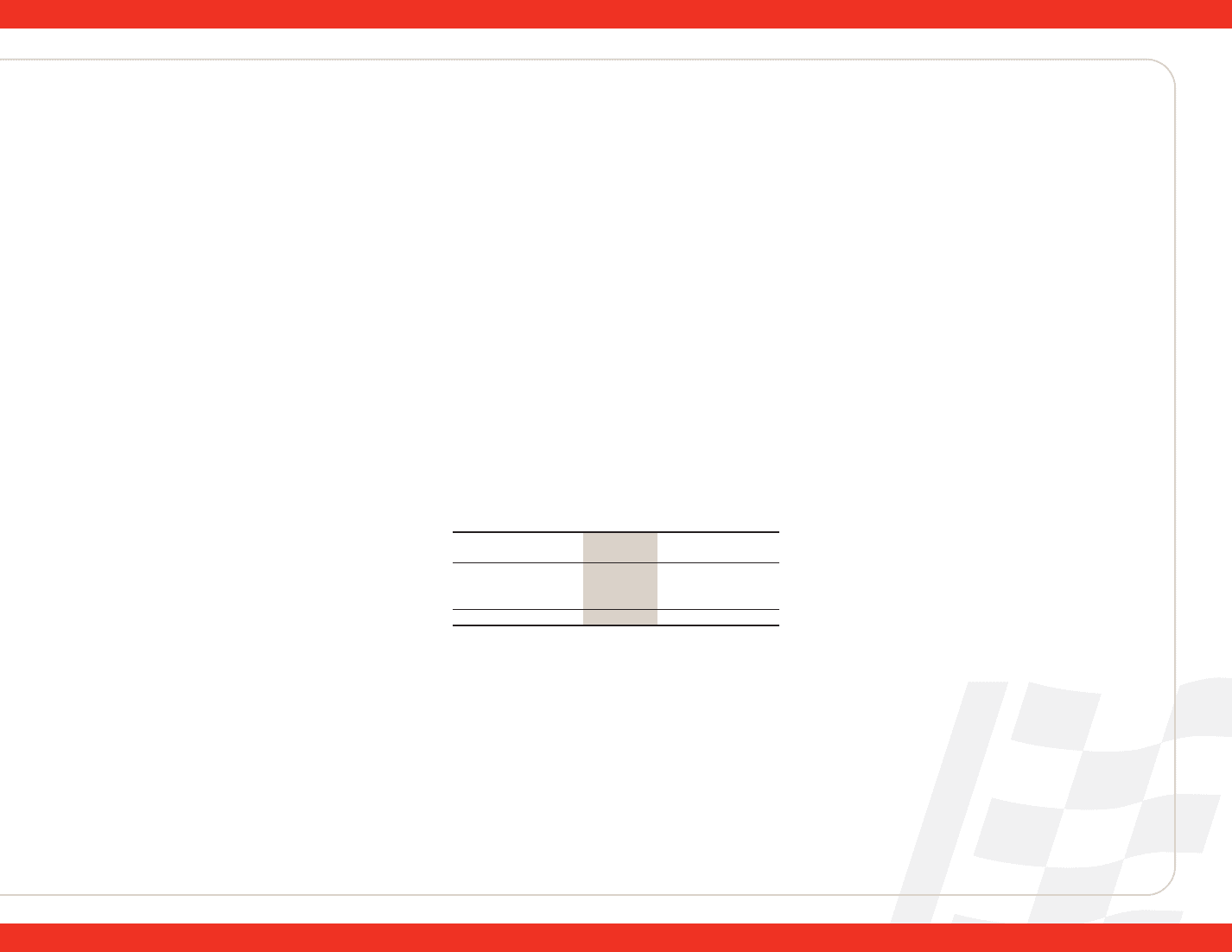

incurred. Comprehensive income for the fiscal years

ended December 31, 2005, January 1, 2005 and

January 3, 2004 is as follows:

December 31, January 1, January 3,

2005 2005 2004

Net income ..................... $234,725 $187,988 $124,935

Unrealized gain on

hedge arrangements ... 2,276 1,343 63

Comprehensive income... $237,001 $189,331 $124,998

Based on the estimated current and future fair val-

ues of the hedge arrangements at December 31, 2005,

the Company estimates amounts currently included

in accumulated other comprehensive income that will

be reclassified to earnings in the next 12 months will

consist of a gain of $1,101 associated with the inter-

est rate swaps.

Segment Reporting

SFAS No. 131, “Disclosures About Segments of an

Enterprise and Related Information,” defines how

operating segments are determined and requires dis-

closures about products, services, major customers

and geographic areas. Subsequent to the disposal of

the Company’s Wholesale Distribution Network

(Note 5) and prior to the acquisition of Autopart

International, or AI, in September 2005, the

Company operated in one business segment as

defined by the provisions of SFAS No. 131. AI’s

results of operations and financial position for the

year ended December 31, 2005 were insignificant to

our consolidated operations due to the timing of the

acquisition. In addition, the Company is evaluating

the nature of the AI operations as it relates to the

Company’s consolidated operations and related seg-

ment disclosure requirements, if any.

Recent Accounting Pronouncements

In November 2004 the FASB issued SFAS No. 151,

“Inventory Costs.” The statement amends Accounting

Research Bulletin No. 43, Chapter 4, “Inventory

Pricing,” to clarify the accounting for abnormal

amounts of idle facility expense, freight, handling

costs and wasted material. This statement requires

that those items be recognized as current-period

charges and requires that allocation of fixed produc-

tion overheads to the cost of conversion be based on

the normal capacity of the production facilities. This

statement is effective for fiscal years beginning after

June 15, 2005. The Company does not expect the

adoption of this statement to have a material impact

on its financial condition, results of operations or

cash flows.

In December 2004 the FASB issued SFAS No. 123

(revised 2004), “Share-Based Payment,” or SFAS No.

123R. SFAS No. 123R replaces SFAS No. 123

Advance Auto Parts

I

Annual Report 2005

I

43