Advance Auto Parts 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

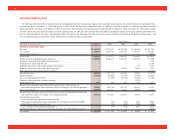

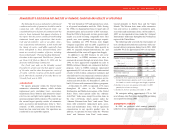

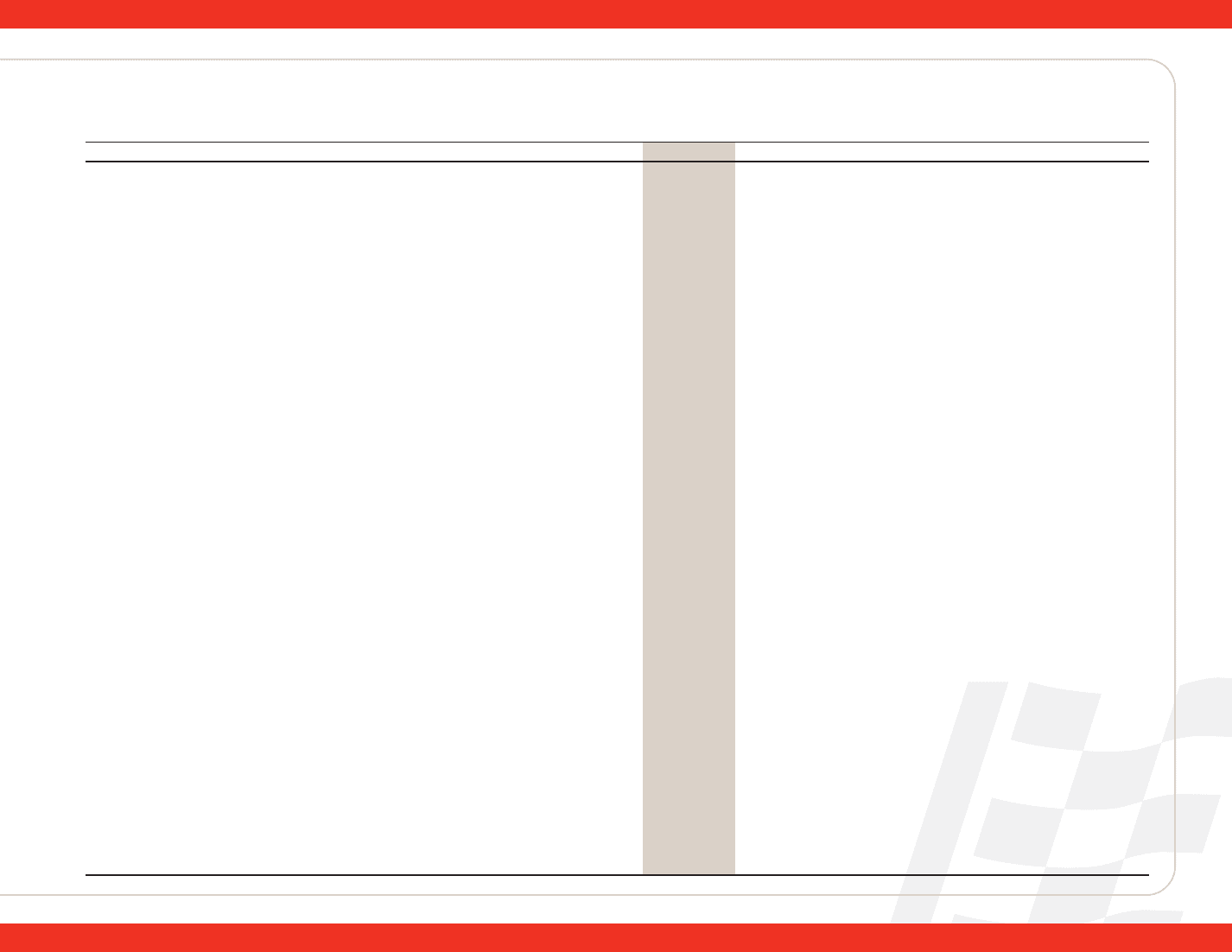

Fiscal Year(1)(2)

(in thousands, except per share data and ratios) 2005 2004 2003 2002 2001

Income from continuing operations before (loss) income on discontinued operations

and cumulative effect of a change in accounting principle per basic share(10) ............... $ 2.17 $ 1.70 $ 1.15 $ 0.59 $ 0.13

Income from continuing operations before (loss) income on discontinued operations

and cumulative effect of a change in accounting principle per diluted share(10)............. $ 2.13 $ 1.66 $ 1.12 $ 0.57 $ 0.13

Net income per basic share(10) ............................................................................................. $ 2.17 $ 1.70 $ 1.14 $ 0.62 $ 0.13

Net income per diluted share(10) .......................................................................................... $ 2.13 $ 1.66 $ 1.11 $ 0.60 $ 0.13

Weighted average basic shares outstanding(10) .................................................................... 108,318 110,846 109,499 105,147 85,911

Weighted average diluted shares outstanding(10) ................................................................. 109,987 113,222 112,115 108,564 87,474

Cash Flows Provided By (Used In):

Operating activities ............................................................................................................ $ 325,211 $ 263,794 $ 355,921 $ 242,996 $ 103,536

Investing activities.............................................................................................................. (302,780) (166,822) (85,474) (78,005) (451,008)

Financing activities............................................................................................................. (37,969) (52,138) (272,845) (169,223) 347,580

Balance Sheet and Other Financial Data:

Cash and cash equivalents.................................................................................................. $ 40,783 $ 56,321 $ 11,487 $ 13,885 $ 18,117

Inventory ............................................................................................................................ $1,367,099 $1,201,450 $1,113,781 $1,048,803 $ 982,000

Inventory turnover(11)........................................................................................................... 1.75 1.74 1.72 1.75 1.72

Inventory per store(12) .......................................................................................................... $ 476,009 $ 453,035 $ 438,669 $ 429,399 $ 392,635

Accounts payable to inventory ratio(13) ............................................................................... 54.8% 53.7% 51.0% 44.9% 43.7%

Net working capital(14) ......................................................................................................... $ 406,476 $ 416,302 $ 372,509 $ 462,896 $ 442,099

Capital expenditures(15)........................................................................................................ $ 216,214 $ 179,766 $ 101,177 $ 98,186 $ 63,695

Total assets ......................................................................................................................... $2,542,149 $2,201,962 $1,983,071 $1,965,225 $1,950,615

Total debt............................................................................................................................ $ 438,800 $ 470,000 $ 445,000 $ 735,522 $ 955,737

Total net debt(16) .................................................................................................................. $ 448,187 $ 433,863 $ 464,598 $ 722,506 $ 972,368

Total stockholders’ equity .................................................................................................. $ 919,771 $ 722,315 $ 631,244 $ 468,356 $ 288,571

Selected Store Data:

Comparable store sales growth(17) ....................................................................................... 8.7% 6.1% 3.1% 5.5% 6.2%

Number of stores at beginning of year............................................................................... 2,652 2,539 2,435 2,484 1,729

New stores ...................................................................................................................... 231 125 125 110 781

Closed stores(18) ............................................................................................................... (11) (12) (21) (159) (26)

Number of stores, end of period ........................................................................................ 2,872 2,652 2,539 2,435 2,484

Relocated stores ................................................................................................................. 54 34 32 39 18

Stores with commercial delivery program, end of period ................................................. 2,254 1,945 1,625 1,411 1,370

Total commercial sales, as a percentage of total sales....................................................... 21.8% 18.4% 15.8% 15.0% 16.8%

Total store square footage, end of period(19) ....................................................................... 20,899 19,734 18,875 18,108 18,717

Average net sales per store(20).............................................................................................. $ 1,551 $ 1,453 $ 1,379 $ 1,303 $ 1,346

Average net sales per square foot(21) ................................................................................... $ 208 $ 195 $ 186 $ 174 $ 175

Advance Auto Parts

I

Annual Report 2005

I

19