Advance Auto Parts 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

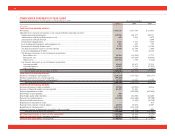

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004 (in thousands, except per share data)

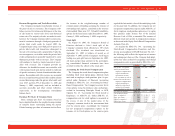

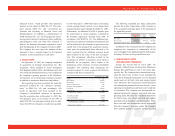

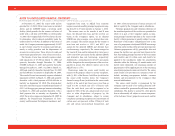

costs of the related physical damage including the

recovery of damaged merchandise at retail values and

damaged capital assets at replacement cost. Prior to

December 31, 2005, the Company and the insurance

carrier settled in full a claim for the retail value of

certain merchandise inventory damaged by

Hurricanes Katrina and Wilma. The Company has

evaluated and recognized a receivable for the recov-

ery of these fixed costs, net of deductibles. The fol-

lowing table represents the net impact of certain

insured fixed costs less recoveries as reflected in the

selling, general and administrative line of the accom-

panying condensed consolidated statement of opera-

tions for the fiscal year ended December 31, 2005. At

December 31, 2005, seven stores remain closed as a

result of these events.

December 31, 2005

Estimated fixed costs .................................... $15,351

Insurance recovery of fixed costs,

net of deductibles...................................... (6,518)

Insurance recovery for merchandise

inventories settled during the year,

net of deductibles...................................... (8,941)

Net expense................................................... $ (108)(a)

(a) Does not include the earnings impact of sales disruptions.

The Company expects the above insurance recover-

ies that have not been settled in full will be collected

within the next twelve months. The Company expects

to recognize additional recoveries in future quarters

primarily representing the remaining retail value of

damaged merchandise and the replacement value of

damaged capital assets not previously settled.

5. DISCONTINUED OPERATIONS:

On December 19, 2003, the Company discontinued

the supply of merchandise to its Wholesale

Distribution Network, or Wholesale. Wholesale con-

sisted of independently owned and operated dealer

locations, for which the Company supplied merchan-

dise inventory. This component of the Company’s

business operated in the Company’s previously

reported wholesale segment. The Company has

accounted for the discontinuance of the wholesale

segment in accordance with SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-

Lived Assets.” The Company has classified these

operating results as discontinued operations in the

accompanying consolidated statements of operations

for the fiscal year ended January 3, 2004. For the fis-

cal year ended January 3, 2004, the Wholesale

Distribution Network had revenues of $52,486. For

the fiscal year ended January 1, 2005, the operating

results related to the discontinued wholesale business

were minimal as a result of recognizing an estimate

of exit costs in fiscal 2003.

The discontinued wholesale segment, excluding

certain allocated and Team Member benefit expenses,

represented the entire results of operations previously

reported in that segment. These excluded expenses

represented $2,361 of allocated and Team Member

benefit expenses for fiscal 2003, which remain a

component of income from continuing operations

and have therefore been excluded from discontinued

operations. The Company has allocated corporate

interest expenses incurred under the Company’s sen-

ior credit facility and subordinated notes. The allocat-

ed interest complies with the provisions of Emerging

Issue Task Force No. 87-24, “Allocation of Interest to

Discontinued Operations,” and is reported in discon-

tinued operations on the accompanying statement of

operations. This amount was $484 for fiscal 2003. The

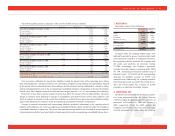

loss on the discontinued operations of Wholesale for

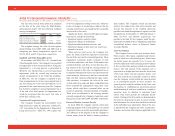

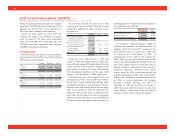

fiscal 2003 included $2,693 of exit costs as follows:

Severance costs.................................................................. $1,183

Warranty allowances ......................................................... 1,656

Other.................................................................................. (146)

Total exit costs................................................................... $2,693

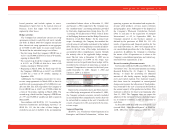

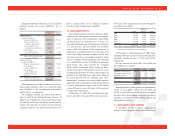

6. CLOSED STORE

AND RESTRUCTURING LIABILITIES:

The Company continually reviews the operating

performance of its existing store locations and closes

certain locations identified as under performing.

Closing an under performing location has not result-

ed in the elimination of the operations and associated

cash flows from the Company’s ongoing operations

as the Company transfers those operations to another

location in the local market. The Company maintains

closed store liabilities that include liabilities for these

exit activities and liabilities assumed through past

acquisitions that are similar in nature but recorded by

the acquired companies prior to acquisition. The

Company had also maintained restructuring liabili-

ties recorded through purchase accounting that

reflected costs of the plan to integrate the acquired

operations into the Company’s business. These inte-

gration plans related to the operations acquired in the

fiscal 1998 merger with Western Auto Supply

Company, or Western, and the fiscal 2001 acquisition

of Discount.