Advance Auto Parts 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

internal use computer software in accordance with

the American Institute of Certified Public

Accountant’s Statement of Position 98-1,

“Accounting for the Cost of Computer Software

Developed or Obtained for Internal Use,” during

fiscal 2005, fiscal 2004 and fiscal 2003, respectively.

These costs are included in the furniture, fixtures and

equipment category above and are depreciated on the

straight-line method over three to seven years.

10. ASSETS HELD FOR SALE:

The Company applies SFAS No. 144, “Accounting

for the Impairment or Disposal of Long-Lived

Assets,” which requires that long-lived assets and cer-

tain identifiable intangible assets to be disposed of be

reported at the lower of the carrying amount or the

fair market value less selling costs. At December 31,

2005 and January 1, 2005, the Company’s assets held

for sale were $8,198 and $18,298, respectively, pri-

marily consisting of closed stores as a result of the

Discount integration and a closed distribution center.

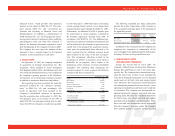

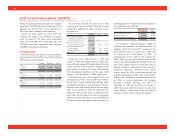

11. ACCRUED EXPENSES:

Accrued expenses consist of the following:

December 31, January 1,

2005 2005

Payroll and related benefits ............. $ 58,553 $ 50,753

Warranty .......................................... 11,352 10,960

Capital expenditures ........................ 39,105 21,479

Self-insurance reserves.................... 39,840 30,605

Other ................................................ 116,587 84,682

Total accrued expenses .................... $265,437 $198,479

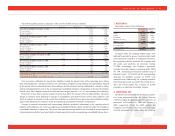

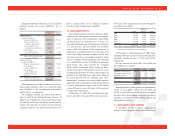

12. OTHER LONG-TERM LIABILITIES:

Other long-term liabilities consist of the following:

December 31, January 1,

2005 2005

Employee benefits............................. $17,253 $18,658

Restructuring and

closed store liabilities................... 2,231 3,122

Deferred income taxes ...................... 36,958 43,636

Other ................................................. 18,432 14,806

Total other long-term liabilities ........ $74,874 $80,222

13. LONG-TERM DEBT:

Long-term debt consists of the following:

December 31, January 1,

2005 2005

Senior Debt:

Tranche A, Senior Secured Term

Loan at variable interest rates

(5.66% and 3.92% at

December 31, 2005 and

January 1, 2005, respectively),

due September 2009 .................... $170,000 $200,000

Tranche B, Senior Secured Term

Loan at variable interest rates

(5.89% and 4.17% at

December 31, 2005 and

January 1, 2005, respectively),

due September 2010 .................... 168,300 170,000

Delayed Draw, Senior Secured

Term Loan at variable interest

rates (5.91% and 4.22% at

December 31, 2005 and

January 1, 2005, respectively),

due September 2010 .................... 100,000 100,000

Revolving facility at variable

interest rates (5.66% and 3.92%

at December 31, 2005 and

January 1, 2005, respectively)

due September 2009 .................... ——

Other................................................. 500 —

438,800 470,000

Less: Current portion of

long-term debt.............................. (32,760) (31,700)

Long-term debt, excluding

current portion ............................. $406,040 $438,300

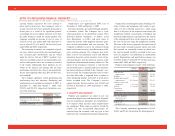

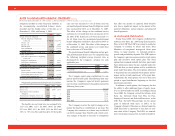

On November 3, 2004, the Company entered into a

new amended and restated $670,000 senior credit

facility. This new senior credit facility initially pro-

vided for a $200,000 tranche A term loan and a

$170,000 tranche B term loan. Proceeds from these

term loans were used to refinance the Company’s pre-

viously existing tranche D and E term loans and

revolver under the Company’s previous senior credit

facility. Additionally, the new senior credit facility

initially provided for a $100,000 delayed draw term

loan, which was available exclusively for stock buy-

backs under the Company’s stock repurchase pro-

gram, and a $200,000 revolving facility, or the

revolver (which provides for the issuance of letters of

credit with a sub limit of $70,000).

In conjunction with this refinancing, the Company

wrote-off existing deferred financing costs related to

the Company’s tranche D and E term loans in accor-

dance with EITF Issue No. 96-19, “Debtor’s

Accounting for a Modification or Exchange of Debt

Instruments.” The write-off of these costs combined

with the related refinancing costs incurred to set up

the new credit facility resulted in a loss on extin-

guishment of debt of $2,818 in the accompanying

consolidated statements of operations for the year

ended January 1, 2005. During fiscal 2004, prior to

the refinancing of its credit facility, the Company

repaid $105,000 in debt prior to its scheduled maturity.

In conjunction with these partial repayments, the

Company wrote-off deferred financing costs in the

amount of $412, which is classified as a loss on

extinguishment of debt in the accompanying consoli-

dated statement of operations for the year ended

January 1, 2005.

Advance Auto Parts

I

Annual Report 2005

I

49