Advance Auto Parts 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004 (in thousands, except per share data)

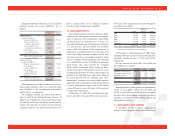

obligation included in other long-term liabilities in

the accompanying consolidated balance sheets,

recorded and the funded status of the plan as of

December 31, 2005 and January 1, 2005:

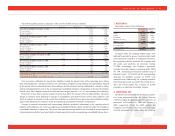

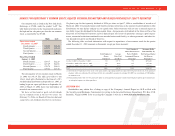

2005 2004

Change in benefit obligation:

Benefit obligation at beginning

of the year......................................... $ 14,625 $ 22,750

Service cost........................................... —2

Interest cost........................................... 802 1,004

Benefits paid......................................... (1,513) (1,239)

Plan amendment ................................... —(7,557)

Actuarial gain ....................................... (203) (335)

Benefit obligation at end of the year.... 13,711 14,625

Change in plan assets:

Fair value of plan assets at beginning

of the year......................................... ——

Employer contributions......................... 1,513 1,239

Participant contributions....................... 2,336 2,485

Benefits paid......................................... (3,849) (3,724)

Fair value of plan assets at end of year... ——

Reconciliation of funded status:

Funded status ........................................ (13,711) (14,625)

Unrecognized transition obligation....... ——

Unrecognized prior service cost ........... (6,531) (7,112)

Unrecognized actuarial loss.................. 3,929 4,371

Accrued postretirement benefit cost ......... $(16,313) $(17,366)

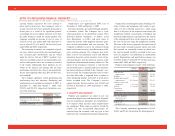

Net periodic postretirement benefit cost is as follows:

2005 2004 2003

Service cost ......................................... $— $2$5

Interest cost ......................................... 802 1,004 1,485

Amortization of the transition

obligation ........................................ ——1

Amortization of the prior service cost... (581) (436) —

Amortization of recognized net losses .. 239 250 146

$ 460 $ 820 $1,637

The health care cost trend rate was assumed to be

12.5% for 2006, 11.5% for 2007, 10.0% for 2008,

9.5% for 2009, 8.5% for 2010, 8.0% for 2011 and

5.0% to 7.0% for 2012 and thereafter. If the health

care cost were increased 1% for all future years the

accumulated postretirement benefit obligation would

have increased by $472 as of December 31, 2005.

The effect of this change on the combined service

and interest cost would have been an increase of $72

for 2005. If the health care cost were decreased 1%

for all future years the accumulated postretirement

benefit obligation would have decreased by $450 as

of December 31, 2005. The effect of this change on

the combined service and interest cost would have

been a decrease of $76 for 2005.

The postretirement benefit obligation and net peri-

odic postretirement benefit cost was computed using

the following weighted average discount rates as

determined by the Company’s actuaries for each

applicable year:

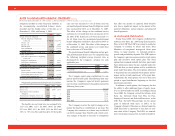

2005 2004

Postretirement benefit obligation ................ 5.50% 5.75%

Net periodic

postretirement benefit cost ..................... 5.75% 6.25%

The Company expects plan contributions to com-

pletely offset benefits paid. The following table sum-

marizes the Company’s expected benefit payments

(net of retiree contributions) to be paid for each of the

following fiscal years:

Amount

2006 ................................................................................... $1,033

2007 ................................................................................... 1,163

2008 ................................................................................... 1,209

2009 ................................................................................... 1,268

2010 ................................................................................... 1,283

2011–2015 ......................................................................... 6,174

The Company reserves the right to change or ter-

minate the benefits or contributions at any time. The

Company also continues to evaluate ways in which it

can better manage these benefits and control costs.

Any changes in the plan or revisions to assumptions

that affect the amount of expected future benefits

may have a significant impact on the amount of the

reported obligation, annual expense and projected

benefit payments.

20. STOCK-BASED COMPENSATION:

During fiscal 2004, the Company established the

Advance Auto Parts, Inc. 2004 Long-Term Incentive

Plan, or the LTIP. The LTIP was created to enable the

Company to continue to attract and retain Team

Members of exceptional managerial talent upon

whom, in large measure, its sustained progress,

growth and profitability depends. The LTIP replaces

the Company’s previous senior executive stock option

plan and executive stock option plan. The stock

options that remained available for future grant under

these predecessor plans became available under the

LTIP and thus, no stock options will be available for

grant under those plans. The stock options authorized

to be granted are non-qualified stock options and ter-

minate on the seventh anniversary of the grant date.

Additionally, the stock options vest over a three-year

period in equal installments beginning on the first

anniversary grant date.

In addition to stock options, the Company also has

the ability to offer additional types of equity incen-

tives as allowed under the LTIP. Accordingly, during

fiscal 2004, the Company created the Advance Auto

Parts, Inc. Deferred Stock Unit Plan for Non-

Employee Directors and Selected Executives, or the

DSU Plan. The DSU Plan provides for the annual

grant of deferred stock units, or DSUs, to the

Company’s Board of Directors as allowed under the

LTIP. Each DSU is equivalent to one share of com-

mon stock of the Company. The DSUs are immedi-

ately vested upon issuance but are held on behalf of