Advance Auto Parts 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advance Auto Parts

I

Annual Report 2005

I

55

reserves could be affected if future claim experience

differs significantly from the historical trends and the

actuarial assumptions.

The Company accrues for tax contingencies when

it is probable that a liability to a taxing authority has

been incurred and the amount of the contingency can

be reasonably estimated, based on past experience.

The Company’s tax contingency reserve is adjusted

for changes in circumstances and additional uncer-

tainties, such as significant amendments to existing

tax law, both legislated and concluded through the

various jurisdictions’ tax court systems. The

Company had a tax contingency reserve of $7,588

and $7,576 at December 31, 2005 and January 1,

2005, respectively. It is the opinion of the Company’s

management that the possibility is remote that costs

in excess of those reserved for will have a material

adverse impact on the Company’s financial position,

results of operations or liquidity.

The Company has entered into employment

agreements with certain Team Members that provide

severance pay benefits under certain circumstances

after a change in control of the Company or upon

termination of the Team Member by the Company.

The maximum contingent liability under these

employment agreements is approximately $1,617

and $2,491 at December 31, 2005 and January 1,

2005, respectively, of which nothing has been accrued.

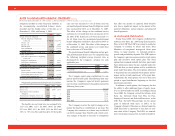

19. BENEFIT PLANS:

401(k) Plan

The Company maintains a defined contribution

Team Member benefit plan, which covers substantially

all Team Members after one year of service and have

attained the age of twenty-one. The plan allows for

Team Member salary deferrals, which are matched at

the Company’s discretion. Company contributions

were $6,779, $6,752 and $6,398 in fiscal 2005, fiscal

2004, and fiscal 2003, respectively.

The Company also maintains a profit sharing plan

covering Western Team Members that was frozen

prior to the Western Merger on November 2, 1998.

This plan covered all full-time Team Members who

had completed one year of service and had attained

the age of twenty-one.

Deferred Compensation

During third quarter of fiscal 2003, the Company

established an unqualified deferred compensation

plan for certain Team Members. The Company has

accounted for the unqualified deferred compensation

plan in accordance with EITF 97-14, “Accounting

for Deferred Compensation Arrangements Where

Amounts Earned Are Held in a Rabbi Trust and

Invested.” The liability related to the former

Discount deferred compensation plan, which was

terminated in May 2002, was merged into the new

plan. This plan provides for a minimum and maxi-

mum deferral percentage of the Team Member base

salary and bonus, as determined by the Retirement

Plan Committee. The Company establishes and main-

tains a deferred compensation liability for this plan.

The Company funds this liability by remitting the

Team Member’s deferrals to a Rabbi Trust where these

deferrals are invested in certain life insurance con-

tracts. Accordingly, any change in the cash surrender

value on these contracts, which are held in the Rabbi

Trust to fund the deferred compensation liability,

is recognized in the Company’s consolidated state-

ment of operations. At December 31, 2005 and

January 1, 2005 these liabilities were $2,693 and

$1,840, respectively.

The Company maintains an unfunded deferred

compensation plan established for certain key Team

Members of Western prior to the fiscal 1998 Western

merger. The Company assumed the plan liability of

$15,253 through the Western merger. The plan was

frozen at the date of the Western merger. As of

December 31, 2005 and January 1, 2005, $1,321 and

$1,598, respectively, was accrued for these plans with

the current portion included in accrued expenses and

the long-term portion in other long-term liabilities in

the accompanying consolidated balance sheets.

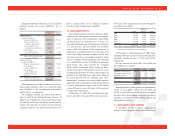

Postretirement Plan

The Company provides certain health care and life

insurance benefits for eligible retired Team Members

through a postretirement plan, or the Plan. These ben-

efits are subject to deductibles, co-payment provisions

and other limitations. The Plan has no assets and is

funded on a cash basis as benefits are paid. During

the second quarter of fiscal 2004, the

Company amended the Plan to exclude outpatient

prescription drug benefits to Medicare eligible

retirees effective January 1, 2006. Due to this nega-

tive plan amendment, the Company’s accumulated

postretirement benefit obligation was reduced by

$7,557, resulting in an unrecognized negative prior

service cost in the same amount. The unrecognized

negative prior service cost is being amortized over

the 13-year estimated remaining life expectancy of

the plan participants as allowed under SFAS No. 106,

“Employers Accounting for Postretirement Benefits

Other Than Pensions.”

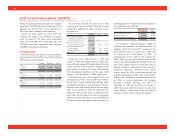

Other financial information related to the plans

was determined by the Company’s independent actu-

aries. The measurement date used by the actuaries

was October 31 of each fiscal year. The following

provides a reconciliation of the accrued benefit