Advance Auto Parts 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004 (in thousands, except per share data)

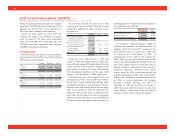

During the prior repurchase program, the Company

repurchased 7,029,900 shares of common stock at an

aggregate cost of $189,160, or an average price of

$26.91 per share, excluding related expenses.

During the third quarter of fiscal 2005, the

Company also retired 7,121,850 shares of common

stock, of which 91,950 shares were repurchased

under the $300,000 stock repurchase plan and

7,029,900 shares were repurchased under the prior

$200,000 stock repurchase program.

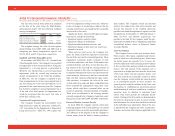

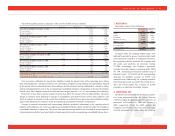

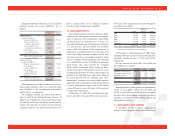

15. INCOME TAXES:

Provision (benefit) for income taxes from continu-

ing operations for fiscal 2005, fiscal 2004 and fiscal

2003 consists of the following:

Current Deferred Total

2005–

Federal............................ $124,978 $ (1,343) $123,635

State................................ 16,430 4,133 20,563

$141,408 $ 2,790 $144,198

2004 –

Federal............................ $102,171 $ 1,318 $103,489

State................................ 9,042 5,190 14,232

$111,213 $ 6,508 $117,721

2003–

Federal............................ $ 23,759 $44,820 $ 68,579

State................................ 923 8,922 9,845

$ 24,682 $53,742 $ 78,424

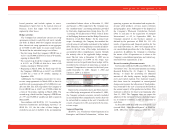

The provision (benefit) for income taxes from

continuing operations differed from the amount

computed by applying the federal statutory income

tax rate due to:

2005 2004 2003

Income from continuing

operations at statutory U.S.

federal income tax rate ......... $132,623 $107,012 $71,298

State income taxes, net of

federal income tax benefit .... 13,366 9,251 6,399

Non-deductible interest &

other expenses....................... (3) 745 1,263

Valuation allowance................... 75 236 (1,002)

Other, net ................................... (1,863) 477 466

$144,198 $117,721 $78,424

During the years ended January 1, 2005 and

January 3, 2004, the Company had a loss from oper-

ations of the discontinued Wholesale Dealer Network

of $63 and $572, respectively. The Company record-

ed an income tax benefit of $24 and $220 related to

these discontinued operations for the years ended

January 1, 2005 and January 3, 2004, respectively.

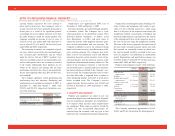

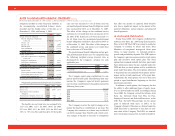

Deferred income taxes are recognized for the tax

consequences in future years of differences between

the tax bases of assets and liabilities and their finan-

cial reporting amounts at each period-end, based on

enacted tax laws and statutory income tax rates appli-

cable to the periods in which the differences are

expected to affect taxable income. Deferred income

taxes reflect the net income tax effect of temporary

differences between the bases of assets and liabilities

for financial reporting purposes and for income tax

reporting purposes. Net deferred income tax balances

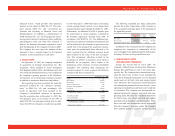

are comprised of the following:

December 31, January 1,

2005 2005

Deferred income tax assets............... $ 42,167 $ 40,009

Valuation allowance.......................... (1,104) (1,029)

Deferred income tax liabilities ......... (113,150) (108,277)

Net deferred income tax liabilities ... $ (72,087) $ (69,297)

At December 31, 2005 and January 1, 2005, the

Company has cumulative net deferred income tax

liabilities of $72,087 and $69,297, respectively. The

gross deferred income tax assets also include state

net operating loss carryforwards, or NOLs, of

approximately $1,579 and $3,720, respectively.

These NOLs may be used to reduce future taxable

income and expire periodically through fiscal year

2024. The Company believes it will realize these tax

benefits through a combination of the reversal of

temporary differences, projected future taxable

income during the NOL carryforward periods and

available tax planning strategies. Due to uncertainties

related to the realization of certain deferred tax assets

for NOLs in various jurisdictions, the Company

recorded a valuation allowance of $1,104 as of

December 31, 2005 and $1,029 as of January 1,

2005. The amount of deferred income tax assets real-

izable, however, could change in the near future if

estimates of future taxable income are changed.