Advance Auto Parts 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advance Auto Parts

I

Annual Report 2005

I

63

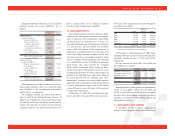

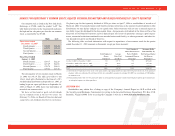

Our common stock is listed on the New York Stock

Exchange, or NYSE, under the symbol “AAP.” The

table below sets forth, for the fiscal periods indicated,

the high and low sale prices per share for our common

stock, as reported by the NYSE.

High Low

Fiscal Year Ended

December 31, 2005

Fourth Quarter ............ $44.88 $35.40

Third Quarter.............. $47.73 $37.45

Second Quarter........... $44.17 $34.10

First Quarter ............... $35.10 $28.13

Fiscal Year Ended

January 1, 2005

Fourth Quarter ............ $29.17 $22.28

Third Quarter.............. $25.29 $22.01

Second Quarter........... $30.78 $24.83

First Quarter ............... $29.61 $25.45

The closing price of our common stock on March

13, 2006 was $41.19. The table gives effect to our

3-for-2 stock split effectuated in the form of a 50%

stock dividend distributed on September 23, 2005, as

trading began on a post-split basis on September 26,

2005. At March 13, 2006, there were 424 holders of

record of our common stock.

We have not declared or paid cash dividends

on our common stock in the last two years. On

February 15, 2006, our Board of Directors declared

a quarterly cash dividend, the first in our history.

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

We plan to pay the first quarterly dividend of $0.06 per share on April 7, 2006 to stockholders of record as of

March 24, 2006. Our amended senior credit facility contains restrictions on the amount of cash dividends or other

distributions we may declare and pay on our capital stock. Such restrictions will not have a material impact on

our ability to pay this dividend for the foreseeable future. Any payments of dividends in the future will be at the

discretion of our Board of Directors and will depend upon our results of operations, earnings, capital require-

ments, contractual restrictions contained in our amended senior credit facility, or other agreements, and other fac-

tors deemed relevant by our Board of Directors.

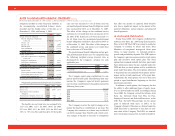

The following table sets forth information with respect to repurchases of our common stock for the quarter

ended December 31, 2005 (amounts in thousands, except per share amounts):

Total Number of Maximum Dollar

Shares Purchased as Value that May Yet

Total Number of Average Part of Publicly Be Purchased Under

Shares Price Paid Announced Plans or the Plans or

Period Purchased per Share Programs(1) Programs(1)(2)

October 9, 2005 to November 5, 2005 ...................... 734 $37.13 734 $253,201

November 6, 2005 to December 3, 2005................... 199 40.66 199 245,103

December 4, 2005 to December 31, 2005................. 106 42.80 106 240,548

Total ........................................................................... 1,039 $38.84 1,039 $240,548

(1) All of the above repurchases were made on the open market at prevailing market rates plus related expenses under our stock repurchase

program, which was authorized by our Board of Directors and publicly announced on August 10, 2005, for a maximum of $300 million

in common stock.

(2) The maximum dollar value yet to be purchased under our stock repurchase program excludes related expenses paid on previous purchases

or anticipated expenses on future purchases.

SEC FORM 10-K

Stockholders may obtain free of charge a copy of the Company’s Annual Report on 10-K as filed with

the Securities and Exchange Commission by writing to the Investor Relations Department, P.O. Box 2710,

Roanoke, Virginia 24001 or by accessing the Company’s web site at www.AdvanceAutoParts.com.