Advance Auto Parts 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

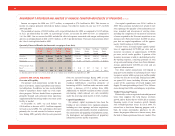

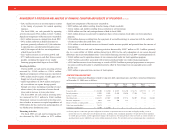

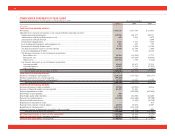

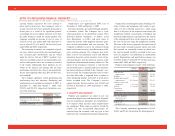

Fiscal Years Ended

2005 2004 2003

(in thousands)

Cash flows from operating activities:

Net income..................................................................................................................................................................... $ 234,725 $ 187,988 $ 124,935

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ................................................................................................................................... 119,938 104,877 100,737

Amortization of deferred debt issuance costs............................................................................................................ 620 1,082 1,470

Amortization of bond discount .................................................................................................................................. —— 3,640

Stock-based compensation ......................................................................................................................................... 3,942 3,891 3,543

Loss on disposal of property and equipment, net ...................................................................................................... 503 447 793

Provision for deferred income taxes .......................................................................................................................... 2,790 6,508 53,742

Tax benefit related to exercise of stock options ........................................................................................................ 30,300 23,749 7,964

Loss on extinguishment of debt ................................................................................................................................. —3,230 47,288

Net decrease (increase) in, net of business acquisitions:

Receivables, net ...................................................................................................................................................... 21,819 (15,945) 17,775

Inventories, net........................................................................................................................................................ (130,426) (87,669) (64,893)

Other assets............................................................................................................................................................. (23,963) 1,750 (7,216)

Net increase (decrease) in, net of business acquisitions:

Accounts payable.................................................................................................................................................... 35,610 19,673 97,535

Accrued expenses ................................................................................................................................................... 32,805 12,581 (27,985)

Other liabilities ....................................................................................................................................................... (3,452) 1,632 (3,407)

Net cash provided by operating activities........................................................................................................... 325,211 263,794 355,921

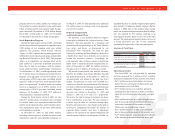

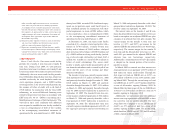

Cash flows from investing activities:

Purchases of property and equipment ........................................................................................................................... (216,214) (179,766) (101,177)

Business acquisitions, net of cash acquired................................................................................................................... (99,300) ——

Proceeds from sales of property and equipment ........................................................................................................... 12,734 12,944 15,703

Net cash used in investing activities ................................................................................................................... (302,780) (166,822) (85,474)

Cash flows from financing activities:

Increase (decrease) in bank overdrafts .......................................................................................................................... 29,986 (10,901) 30,216

Increase in financed vendor accounts payable .............................................................................................................. 62,455 56,896 —

Early extinguishment of debt......................................................................................................................................... —(105,000) (647,462)

Borrowings on note payable .......................................................................................................................................... 500 ——

Borrowings under credit facilities ................................................................................................................................. 1,500 256,500 452,600

Payments on credit facilities.......................................................................................................................................... (33,200) (126,500) (99,300)

Payment of debt related costs ........................................................................................................................................ —(3,509) (38,330)

Repayment of management loans.................................................................................................................................. —— 976

Proceeds from exercise of stock options ....................................................................................................................... 28,696 20,470 25,407

Repurchase of common stock........................................................................................................................................ (101,594) (146,370) —

(Decrease) increase in borrowings secured by trade receivables .................................................................................. (26,312) 6,276 3,048

Net cash used in financing activities .................................................................................................................. (37,969) (52,138) (272,845)

Net (decrease) increase in cash and cash equivalents

................................................................................................ (15,538) 44,834 (2,398)

Cash and cash equivalents,

beginning of period.......................................................................................................... 56,321 11,487 13,885

Cash and cash equivalents,

end of period.................................................................................................................... $ 40,783 $ 56,321 $ 11,487

38

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004