Advance Auto Parts 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

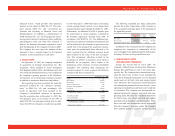

carrying balance represents the costs relating to

prices paid in prior years. The Company’s costs to

acquire inventory have been generally decreasing in

recent years as a result of its significant growth.

Accordingly, the cost to replace inventory is less than

the LIFO balances carried for similar product. The

Company recorded an increase in cost of sales of

$526 for fiscal year ended 2005 and reductions to

cost of sales of $11,212 and $2,156 for fiscal years

ended 2004 and 2003, respectively.

The remaining inventories are comprised of prod-

uct cores, which consist of the non-consumable por-

tion of certain parts and batteries and are valued

under the first-in, first-out (“FIFO”) method. Core

values are included as part of our merchandise costs

and are either passed on to the customer or returned

to the vendor. Additionally, these products are not

subject to the frequent cost changes like our other

merchandise inventory, thus, there is no material dif-

ference from applying either the LIFO or FIFO valu-

ation methods.

The Company capitalizes certain purchasing and

warehousing costs into inventory. Purchasing and

warehousing costs included in inventory, at FIFO, at

December 31, 2005 and January 1, 2005, were

$92,833 and $81,458, respectively. Inventories con-

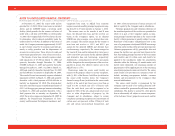

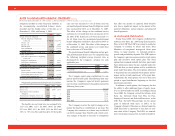

sist of the following:

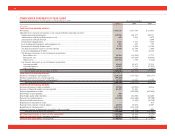

December 31, January 1,

2005 2005

Inventories at FIFO, net................... $1,294,310 $1,128,135

Adjustments to state inventories

at LIFO........................................ 72,789 73,315

Inventories at LIFO, net .................. $1,367,099 $1,201,450

Replacement cost approximated FIFO cost at

December 31, 2005 and January 1, 2005.

Inventory quantities are tracked through a perpetu-

al inventory system. The Company uses a cycle

counting program in all distribution centers, Parts

Delivered Quickly warehouses, or PDQ®s, Local

Area Warehouses, or LAWs, and retail stores to

ensure the accuracy of the perpetual inventory quan-

tities of both merchandise and core inventory. The

Company establishes reserves for estimated shrink

based on historical accuracy and effectiveness of the

cycle counting program. The Company also estab-

lishes reserves for potentially excess and obsolete

inventories based on current inventory levels of dis-

continued product and the historical analysis of the

liquidation of discontinued inventory below cost. The

nature of the Company’s inventory is such that the

risk of obsolescence is minimal and excess inventory

has historically been returned to the Company’s ven-

dors for credit. The Company provides reserves when

less than full credit is expected from a vendor or

when liquidating product will result in retail prices

below recorded costs. The Company’s reserves

against inventory for these matters were $22,825 and

$21,929 at December 31, 2005 and January 1, 2005,

respectively.

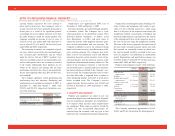

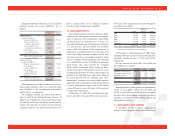

9. PROPERTY AND EQUIPMENT:

Property and equipment are stated at cost, less

accumulated depreciation and amortization. Expendi-

tures for maintenance and repairs are charged direct-

ly to expense when incurred; major improvements

are capitalized. When items are sold or retired, the

related cost and accumulated depreciation are

removed from the accounts, with any gain or loss

reflected in the consolidated statements of operations.

Depreciation of land improvements, buildings, fur-

niture, fixtures and equipment, and vehicles is pro-

vided over the estimated useful lives, which range

from 2 to 40 years, of the respective assets using the

straight-line method. Amortization of building and

leasehold improvements is provided over the shorter

of the original useful lives of the respective assets or

the term of the lease using the straight-line method.

The term of the lease is generally the initial term of

the lease unless external economic factors exist such

that renewals are reasonably assured in which case,

the renewal period would be included in the lease

term for purposes of establishing an amortization

period. Depreciation and amortization expense was

$119,938, $104,877 and $100,737 for the fiscal years

ended 2005, 2004 and 2003, respectively.

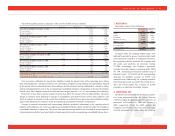

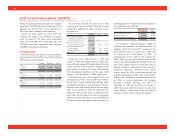

Property and equipment consists of the following:

Original December 31, January 1,

Useful Lives 2005 2005

Land and land

improvements........... 0 – 10 years $ 212,110 $ 187,624

Buildings....................... 40 years 295,699 240,447

Building and leasehold

improvements........... 10 – 40 years 159,568 133,415

Furniture, fixtures and

equipment................. 3 – 12 years 745,142 632,312

Vehicles......................... 2 – 10 years 35,339 32,963

Construction

in progress .................. 11,035 29,936

Other ............................. 4,516 4,335

1,463,409 1,261,032

Less – Accumulated

depreciation and

amortization ............. (564,558) (474,820)

Property and

equipment, net.......... $ 898,851 $ 786,212

The Company capitalized approximately $6,584,

$4,625 and $5,423 incurred for the development of

48

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004 (in thousands, except per share data)