Advance Auto Parts 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advance Auto Parts

I

Annual Report 2005

I

53

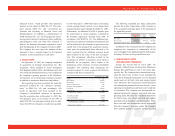

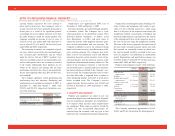

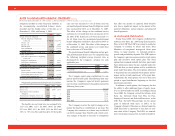

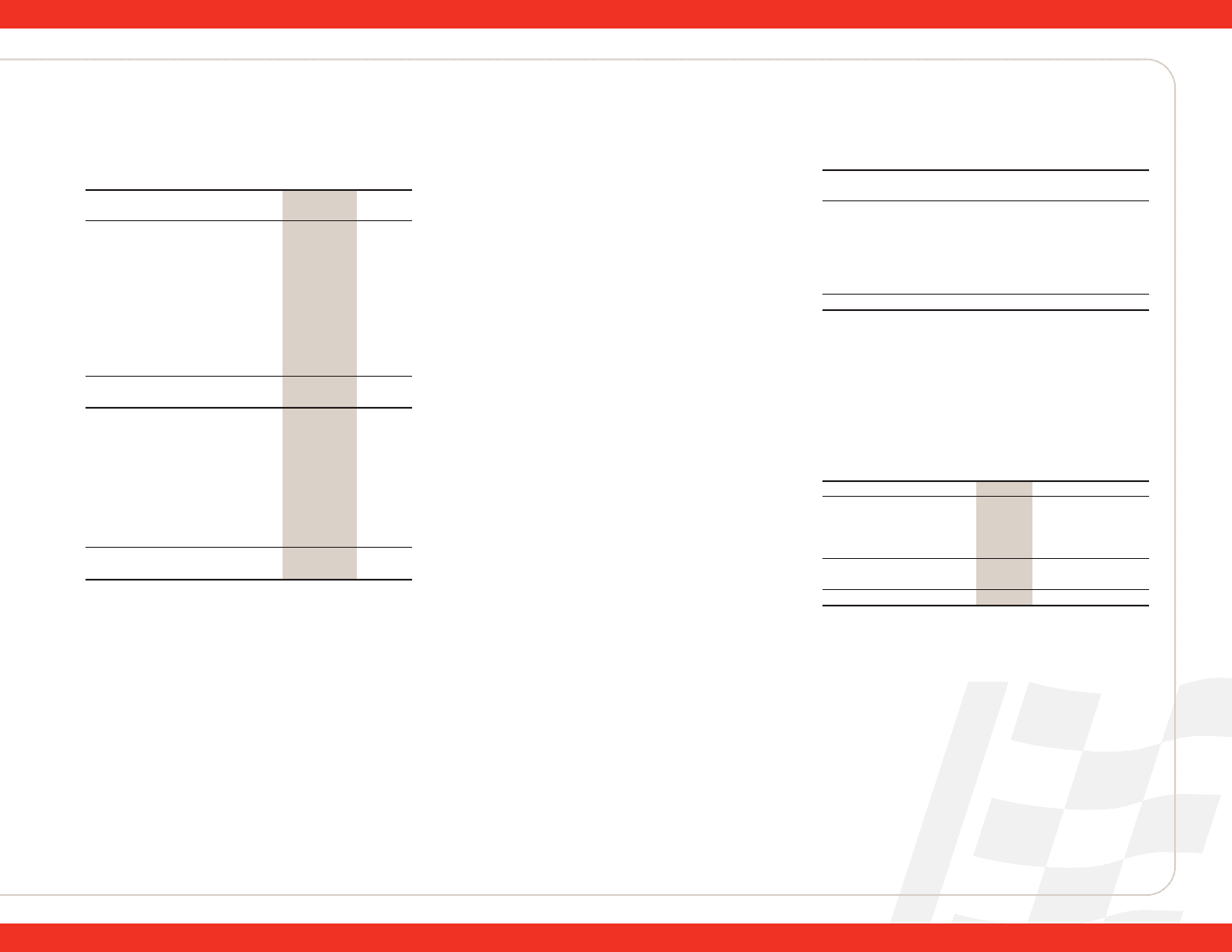

Temporary differences which give rise to significant

deferred income tax assets (liabilities) are as

follows:

December 31, January 1,

2005 2005

Current deferred

income tax liabilities

Inventory differences ................ $(68,250) $(57,127)

Accrued medical and

workers compensation............ 16,134 13,701

Accrued expenses not

currently deductible for tax.... 16,661 15,194

Net operating

loss carryforwards.................. 326 2,152

Tax credit carryforwards........... —419

Total current deferred income

tax assets (liabilities) ............... $(35,129) $(25,661)

Long-term deferred

income tax liabilities

Property and equipment............ (44,900) (52,605)

Postretirement

benefit obligation................... 6,649 6,975

Net operating

loss carryforwards.................. 1,253 1,568

Valuation allowance .................. (1,104) (1,029)

Other, net................................... 1,144 1,455

Total long-term deferred

income tax assets (liabilities)... $(36,958) $(43,636)

These amounts are recorded in other current assets,

other current liabilities, other assets and other long-

term liabilities in the accompanying consolidated

balance sheets, as appropriate.

The Company currently has certain years that are

open to audit by the Internal Revenue Service. In

addition, the Company has certain years that are open

for audit by various state and foreign jurisdictions for

income taxes and sales, use and excise taxes. In man-

agement’s opinion, any amounts assessed will not

have a material effect on the Company’s financial

position, results of operations or liquidity.

16. LEASE COMMITMENTS:

The Company leases certain store locations, distri-

bution centers, office space, equipment and vehicles,

some of which are with related parties. Initial terms

for facility leases are typically 10 to 15 years, fol-

lowed by additional terms containing renewal options

at 5 year intervals, and may include rent escalation

clauses. The total amount of the minimum rent is

expensed on a straight-line basis over the initial term

of the lease unless external economic factors exist

such that renewals are reasonably assured, in which

case the Company would include the renewal period

in its amortization period. In addition to minimum

fixed rentals, some leases provide for contingent

facility rentals. Contingent facility rentals are deter-

mined on the basis of a percentage of sales in excess

of stipulated minimums for certain store facilities as

defined in the individual lease agreements. Most of

the leases provide that the Company pays taxes,

maintenance, insurance and certain other expenses

applicable to the leased premises and include options

to renew. Management expects that, in the normal

course of business, leases that expire will be renewed

or replaced by other leases.

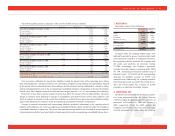

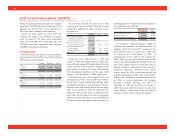

At December 31, 2005, future minimum lease pay-

ments due under non-cancelable operating leases

with lease terms ranging from one year through the

year 2024 are as follows:

Related

Other (a) Parties (a) Total

2006 ................................ $ 214,702 $ 2,345 $ 217,047

2007 ................................ 192,880 2,020 194,900

2008 ................................ 175,219 1,937 177,156

2009 ................................ 155,255 1,652 156,907

2010 ................................ 134,040 1,584 135,624

Thereafter........................ 764,474 2,130 766,604

$1,636,570 $11,668 $1,648,238

(a) The Other and Related Parties columns include stores closed

as a result of the Company’s restructuring plans.

At December 31, 2005 and January 1, 2005, future

minimum sub-lease income to be received under non-

cancelable operating leases is $7,929 and $8,413,

respectively.

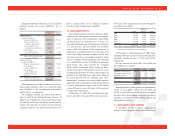

Net rent expense for fiscal 2005, fiscal 2004 and

fiscal 2003 was as follows:

2005 2004 2003

Minimum facility rentals....... $191,897 $169,449 $154,461

Contingent facility rentals ..... 1,334 1,201 1,395

Equipment rentals.................. 4,128 5,128 5,117

Vehicle rentals ....................... 11,316 6,007 7,104

208,675 181,785 168,077

Less: Sub-lease income ......... (3,665) (3,171) (3,223)

$205,010 $178,614 $164,854

Rental payments to related parties of approximately

$2,925 in fiscal 2005, $3,044 in fiscal 2004 and

$3,011 in fiscal 2003 are included in net rent expense

for open stores. Rent expense associated with closed

locations is included in other selling, general and

administrative expenses.

17. INSTALLMENT SALES PROGRAM:

A subsidiary of the Company maintains an

in-house finance program, which offers financing to