Advance Auto Parts 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

properties and assets of its existing domestic sub-

sidiaries and will be secured by the properties and

assets of its future domestic subsidiaries.

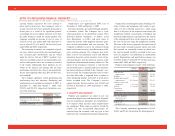

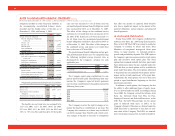

The senior credit facility contains covenants

restricting the ability of the Company and its sub-

sidiaries to, among other things, (1) declare dividends

or redeem or repurchase capital stock, (2) prepay,

redeem or purchase debt, (3) incur liens or engage in

sale-leaseback transactions, (4) make loans and

investments, (5) incur additional debt (including

hedging arrangements), (6) engage in certain mergers,

acquisitions and asset sales, (7) engage in transac-

tions with affiliates, (8) change the nature of the

Company’s business and the business conducted by

its subsidiaries and (9) change the holding company

status of the Company. The Company is required to

comply with financial covenants with respect to a

maximum leverage ratio, a minimum interest cover-

age ratio, a minimum current assets to funded senior

debt ratio, a maximum senior leverage ratio and max-

imum limits on capital expenditures.

During fiscal 2003, the Company completed the

redemption of its outstanding senior subordinated

notes and senior discount debentures. Incremental

facilities were added to fund the redemption in the

form of a tranche A-1 term loan facility of $75,000

and tranche C-1 term loan facility of $275,000. In

conjunction with this redemption and overall partial

repayment of $54,433, the Company wrote-off

deferred financing costs. The write-off of these costs

combined with the accretion of the discounts and

related premiums paid on the repurchase of the senior

subordinated notes and senior discount debentures

resulted in a loss on extinguishment of debt of

$46,887 in the accompanying consolidated statements

of operations for the year ended January 3, 2004.

During the remainder of fiscal 2003, the Company

repaid $236,089 of its terms loans under the senior

credit facility. In conjunction with this partial repay-

ment, the Company wrote-off additional deferred

financing costs in the amount of $401, which is clas-

sified as a loss on extinguishment of debt in the

accompanying consolidated statements of operations

for the year ended January 3, 2004. Additionally in

December 2003, the Company refinanced the

remaining portion of its tranche A, A-1, C and C-1

term loan facilities under the previous senior credit

facility by amending and restating the credit facility

to add a new $100,000 tranche D term loan facility

and $340,000 tranche E term loan facility. The bor-

rowings under the tranche D term loan facility and

tranche E term loan facility were used to replace the

tranche A, A-1, C and C-1 term loan facilities.

As of December 31, 2005, the Company was

in compliance with the covenants of the senior

credit facility. Substantially all of the net assets of

the Company’s subsidiaries are restricted at

December 31, 2005.

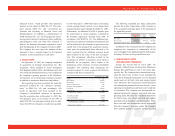

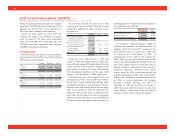

At December 31, 2005, the aggregate future annual

maturities of long-term debt are as follows:

2006 ............................................................................ $ 32,760

2007 ............................................................................ 32,093

2008 ............................................................................ 63,450

2009 ............................................................................ 52,771

2010 ............................................................................ 257,573

Thereafter.................................................................... 153

$438,800

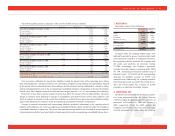

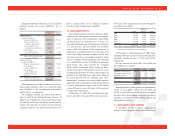

14. STOCK REPURCHASE PROGRAM:

During the third quarter of fiscal 2005, the

Company’s Board of Directors authorized a stock

repurchase program of up to $300,000 of the

Company’s common stock plus related expenses. The

program, which became effective August 15, 2005,

replaced the remaining portion of a $200,000 stock

repurchase program authorized by the Company’s

Board of Directors during fiscal 2004. The program

allows the Company to repurchase its common stock

on the open market or in privately negotiated transac-

tions from time to time in accordance with the

requirements of the Securities and Exchange

Commission. During fiscal 2005, the Company

repurchased a total of 1,530,675 shares of common

stock under the new program, at an aggregate cost of

$59,452, or an average price of $38.84 per share,

excluding related expenses. At December 31, 2005,

20,800 shares remained unsettled representing $889.

Advance Auto Parts

I

Annual Report 2005

I

51