Advance Auto Parts 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

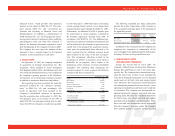

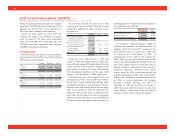

At December 31, 2005, the senior credit facility

provided for (1) $438,300 in term loans (as detailed

above) and (2) $200,000 under a revolving credit

facility (which provides for the issuance of letters of

credit with a sub limit of $70,000). As of December

31, 2005, the Company had $54,579 in letters of cred-

it outstanding, which reduced availability under the

credit facility to $145,421. In addition to the letters of

credit, the Company maintains approximately $1,607

in surety bonds issued by its insurance provider pri-

marily to utility providers and the departments of

revenue for certain states. These letters of credit and

surety bonds generally have a term of one year or less.

The tranche A term loan currently requires sched-

uled repayments of $7,500 on March 31, 2006 and

quarterly thereafter through December 31, 2006,

$10,000 on March 31, 2007 and quarterly thereafter

through December 31, 2007, $12,500 on March 31,

2008 and quarterly thereafter through June 30, 2009

and $25,000 due at maturity on September 30, 2009.

The tranche B term loan currently requires scheduled

repayments of $425 on March 31, 2006 and quarterly

thereafter, with a final payment of $160,650 due at

maturity on September 30, 2010. The delayed draw

term loan currently requires scheduled repayments of

0.25% of the aggregate principal amount outstanding

on March 31, 2006 and quarterly thereafter, with a

final payment due at maturity on September 30,

2010. The revolver expires on September 30, 2009. In

addition, the Pennsylvania Department of Com-

munity and Economic Development machinery and

equipment loan fund, or MELF, loan currently

requires nominal monthly principal repayments rang-

ing from $5 to $7 until maturity on January 1, 2010.

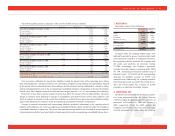

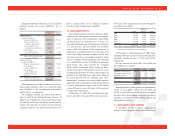

The interest rates on the tranche A and B term

loans, the delayed term loan and the revolver are

based, at the Company’s option, on an adjusted

LIBOR rate, plus a margin, or an alternate base rate,

plus a margin. The current margin for the tranche A

term loan and revolver is 1.25% and 0.25% per

annum for the adjusted LIBOR and alternate base

rate borrowings, respectively. The current margin for

the tranche B loan and the delayed draw term loan is

1.50% and 0.50% per annum for the adjusted LIBOR

and alternative base rate borrowings, respectively.

Additionally, a commitment fee of 0.25% per annum

will be charged on the unused portion of the revolver,

payable in arrears. The effective interest rate on the

MELF loan is 2.75%.

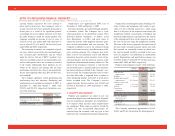

Borrowings under the senior credit facility are

required to be prepaid, subject to certain exceptions,

with (1) 50% of the Excess Cash Flow (as defined in

the senior credit facility) unless the Company’s

Senior Leverage Ratio (as defined in the senior credit

facility) at the end of any fiscal year is less than or

equal to 1.00, in which case 25% of Excess Cash

Flow for such fiscal year will be required to be

repaid, (2) 100% of the net cash proceeds of all asset

sales or other dispositions of property by the

Company and its subsidiaries, subject to certain

exceptions (including exceptions for reinvestment of

certain asset sale proceeds within 270 days of such

sale and certain sale-leaseback transactions), and

(3) 100% of the net proceeds of certain issuances of

debt or equity by the Company and its subsidiaries.

Voluntary prepayments and voluntary reductions of

the unutilized portion of the revolver are permitted in

whole or in part, at the Company’s option, in mini-

mum principal amounts specified in the senior credit

facility, without premium or penalty, subject to reim-

bursement of the lenders’ redeployment costs in the

case of a prepayment of adjusted LIBOR borrowings

other than on the last day of the relevant interest period.

Voluntary prepayments will (1) generally be allocated

among the facilities on a pro rata basis (based on the

then outstanding principal amount of the loans under

each facility) and (2) within each such facility, be

applied to the installments under the amortization

schedule within the following 12 months under such

facility until eliminated. All remaining amounts of

prepayments will be applied pro rata to the remaining

amortization payments under such facility. The senior

credit facility also provides for customary events of

default, including non-payment defaults, covenant

defaults and cross-defaults to the Company’s other

material indebtedness.

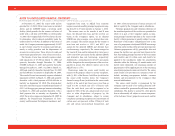

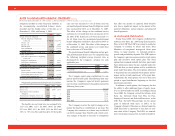

The senior credit facility is guaranteed by the

Company and by each of its existing domestic sub-

sidiaries and will be guaranteed by all future domestic

subsidiaries. The facility is secured by a first priority

lien on substantially all, subject to certain exceptions,

of the Advance Stores’ properties and assets and the

50

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004 (in thousands, except per share data)