Advance Auto Parts 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

margin improvements. These results helped us generate

strong cash flow and drive a higher return on our

invested capital. Our strong sales were primarily driven

by an 8.7% increase in comparable store net sales for

the year, our highest comparative sales increase as a

public company. Additionally, our average net sales

per store rose to more than $1.5 million, which is one

of the highest among our major competitors.

We remain focused on the following four goals:

1. Raising average sales per store;

2. Expanding operating margins;

3. Generating strong free cash flow; and

4. Increasing return on invested capital.

We believe our 2005 results also reflect the

progress made on the following key initiatives that

focus specifically on driving higher sales per store

and leveraging our fixed expenses:

• Improving store execution towards “best in class”

in automotive aftermarket retail;

• Continued execution of our category management

program;

• Continued implementation of our 2010 store

remodeling program, now resulting in more than

50% of our chain remodeled;

• Our focus on making our supply chain more

responsive and improving our in-stock position;

• Consistent growth and execution of our

commercial program;

• Our focus on recruiting, training and retaining

high-performing Team Members, especially those

who are ASE-certified and/or bilingual; and

• Enhanced national advertising.

Beyond the implementation of our key business

initiatives, various conditions that impact our indus-

try continue to remain strong. The number of regis-

tered vehicles on the road is at an all time high and

continues to increase. The average age of vehicles

also continues to increase and is now over nine years

old. Additionally, technological changes in newer

models and the shift from cars to light trucks and

sport utility vehicles have resulted in more expensive

replacement parts for these vehicles. We believe the

combination of our execution on key business initia-

tives and favorable industry dynamics will continue

to drive our earnings per share growth into the fore-

seeable future.

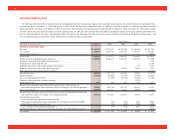

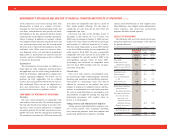

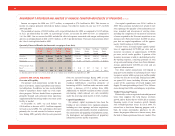

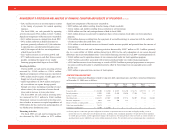

The following table highlights certain operating

results and key metrics for 2005, 2004 and 2003:

Fiscal Year

2005 2004 2003(1)

Total net sales

(in thousands)........... $4,264,971 $3,770,297 $3,493,696

Total commercial net

sales (in thousands).. $ 931,320 $ 693,449 $ 553,003

Comparable store net

sales growth........... 8.7% 6.1% 3.1%

DIY comparable store

net sales growth..... 4.8% 2.8% 2.4%

DIFM comparable

store net sales

growth.................... 25.2% 22.9% 7.2%

Average net sales per

store (in thousands).. $ 1,551 $ 1,453 $ 1,379

Inventory per store

(in thousands)........... $ 476,009 $ 453,035 $ 438,669

Inventory turnover ..... 1.75 1.74 1.72

Gross margin.............. 47.2% 46.5% 45.9%

Operating margin....... 9.6% 8.7% 8.3%

Note: These metrics should be reviewed along with the footnotes

to the table setting forth our selected store data in “Selected

Financial Data” located elsewhere in this report. The footnotes

contain descriptions regarding the calculation of these metrics.

(1) All financial metrics for 2003 include the 53rd week, except

the average net sales per store and inventory turnover metrics.

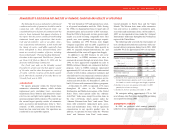

KEY 2005 EVENTS

The following key events occurred during 2005:

• Began servicing stores from our new Northeast

distribution center;

• Acquired substantially all of the assets of Lappen

Auto Supply;

• Completed the acquisition of Autopart

International, Inc.;

• Commenced a new $300 million stock repurchase

program authorized by our Board of Directors;

• Effected a 3-for-2 stock split in the form of a 50%

stock dividend;

• Suffered structural damages and disruptions created

by three major hurricanes – Katrina, Rita and

Wilma; and

• Completed the physical conversion of our Florida

stores acquired from Discount Auto Parts.

Acquisitions

On September 14, 2005, we completed the acqui-

sition of Autopart International, Inc., or AI. The

acquisition, which included 61 stores throughout

New England and New York, a distribution center

and AI’s wholesale distribution business, will com-

plement our growing presence in the Northeast. AI’s

business serves the growing commercial market in

addition to warehouse distributors and jobbers. The

acquisition has been accounted for under the pur-

chase method of accounting. Accordingly, AI’s

results of operations have been included in our con-

solidated statement of operations since the acquisi-

tion date. The purchase price of $87.4 million, inclu-

sive of contingent consideration of $12.5 million

payable no later than April 1, 2006 based upon AI

satisfying certain earnings before interest, taxes,

depreciation and amortization targets met through

December 31, 2005, has been allocated to the assets

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

22