Advance Auto Parts 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

not be sufficient to recover the carrying value. This

determination is based on a number of factors,

including the store’s historical operating results and

cash flows, estimated future sales growth, real estate

development in the area and perceived local market

conditions that can be difficult to predict and may be

subject to change. In addition, we regularly evaluate

our computer-related and other long-lived assets and

may accelerate depreciation over the revised useful

life if the asset is expected to be replaced or has lim-

ited future value. When assets are retired or other-

wise disposed of, the cost and related accumulated

depreciation or amortization are removed from the

accounts, and any resulting gain or loss is reflected

in income for that period.

Tax Reserves

The determination of our income tax liabilities is

based upon the code, regulations, pronouncements

and applicable case law of the taxing jurisdictions in

which we do business. Applying these complex rules

requires significant judgment. We believe our tax

positions are fully supportable, but we establish

reserves for certain positions which may be success-

fully challenged. These reserves are adjusted, on a

facts and circumstances basis, as challenges are

resolved or the relevant tax guidance evolves.

COMPONENTS OF STATEMENT OF OPERATIONS

Net Sales

Net sales consist primarily of comparable store

sales and new store net sales. We calculate compara-

ble store sales based on the change in net sales start-

ing once a store has been opened for 13 complete

accounting periods. We include relocations in com-

parable store sales from the original date of opening.

We exclude net sales from the 36 Western Auto retail

stores from our comparable store sales as a result of

their unique product offerings. We also plan to

exclude the net sales from the AI stores from our

comparable store sales.

Our fiscal year ends on the Saturday closest to

December 31 and consists of 52 or 53 weeks. Our

2004 fiscal year began on January 4, 2004 and con-

sisted of 52 weeks, while our 2003 fiscal year began

on December 29, 2002 and consisted of 53 weeks.

The extra week of operations in fiscal 2003 resulted

in our fiscal 2004 consisting of non-comparable cal-

endar weeks to fiscal 2003. To create a meaningful

comparable store sales measure for fiscal 2004, we

have compared the calendar weeks of 2004 to the

corresponding calendar weeks of fiscal 2003.

Accordingly, our calculation of comparable stores

sales for fiscal 2004 excludes week one of opera-

tions from fiscal 2003.

Cost of Sales

Our cost of sales consists of merchandise costs,

net of incentives under vendor programs, inventory

shrinkage and warehouse and distribution expenses.

Gross profit as a percentage of net sales may be

affected by variations in our product mix, price

changes in response to competitive factors and fluc-

tuations in merchandise costs and vendor programs.

We seek to avoid fluctuation in merchandise costs

and instability of supply by entering into long-term

purchasing agreements with vendors when we

believe it is advantageous.

Selling, General and Administrative Expenses

Selling, general and administrative expenses con-

sist of store payroll, store occupancy (including

rent), advertising expenses, other store expenses and

general and administrative expenses, including

salaries and related benefits of store support center

Team Members, store support center administrative

office expenses, data processing, professional

expenses and other related expenses.

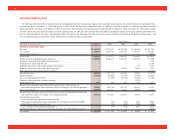

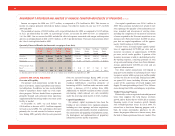

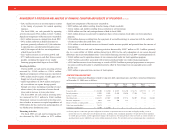

RESULTS OF OPERATIONS

The following table sets forth certain of our oper-

ating data expressed as a percentage of net sales for

the periods indicated:

Fiscal Year Ended

December 31, January 1, January 3,

2005 2005 2004

Net sales ............................. 100.0% 100.0% 100.0%

Cost of sales ....................... 52.8 53.5 54.1

Gross profit ........................ 47.2 46.5 45.9

Selling, general and

administrative expenses .. 37.6 37.8 37.3

Expenses associated with

merger and integration.... —— 0.3

Operating income............... 9.6 8.7 8.3

Interest expense.................. (0.7) (0.5) (1.1)

Loss on extinguishment

of debt............................ —(0.1) (1.4)

Other income, net............... (0.0) 0.0 0.0

Income tax expense............ 3.4 3.1 2.2

Income from continuing

operations before

discontinued operations .. 5.5 5.0 3.6

Discontinued operations:

(Loss) income from

operations of dis-

continued wholesale

distribution network ... —(0.0) (0.0)

(Benefit) provision for

income taxes.............. —(0.0) (0.0)

(Loss) income on dis-

continued operations .. —(0.0) (0.0)

Net income ......................... 5.5% 5.0% 3.6%

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

26