Advance Auto Parts 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advance Auto Parts

I

Annual Report 2005

I

27

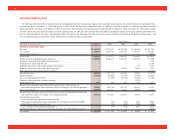

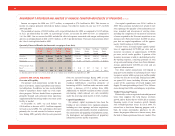

Fiscal 2005 Compared to Fiscal 2004

Net sales for 2005 were $4,265.0 million, an

increase of $494.7 million, or 13.1%, over net sales

for 2004. The net sales increase was due to an

increase in comparable store sales of 8.7%, contribu-

tions from the 151 new stores opened within the last

year and sales from acquired operations. The compa-

rable store sales increase was driven by an increase in

average ticket sales and a slight increase in customer

traffic. We believe these results reflect the execution

of the key business initiatives discussed previously in

the Management Overview section. In addition, we

believe our DIFM sales have increased as a result of

the continued execution of our commercial plan as dis-

cussed previously in the Commercial Program section.

Gross profit for 2005 was $2,014.5 million, or

47.2% of net sales, as compared to $1,753.4 million,

or 46.5% of net sales, in 2004. The increase in gross

profit as a percentage of sales reflects continued

benefits realized from our category management

program in the form of better margins on key product

categories and increased incentives under our vendor

programs and supply chain efficiencies.

Selling, general and administrative expenses were

$1,606.0 million, or 37.6% of net sales for 2005, as

compared to $1,424.6 million, or 37.8% of net sales

for 2004. For fiscal 2005, we experienced a decrease

in selling, general and administrative expenses as a

percentage of net sales resulting from our ability to

leverage our strong comparable store sales and lower

self-insurance expense partially offset by higher fuel

and energy costs.

Interest expense for 2005 was $32.4 million, or

0.7% of net sales, as compared to $20.1 million, or

0.5% of net sales, in 2004. The increase in interest

expense is a result of both higher average outstand-

ing debt levels and borrowing rates as compared to

fiscal 2004.

Income tax expense for 2005 was $144.2 million,

as compared to $117.7 million for 2004. This in-

crease in income tax expense primarily reflects our

higher earnings. Our effective income tax rate was

38.1% and 38.5% for 2005 and 2004, respectively.

We recorded net income of $234.7 million, or

$2.13 per diluted share for 2005, as compared to

$188.0 million, or $1.66 per diluted share for 2004. As

a percentage of sales, net income for 2005 was 5.5%,

as compared to 5.0% for 2004. The earnings per share

results reflect the effect of a 3-for-2 stock split of our

common stock distributed on September 23, 2005.

Fiscal 2004 Compared to Fiscal 2003

Net sales for 2004 were $3,770.3 million, an

increase of $276.6 million, or 7.9%, over net sales for

2003. Excluding the effect of the 53rd week for 2003

our net sales increased $339.6 million, or 9.9%, over

net sales for 2003. The net sales increase was due to

an increase in comparable store sales of 6.1% and

contributions from our 125 new stores opened during

fiscal 2004. The comparable store sales increase was

primarily the result of increases in both customer

traffic and average ticket sales. Overall, we believe

our 2010 store format, category management and

enhanced nationwide advertising program drove our

growth in net sales. In addition, we believe our DIFM

sales have increased as a result of the continued exe-

cution of our commercial delivery programs in our

existing markets and our continued focus on a high

level of service to our DIFM customers.

Gross profit for 2004 was $1,753.4 million, or

46.5% of net sales, as compared to $1,604.5 million,

or 45.9% of net sales, in 2003. The increase in gross

profit as a percentage of sales reflect continued ben-

efits realized from our category management initia-

tives and reduced inventory shrinkage.

Selling, general and administrative expenses

increased to $1,424.6 million, or 37.8% of net sales

for 2004, from $1,316.3 million, or 37.6% of net

sales for 2003. The increase in selling, general and

administrative expenses as a percentage of net sales

in 2004 was primarily a result of increased expenses

associated with our self-insurance programs, includ-

ing the increased costs required to close claims

below our stop-loss limits and increased medical

costs for covered Team Members due to inflation in

the health care sector. Selling, general and adminis-

trative expenses for 2003 included $10.4 million in

merger and integration expenses related to the inte-

gration of Discount. These integration expenses

were related to, among other things, overlapping

administrative functions and store conversion

expenses. Excluding the merger and integration

expenses from 2003, selling, general and administra-

tive expenses were 37.3% of net sales.

Interest expense for 2004 was $20.1 million, or

0.5% of net sales, as compared to $37.6 million, or

1.1% of net sales, in 2003. The decrease in interest

expense is a result of lower overall interest rates due

primarily to our redemption of our outstanding senior

subordinated notes and senior discount debentures in

the first quarter of fiscal 2003. Additionally, the

decrease resulted from lower average outstanding debt

levels on our senior credit facility throughout fiscal

2004 as compared to fiscal 2003.