Acer 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 79 -

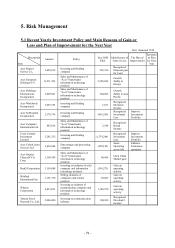

5.2 Items to be Noticed for Risk Management & Evaluation

5.2.1 How does interest rate, exchange rate, or inflation influence Company’s profit and

loss, and how to manage such risks?

Interest Rate:

US Fed had raised the USD interest rate from 2.5% to 4.25% last year. The influence of

such raise on the Company are not great due to neither medium nor long term USD

liability, and only temporary gap on the big payment date.

Exchange rate:

The major foreign currency position of the Company is Euro receipt. Euro was trading

in a range in year 2005. Under the suitable hedge tools utilization and stop loss strategy,

there is no FX loss but small FX gain of whole year 2005. The company will maintain

the consistent steady strategy and hedge the foreign exchange position aggressively to

reduce the impact to the Company’s profit and loss.

Inflation:

For year 2005, the inflation rate in Taiwan remained stable; thus there was not

significant impact on the Company’s operations and profits.

5.2.2 What is the Company’s policy to make high risk or leverage investment, make a

loan, make a guarantee or buy derivatives? And what are the reasons of gain or loss

and what are the future plans?

The Company does not make any high risk/leverage investment. The short-term idle

capital is used to purchase the government bonds and high raking bond funds or

corporate bonds. The long-term idle capital is used to invest companies whose business

related to our core business.

Generally speaking, aside from the 100% owned subsidiary, the Company will not loan

funds or provide corporate guarantee to others. When the company will make a loan or

provide guarantee required by business, it has to comply with competent internal

procedures. Until Dec. 31, 2005, the aggregate amount the Company had provided

corporate guarantees was NT $7,195 million and the utilization by the parties on behalf

of which the guarantees was NT $2,588 million. LTSC was the only firm not 100%

owned but guaranteed by the Company in proportion to its shareholding percentages in

accordance with joint venture agreement. Until Dec. 31, 2005, the amount the

Company had provided corporate guarantees and utilized by LTSC was NT $308 million.

Except for hedging purposes, Company will not engage in any derivatives trading. If the

Company has to engaging in derivatives trading as necessary for business, it has to

comply with related internal procedures.