Acer 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 15 -

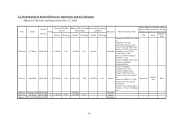

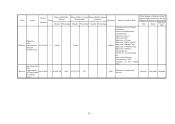

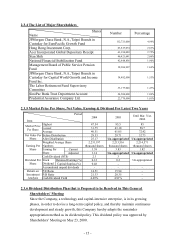

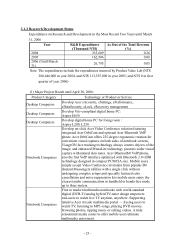

2.3.4 The List of Major Shareholders

Shares

Name Number Percentage

JPMorgan Chase Bank, N.A.,Taipei Branch in

Custoday for EuroPacific Growth Fund 112,721,000 4.99%

Hong Rong Investment Corp. 63,817,074 2.83%

Acer Incorporated Global Depositary Receipt 61,934,089 2.75%

Stan Shih 46,421,641 2.06%

National Financial Stabilization Fund 42,848,856 1.90%

Management Board of Public Service Pension

Fund 38,206,907 1.69%

JPMorgan Chase Bank, N.A.,Taipei Branch in

Custoday for Capital World Growth and Income

Fund Inc.

34,482,000 1.53%

The Labor Retirement Fund Supervisory

Committee 33,177,048 1.47%

SinoPac Bank Trust Department Account 24,500,000 1.09%

Prudential Assurance Company Ltd. 22,770,000 1.01%

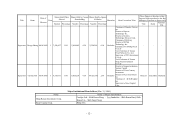

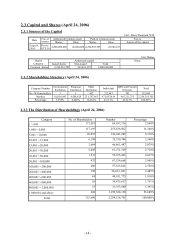

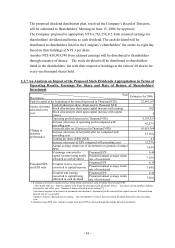

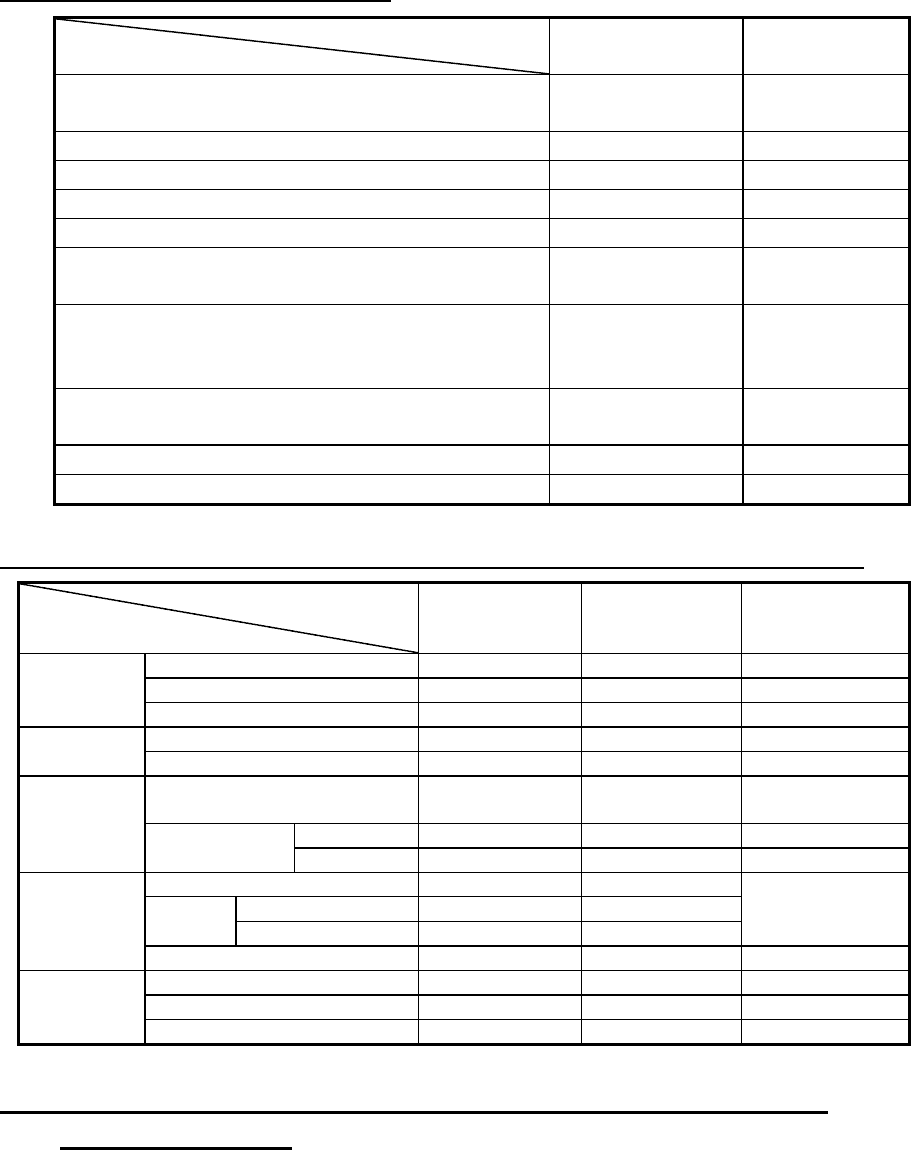

2.3.5 Market Price Per Share, Net Value, Earning & Dividend For Latest Two Years

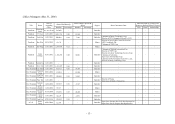

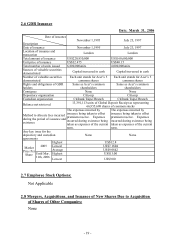

2.3.6 Dividend Distribution Plan that is Proposed to be Resolved in This General

Shareholders’ Meeting

Since the Company, a technology and capital-intensive enterprise, is in its growing

phases, in order to devise a long-term capital policy, and thereby maintain continuous

development and steady growth, this Company hereby adopts the remainder

appropriation method as its dividend policy. This dividend policy was approved by

Shareholders’ Meeting on May 23, 2000.

Period

Item

2004 2005

Until Mar. 31st,

2006

Highest 47.54 85.5 85

Lowest 31.75 43.18 58.7

Market Price

Per Share Average 40.51 61.05 72.42

Before Distribution 29.53 29.71 32.73 Net Value Per

Share After Distribution 25.17 Un-appropriated Un-appropriated

Weighted Average Share

Numbers

2,231,197

thousand shares

2,213,516

thousand shares

2,214,571

thousand shares

Current 3.38 3.83 1.82

Earning Per

Share Earning Per

Share Adjusted 3.14

Un-appropriated Un-appropriated

Cash Dividend (NT$) 2.3 3

Retained Earning (%) 0.12 0.2 Stock

Dividend Capital Surplus (%) 0.48 -

Un-appropriated

Dividend Per

Share

Accumulated unpaid dividends - - -

P/E Ratio 14.51 15.94 -

P/D Ratio 21.33 20.35 -

Return on

Investment

Analysis Cash Dividend Yield 4.69% 4.91% -