Acer 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 18 -

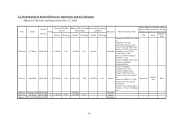

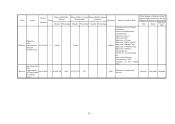

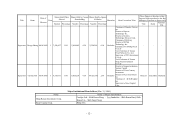

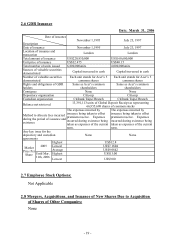

2.4 The Secured Corporate Bonds in Taiwan

Category of corporate bonds The first secured corporate bonds

in Taiwan

The Second secured corporate

bonds in Taiwan

Date of issuance January 21, 2000 December 21, 2000 ~ December

27, 2000

Par value NT$1,000,000 NT$1,000,000

Location of issuance and

transaction

Taiwan Over-The-Counter

Securities Exchange

Taiwan Over-The-Counter

Securities Exchange

Issuing price At 100% par value. At 100% par value.

Total amount NT$3,000,000,000 NT$3,000,000,000

Interest Rate Per Annum 5.76% 5.26%

Period 5 Years. Maturity Date: Jan 20,

2005

5 Years. Maturity Date: Dec.

11-26, 2005

Consignee TC Bank, Trust Dept. TC Bank, Trust Dept.

Underwriter Chien Hung Securities Co., Ltd. Fubon Securities Co., Ltd.

Verifying Attorney-at-Law Huang Tai-feng Office,

Attorneys-at-Law

Huang Tai-feng Office,

Attorneys-at-Law

Verifying CPA Peat, Marwick, Mitchell & Co., Peat, Marwick, Mitchell & Co.,

Method of repayment

Interests are calculated and paid

according to the terms listed in

bonds once per year.

Repayment is once and for all

upon maturity date.

Interests are calculated and paid

according to the terms listed in

bonds once per year.

Repayment is once and for all

upon maturity date.

Un-expiated principal

NT$3,000,000,000 NT$3,000,000,000

Terms of redemption or

repayment ahead of schedule None None

Restrictive terms None None

Credit rating organization, date,

results of corporate bond rating None None

Amount of

converted

common

shares, GDRs

or valuable

securities

None None

Auxiliary right o

f

conversion

Regulations for

issuance and

conversion

None None

Any impact on the value of the

stocks and shareholder's equity

from the issuance or conversion

None None

Depository organization

consigned for the objects of

conversion

None None

2.5 Special Shares:

Not Applicable