Acer 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 59 -

The interest rates on the above long-term borrowings ranged from 3.10% to 6.10% in 2004

and from 3% to 7% in 2005. Refer to note 6 for a description of pledged assets related to

these loans.

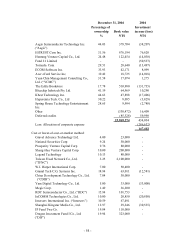

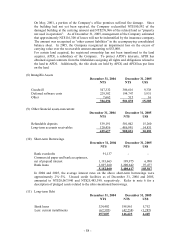

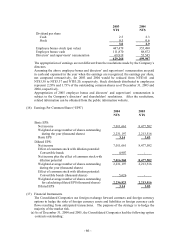

(12) Bonds Payable

December 31, 2004

NT$

First secured domestic bonds 3,000,000

Second secured domestic bonds 3,000,000

6,000,000

Less: current installments (6,000,000)

-

(a) Five-year 5.76% first secured domestic bonds with face value of NT$3,000,000 were issued

on January 21, 2000. The maturity date is five years subsequent to the issuance date.

Interest is paid annually, and principal is paid in whole at maturity. The bonds are secured

by common shares of BenQ and TSMC owned by the Company.

As of January 20, 2005, the Company redeemed the bonds at maturity.

(b) Five-year 5.26% second secured domestic bonds with face value of NT$3,000,000 were

issued on December 12, 2000. The maturity date is five years subsequent to the issuance

date. Interest is paid annually, and principal is paid in whole at maturity. The bonds are

secured by common shares of BenQ and TSMC owned by the Company.

As of December 21, 2005, the Company redeemed the bonds at maturity.

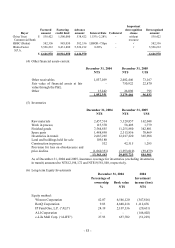

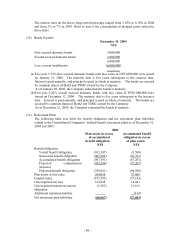

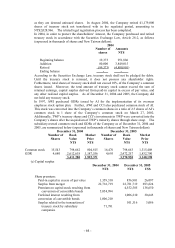

(13) Retirement Plans

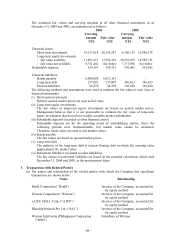

The following table sets forth the benefit obligation and net retirement plan liabilities

related to the Consolidated Companies’ defined benefit retirement plans as of December 31,

2004 and 2005:

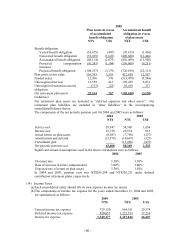

2004

Plan assets in excess

of accumulated

benefit obligation

Accumulated benefit

obligation in excess

of plan assets

NT$ NT$

Benefit obligation:

Vested benefit obligation (102,185) (8,500)

Nonvested benefit obligation (405,206) (58,781)

Accumulated benefit obligation (507,391) (67,281)

Projected compensation

increases

(242,290) (27,307)

Projected benefit obligation (749,681) (94,588)

Plan assets at fair value 564,098 37,445

Funded status (185,583) (57,143)

Unrecognized net loss 124,298 14,041

Unrecognized transition (assets)

obligation

(5,382) 15,611

Additional minimum liability -

(112)

Net retirement plan liabilities (66,667) (27,603)