Acer 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 50 -

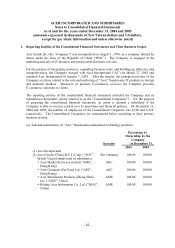

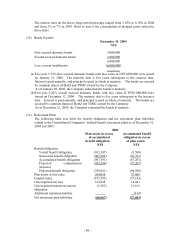

requirements of the ROC Labor Standards Law, the funding of retirement plans by the

Company and its domestic subsidiaries are based on a percentage of employees’ total

salaries.

Under the defined benefit retirement plan, the Consolidated Companies recognize a

minimum pension liability equal to the amount by which the actuarial present value of the

accumulated benefit obligation exceeds the fair value of the retirement plan’ s assets.

The Consolidated Companies also recognize the net periodic pension cost using actuarial

techniques.

(2) Defined contribution retirement plans

Starting from July 1, 2005, in accordance with the enforcement rules of the newly enacted

Labor Pension Act (the “New Act”), the Company and its domestic subsidiaries made

monthly contribution to an individual labor pension fund account of the following

categories of employees in the amount equal to 6% of the employee’ s monthly salaries:

(i) employees who originally adopted the Plans and opted to be subject to the pension

mechanism under the New Act; or

(ii) employees who commenced working after the enforcement date of the New Act.

Certain of the Company’ s foreign subsidiaries adopt defined contribution retirement plans.

These plans are funded in accordance with the regulations of their respective countries.

Contributions to defined contribution retirement plans are expensed as incurred.

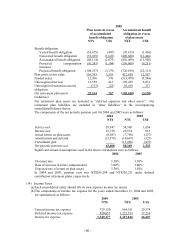

(p) Income taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax is

determined based on differences between the financial statements and tax basis of assets and

liabilities using enacted tax rates in effect during the years in which the differences are

expected to reverse. The income tax effects resulting from taxable temporary differences are

recognized as deferred income tax liabilities. The income tax effects resulting from

deductible temporary differences, net operating loss carryforwards, and income tax credits are

recognized as deferred income tax assets. The realization of the deferred income tax assets is

evaluated, and if it is considered more likely than not that the asset will not realized, a

valuation allowance is recognized accordingly.

Classification of the deferred income tax assets or liabilities as current or noncurrent is based

on the classification of the related asset or liability. If the deferred income tax asset or

liability is not directly related to a specific asset or liability, then the classification is based on

the asset’ s or liability’ s expected realization date.

Income tax is reduced by investment tax credits in the year which the credit arises.

According to the ROC Income Tax Law, the Company’ s undistributed earnings, if any, earned

after December 31, 1997, are subject to an additional 10% retained earnings tax. The surtax

is accounted for as income tax expense upon the stockholders’ resolution on distribution of

earnings in the following year.

(q) Treasury stock

The Consolidated Companies account for the their purchase of the Company’ s outstanding

stock as “treasury stock” and include the treasury stock as a component of stockholders’

equity in the accompanying consolidated balance sheet. Upon disposal of the treasury stock,

the excess of the sale proceeds over cost is accounted for as capital surplus-treasury stock.

If the sale proceeds are less than cost, the deficiency is accounted for as a reduction of the

remaining balance of capital surplus-treasury stock. If the remaining balance of capital

surplus-treasury stock is insufficient to cover the deficiency, the remainder is recorded as a

reduction of retained earnings. The cost of treasury stock is computed using the

weighted-average method. Cash dividends paid by the Company to its consolidated

subsidiaries that hold the treasury stock are also accounted for as capital surplus-treasury

stock.

If treasury stock is retired, the weighted-average cost of the retired treasury stock is written off

to offset the par value and the capital surplus, if any, of the stock retired. If the

weighted-average cost written off exceeds the sum of both the par value and the capital