Acer 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 58 -

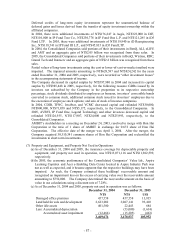

On May, 2001, a portion of the Company’ s office premises suffered fire damage. Since

the building had not yet been repaired, the Company reclassified NT$180,592 of the

damaged building at the carrying amount and NT$276,966 of the related land as “property

not used in operation”. As of December 31, 2005, management of the Company estimated

that approximately NT$116,308 of losses will not be indemnified by the insurance company.

The amount was recognized as “other current liabilities” in the accompanying consolidated

balance sheet. In 2005, the Company recognized an impairment loss on the excess of

carrying value over the recoverable amount amounting to $53,000.

For certain land acquired, the registered ownership has not been transferred to the land

acquirer, APDI, a subsidiary of the Company. To protect APDI’ s interests, APDI has

obtained signed contracts from the titleholders assigning all rights and obligations related to

the land to APDI. Additionally, the title deeds are held by APDI, and APDI has put liens

on the land.

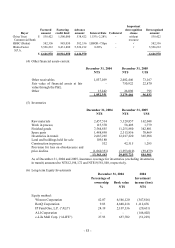

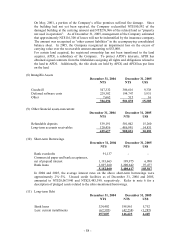

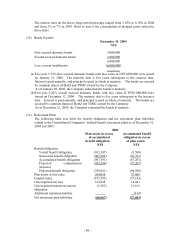

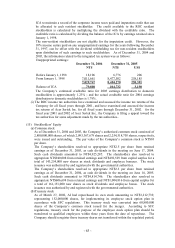

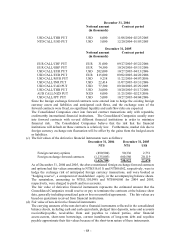

(8) Intangible Assets

December 31, 2004 December 31, 2005

NT$ NT$ US$

Goodwill 547,332 306,616 9,338

Deferred software costs 229,302 194,747 5,931

Other 7,662 515 16

784,296 501,878 15,285

(9) Other financial assets-noncurrent

December 31, 2004 December 31, 2005

NT$ NT$ US$

Refundable deposits 539,191 501,042 15,260

Long-term accounts receivables 120,436 486,991 14,831

659,627 988,033 30,091

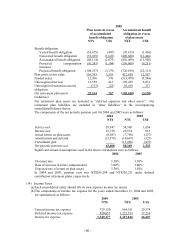

(10) Short-term Borrowings

December 31, 2004 December 31, 2005

NT$ NT$ US$

Bank overdrafts 91,137 - -

Commercial paper and bank acceptances,

net of prepaid interest

1,193,663

199,975

6,090

Bank loans 3,897,260 3,200,642 97,477

5,182,060 3,400,617 103,567

In 2004 and 2005, the average interest rates on the above short-term borrowings were

approximately 2%~3%. Unused credit facilities as of December 31, 2004 and 2005,

amounted to NT$28,067,940 and NT$25,483,399, respectively. Refer to note 6 for a

description of pledged assets related to the afore-mentioned borrowings.

(11) Long-term Debt

December 31, 2004 December 31, 2005

NT$ NT$ US$

Bank loans 324,402 188,861 5,752

Less: current installments (67,395) (42,238) (1,287)

257,007 146,623 4,465