Acer 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

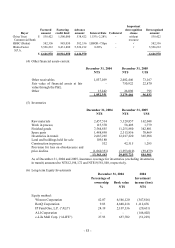

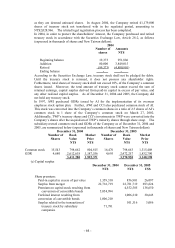

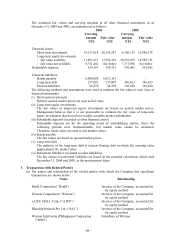

- 60 -

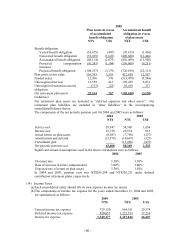

2005

Plan assets in excess

of accumulated

benefit obligation

Accumulated benefit

obligation in excess

of plan assets

NT$ US$ NT$ US$

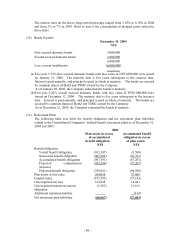

Benefit obligation:

Vested benefit obligation (14,675) (447) (47,819) (1,456)

Nonvested benefit obligation (53,439) (1,628) (408,680) (12,446)

Accumulated benefit obligation (68,114) (2,075) (456,499) (13,902)

Projected compensation

increases

(36,243) (1,104) (269,609) (8,211)

Projected benefit obligation (104,357) (3,179) (726,108) (22,113)

Plan assets at fair value 116,743 3,555 412,630 12,567

Funded status 12,386 376 (313,478) (9,546)

Unrecognized net loss 13,559 413 199,439 6,074

Unrecognized transition (assets)

obligation

(731) (22) 10,419 317

Net retirement plan assets

(liabilities)

25,214 767 (103,620) (3,155)

Net retirement plan assets are included in “deferred expenses and other assets”. Net

retirement plan liabilities are included in “other liabilities” in the accompanying

consolidated balance sheets.

The components of the net periodic pension cost for 2004 and 2005 were as follows:

2004 2005

NT$ NT$ US$

Service cost 59,947 54,309 1,654

Interest cost 25,726 29,974 913

Actual return on plan assets (8,687) (7,769) (237)

Amortization and deferral (13,578) (10,667) (325)

Curtailment gain - (15,498) (472)

Net periodic pension cost 63,408 50,349 1,533

Significant actuarial assumptions used in the above calculations were as follows:

2004 2005

Discount rate 3.50% 3.50%

Rate of increase in future compensation 3.00% 3.00%

Expected rate of return on plan assets 3.50% 3.50%

In 2004 and 2005, pension cost was NT$285,298 and NT$320,231 under defined

contribution retirement plans, respectively.

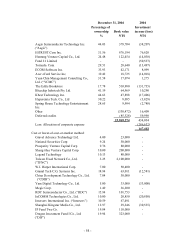

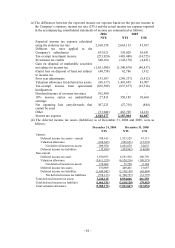

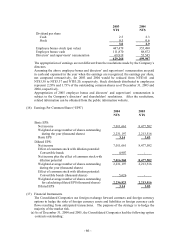

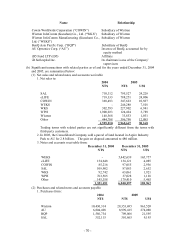

(14) Income Taxes

(a) Each consolidated entity should file its own separate income tax return.

(b) The components of income tax expense for the years ended December 31, 2004 and 2005,

are summarized as follows:

2004 2005

NT$ NT$ US$

Current income tax expense 729,120 964,511 29,374

Deferred income tax expense 820,057 1,222,533 37,233

Income tax expense 1,549,177 2,187,044 66,607