Acer 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 71 -

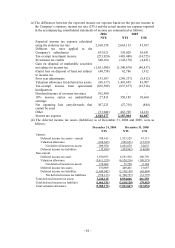

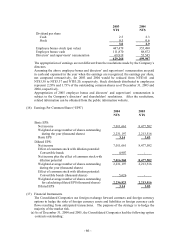

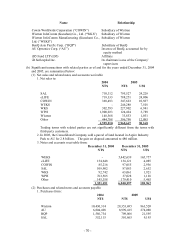

2004 2005

NT$ NT$ US$

Other 550,966 154,336 4,700

19,724,627 38,518,377 1,173,088

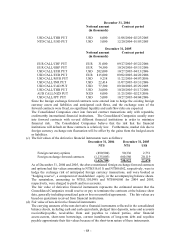

Trading terms with related parties are not significantly different from the terms with

third-party suppliers.

In 2004 and 2005, the Consolidated Companies sold raw material to Wistoron or its

foreign subsidiaries and purchased back the finished goods after being manufactured

by them. To advoid overstatement of revenues, sales of raw material to Wistron or

its foreign subsidiaries amounting to NT$14,899,418 and NT$21,382,152, respectively,

for the years ended December 31, 2004 and 2005, were excluded form the

consolidated revenues. However, the outstanding receivables and payables resulting

from the above-mentioned transactions can not be offset due to lacking of legally

enforceable right. As of December 31, 2004 and 2005, the related accounts

receivables and payables amounted to NT$0 and NT$5,254,206, respectively.

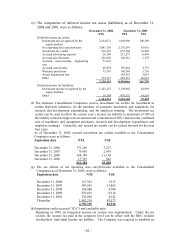

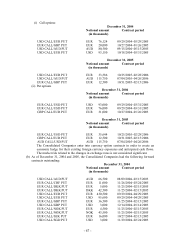

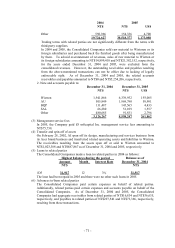

2. Note and accounts payable to:

December 31, 2004 December 31, 2005

NT$ NT$ US$

Wistron 1,941,866 6,339,952 193,085

AU 505,949 1,969,790 59,991

BQP 131,487 145,565 4,433

SAL 66,280 51,109 1,557

Other 480,685 91,831 2,796

3,126,267 8,598,247 261,862

(3) Management service fees

In 2005, the Company paid iD softcapital Inc. management service fees amounting to

NT$75,738.

(4) Transfer and spin-off of assets

On February 28, 2002, AI spun off its design, manufacturing and services business from

its Acer brand business and transferred related operating assets and liabilities to Wistron.

The receivables resulting from the assets spun off or sold to Wistron amounted to

NT$1,023,388 and NT$687,867 as of December 31, 2004 and 2005, respectively.

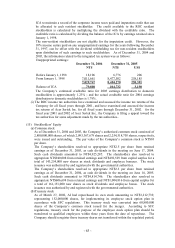

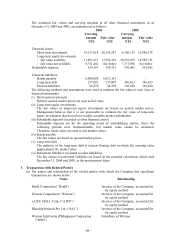

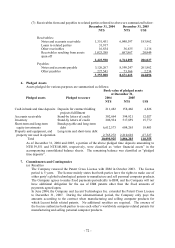

(5) Loans to related parties

The Consolidated Companies made a loan to related parties in 2004 as follows:

Highest balances during the period Balance as of

Amount

Month Interest Rate December 31, 2004

NT$ NT$

iD5 31,917 12 3% 31,917

The loan had been repaid in 2005 and there were no other such loans in 2005.

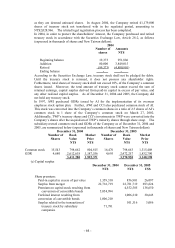

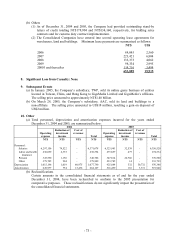

(6) Advances to/from related parties

The Consolidated Companies paid certain expenses on behalf of related parties.

Additionally, related parties paid certain expenses and accounts payable on behalf of the

Consolidated Companies. As of December 31, 2004 and 2005, the Consolidated

Companies had aggregate receivables from related parties of NT$16,834 and NT$36,635,

respectively, and payables to related parties of NT$227,541 and NT$73,366, respectively,

resulting from these transactions.