Acer 2005 Annual Report Download - page 56

Download and view the complete annual report

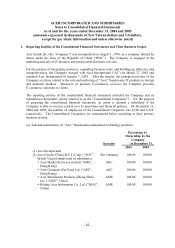

Please find page 56 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 51 -

surplus, the difference is accounted for as a reduction of capital surplus-treasury stock, or a

reduction of retained earnings for any deficiency where capital surplus-treasury stock is

insufficient to cover the difference. If the weighted-average cost written off is less than the

sum of both the par value and capital surplus, if any, of the stock retired, the difference is

accounted for as an increase in capital surplus-treasury stock.

(r) Financial derivatives

(1) Foreign currency exchange forward contracts

Foreign currency exchange forward contracts committed to hedge foreign currency

receivables and payables are translated into the entity’ s functional currency using year-end

exchange rates. The translation difference is recorded as an exchange gain or loss in the

accompanying consolidated statements of income. The difference between the forward

and spot rate on the date the contract is entered into is amortized as an exchange gain or

loss over the term of the contract.

Forward contracts that hedge the foreign currency exposures of anticipated sale and

purchase transactions are valued by their fair value at the balance sheet date and are

recorded in the balance sheet as other financial assets or other liabilities. Changes in fair

values are classified as “hedging reserve”, a separate component of shareholders’ equity.

Such valuation gains or losses are transferred to income or loss in the period when the

related transaction incurs.

(2) Foreign currency options

Foreign currency options are conducted for non-trading purposes. The consolidated

Companies do not record assets or liabilities when committing to foreign currency options.

The foreign currency options are measured at fair value on the balance sheet date and are

recognized as assets or liabilities. Changes in the fair value of options are included in the

income statements if such options are used to hedge the foreign currency risk exposure of

the existing foreign currency assets or liabilities. On the other hand, if the options are used

to hedge the foreign currency risk exposure of the anticipated cash flows, the changes are

recognized in “hedging reserve”.

(s) Earnings per common share

Net income per common share (“EPS”) is based on net income divided by the

weighted-average number of common shares outstanding and those common shares with

dilution potential. The increase in the number of outstanding shares through distribution of

stock dividends from retained earnings or capital surplus is included in the outstanding shares

retroactively.

Convertible bonds are common stock equivalents. If the common stock equivalents have a

diluted effect, diluted EPS is disclosed in addition to basic EPS. In calculating diluted EPS,

it is assumed all common stock equivalents are outstanding during the year. Therefore, net

income and outstanding shares are adjusted for the effect of common stock equivalents.

(t) Translation of New Taiwan dollars into United States dollar amounts

The consolidated financial statements are stated in New Taiwan dollars. Translations of the

2005 New Taiwan dollar amount financial statement into US dollar amounts, using the spot

rate of the Bank of Taiwan on December 31, 2005, of NT$32.835 to US$1, is included solely

for the convenience of the readers. The convenience translations should not be construed as

representations that the New Taiwan dollar amounts have been, could have been, or could in

the future be, converted into US dollars at this or any other rate of exchange.

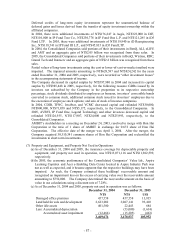

3. Changes in Accounting Policies

The Consolidated Companies adopted ROC SFAS 35 “Accounting for Asset Impairment” in 2005.

After performing an impairment test, the Consolidated Companies recognized an impairment loss

amounting to $805,000 related to property and equipment and property not used in operation.

The change in accounting policy decreases net income of 2005 by $805,000 and basic earnings per

common share by $0.36.