Acer 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

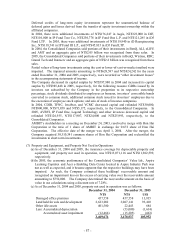

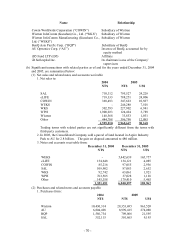

- 66 -

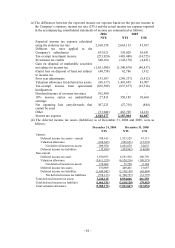

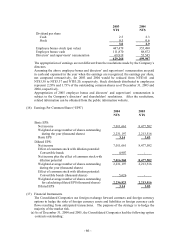

2003 2004

NT$ NT$

Dividend per share

Cash 2.5 2.3

Stock 0.5 0.6

3.0 2.9

Employee bonus-stock (par value) 447,479 355,490

Employee bonus-cash 111,870 88,872

Directors’ and supervisors’ remuneration 69,919 55,545

629,268 499,907

The appropriation of earnings are not different from the resolutions made by the Company’ s

directors.

Assuming the above employee bonus and directors’ and supervisors’ remuneration are paid

in cash and expensed in the year when the earnings are recognized, the earnings per share,

not computed retroactively, for 2003 and 2004 would be reduced from NT$3.61 and

NT$3.38 to NT$3.37 and NT$3.20, respectively. Stock dividends distributed to employees

represent 2.28% and 1.73% of the outstanding common shares as of December 31, 2003 and

2004, respectively.

Appropriation of 2005 employee bonus and directors’ and supervisors’ remuneration is

subject to the Company’ s directors’ and shareholders’ resolutions. After the resolutions,

related information can be obtained from the public information website.

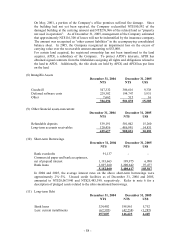

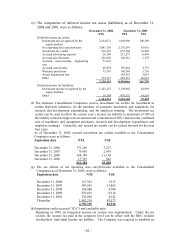

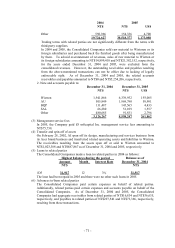

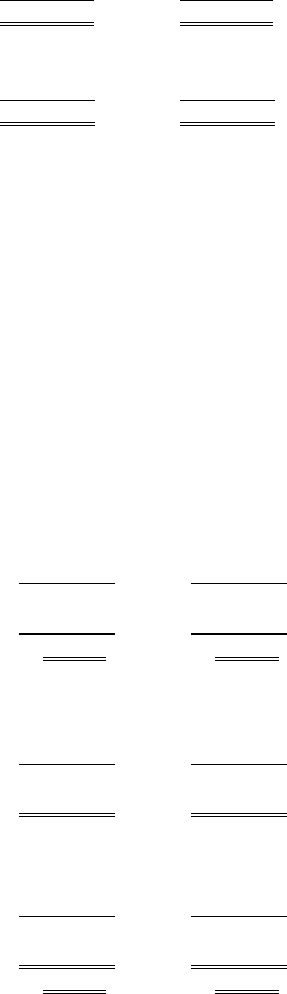

(16) Earnings Per Common Share (“EPS”)

2004 2005

NT$ NT$

Basic EPS:

Net income 7,011,661 8,477,502

Weighted-average number of shares outstanding

during the year (thousand shares)

2,231,197

2,213,516

Basic EPS 3.14 3.83

Diluted EPS:

Net income 7,011,661 8,477,502

Effect of common stock with dilution potential:

Convertible bonds 4,907 -

Net income plus the effect of common stock with

dilution potential

7,016,568

8,477,502

Weighted-average number of shares outstanding

during the year (thousand shares)

2,231,197 2,213,516

Effect of common stock with dilution potential:

Convertible bonds (thousand shares) 5,626 -

Weighted-average number of shares outstanding

for calculating diluted EPS (thousand shares)

2,236,823

2,213,516

Diluted EPS 3.14 3.83

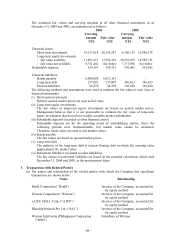

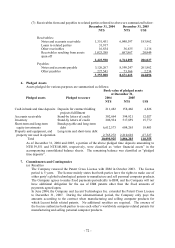

(17) Financial Instruments

The Consolidated Companies use foreign exchange forward contracts and foreign currency

options to hedge the risks of foreign currency assets and liabilities or foreign currency cash

flows resulting from anticipated transactions. The purpose of the strategy is to hedge the

majority of the market risk.

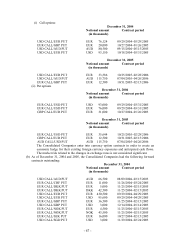

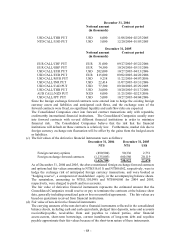

(a) As of December 31, 2004 and 2005, the Consolidated Companies had the following option

contracts outstanding: