Acer 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 47 -

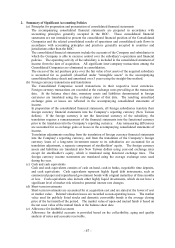

2. Summary of Significant Accounting Policies

(a) Principles for preparation and presentation of consolidated financial statements

The accompanying consolidated financial statements are prepared in accordance with

accounting principles generally accepted in the ROC. These consolidated financial

statements are not intended to present the consolidated financial position of the Consolidated

Companies and the related consolidated results of operations and consolidated cash flows in

accordance with accounting principles and practices generally accepted in countries and

jurisdictions other than the ROC.

The consolidated financial statements include the accounts of the Company and subsidiaries in

which the Company is able to exercise control over the subsidiary’ s operations and financial

policies. The operating activity of the subsidiary is included in the consolidated statement of

income from the date of acquisition. All significant inter-company transactions among the

Consolidated Companies are eliminated in consolidation.

The excess of the net purchase price over the fair value of net assets of the acquired subsidiary

is accounted for as goodwill (classified under “intangible assets” in the accompanying

consolidated balance sheet) and amortized over 5 years using the straight-line method.

(b) Foreign currency transactions and translations

The Consolidated Companies record transactions in their respective local currencies.

Foreign currency transactions are recorded at the exchange rates prevailing at the transaction

date. At the balance sheet date, monetary assets and liabilities denominated in foreign

currencies are translated using the exchange rates of that date. The resulting unrealized

exchange gains or losses are reflected in the accompanying consolidated statements of

income.

In preparation of the consolidated financial statements, all foreign subsidiaries translate their

foreign currency financial statements into the Company’ s reporting currency (New Taiwan

dollars). If the foreign currency is not the functional currency of the subsidiary, the

translation requires a remeasurement of the financial statements into the functional currency

prior to the translation into the Company’ s reporting currency. Any remeasuring differences

are accounted for as exchange gains or losses in the accompanying consolidated statements of

income.

Translation adjustments resulting from the translation of foreign currency financial statements

into the Company’ s reporting currency, and from the translation of the Company’ s foreign

currency loans of a long-term investment nature to its subsidiaries are accounted for as

translation adjustment, a separate component of stockholders’ equity. The foreign currency

assets and liabilities are translated into New Taiwan dollars using year-end exchange rates

except for stockholder’ s equity, which is translated using historical exchange rates. The

foreign currency income statements are translated using the average exchange rates used

during the year.

(c) Cash and cash equivalents

Cash and cash equivalents consists of cash on hand, cash in banks, negotiable time deposits,

and cash equivalents. Cash equivalents represent highly liquid debt instruments, such as

commercial paper and repurchased government bonds with original maturities of three months

or less. Cash equivalents also include other highly liquid investments, which do not have a

significant level of market risk related to potential interest rate changes.

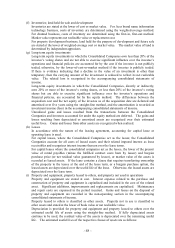

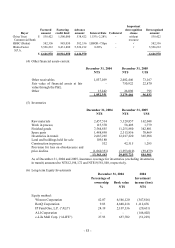

(d) Short-term investments

Short-term investments are accounted for at acquisition cost and are stated at the lower of cost

or market value. Related valuation losses are recorded as non-operating losses. The market

value used for publicly listed stocks and domestic convertible bonds is the average closing

price of the last month of the period. The market value of open-end mutual funds is based on

the net asset value of the mutual funds at the balance sheet date.

(e) Allowance for doubtful accounts

Allowance for doubtful accounts is provided based on the collectibility, aging and quality

analysis of notes and accounts receivable.