Acer 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 49 -

1. Buildings and improvements: 20~50 years

2. Machinery and computer equipment: 3~10 years

3. Furniture and fixtures: 3~5 years

4. Other equipment: 3~10 years

5. Leasehold improvement: 3~10 years

6. Leased equipment: 3~10 years

(j) Intangible assets

Intangible assets are stated at cost and primarily consist of goodwill and computer software

obtained for internal use. Goodwill is amortized using the straight-line method over five

years, and software costs are amortized over three years. Other intangible assets are

amortized using the straight-line method over their useful lives. Starting from 2005,

goodwill is also subject to impairment test at each balance sheet date.

(k) Deferred expenses

Deferred expenses are stated at cost and primarily consist of additions and improvements to

office buildings. These costs are amortized using the straight-line method over their

estimated useful lives.

(l) Asset impairment

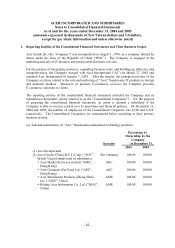

Effective January 1, 2005, the Consolidated Companies adopted ROC Statement of Financial

Accounting Standards No. 35 (“SFAS 35”) “Accounting for Asset Impairment”. In

accordance with SFAS 35, the Consolidated Companies assess at each balance sheet date

whether there is any indication that an asset (individual asset or cash-generating unit) other

than goodwill may have been impaired. If any such indication exists, the Consolidated

Companies estimate the recoverable amount of the asset. The Consolidated Companies

recognize impairment loss for an asset whose carrying value is higher than the recoverable

amount. An impairment loss recognized in prior periods is reversed for assets other than

goodwill if there is indication that the impairment loss recognized no longer exists or has

decreased. The carrying value after the reversal should not exceed the recoverable amount or

the depreciated or amortized balance of the assets assuming no impairment loss was

recognized in prior periods.

The Consolidated Companies perform an impairment test on the cash-generating unit to which

goodwill is allocated on an annual basis and recognize an impairment loss on the excess of

carrying value over the recoverable amount.

(m) Revenue recognition

Revenue from sales of products is recognized at the time products are delivered and the

significant risks and rewards of ownership are transferred to customers. Revenue generated

from service is recognized using the percentage of completion method. Revenue generated

from property development is recognized when the development and construction have been

completed and the property title has been transferred to the customer.

(n) Selling and administrative expenses

The Company’ s selling and administrative (“S&A”) expenses include direct expenses incurred

for the business unit within the Company, and expenses incurred on behalf of investee

companies.

To reflect the operating income of the Consolidated Companies, S&A expenses are divided

into two parts. The first part, representing the direct expenses for the Consolidated

Companies, is included as administrative expenses in the accompanying consolidated

statements of income. The second part, representing expenses incurred on behalf of investee

companies of the Acer Group, is presented as a reduction of net investment income (loss) in

the consolidated statements of income.

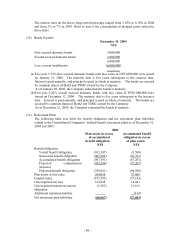

(o) Retirement plan

(1) Defined benefit retirement plans

The Company and its domestic subsidiaries established individual noncontributory

defined benefit retirement plans (the “Plans”) and retirement fund administration

committees. The Plans provide for lump-sum retirement benefits to retiring employees

based on length of service, age, and certain other factors. In accordance with the