Acer 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 63 -

ICA to maintain a record of the corporate income taxes paid and imputation credit that can

be allocated to each resident stockholder. The credit available to the ROC resident

stockholders is calculated by multiplying the dividend with the creditable ratio. The

creditable ratio is calculated by dividing the balance of the ICA by earnings retained since

January 1, 1998.

The non-resident stockholders are not eligible for the imputation credit. However, the

10% income surtax paid on any unappropriated earnings for the years following December

31, 1997, can be offset with the dividend withholding tax for non-resident stockholders

upon distribution of such earnings to such stockholders. As of December 31, 2004 and

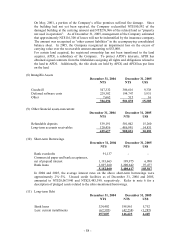

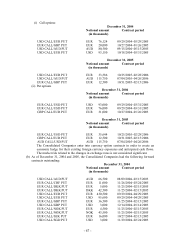

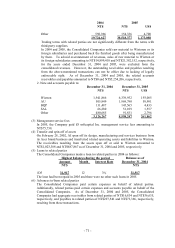

2005, the information related to the integrated tax system was as follows:

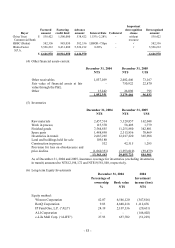

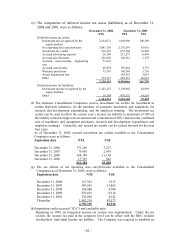

Unappropriated earnings:

December 31, 2004 December 31, 2005

NT$ NT$ US$

Before January 1, 1998 18,106 6,776 206

From January 1, 1998 7,011,661 8,477,502 258,185

7,029,767 8,484,278 258,391

Balance of ICA 79,800 104,732 3,190

The Company’ s estimated creditable ratio for 2005 earnings distribution to domestic

stockholders is approximately 1.23% ; and the actual creditable ratio for 2004 earnings

distribution to domestic stockholders is 1.79% .

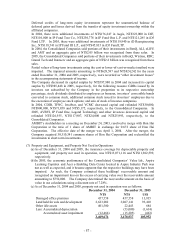

(i) The ROC income tax authorities have examined and assessed the income tax returns of the

Company for all fiscal years through 2001, and have examined and assessed the income

tax returns of Acer Sertek Inc. for all fiscal years through December 31, 2002. for the

fiscal year 2001 and 2002 of Acer Sertek Inc., the Company is filing a appeal toward the

tax authorities for some adjustment made by the tax authorities..

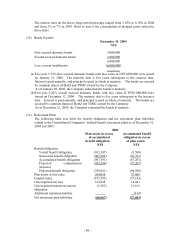

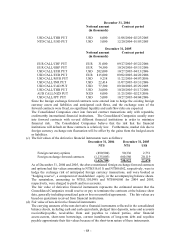

(15) Stockholders’ Equity

(a) Common stock

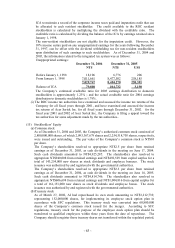

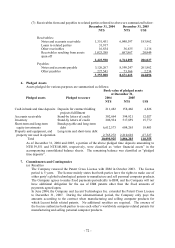

As of December 31, 2004 and 2005, the Company’ s authorized common stock consisted of

2,800,000,000 shares, of which 2,093,367,679 shares and 2,254,518,705 shares, respectively,

were issued and outstanding. The par value of the Company’ s common stock is NT$10

per share.

The Company’ s shareholders resolved to appropriate NT$2.5 per share from retained

earnings as of December 31, 2003, as cash dividends in the meeting on June 17, 2004.

Such cash dividends amounted to NT$4,925,285. The shareholders also resolved to

appropriate NT$940,008 from retained earnings and NT$492,529 from capital surplus for a

total of 143,254,000 new shares as stock dividends and employee bonuses. The stock

issuance was authorized by and registered with the governmental authorities.

The Company’ s shareholders resolved to appropriate NT$2.3 per share from retained

earnings as of December 31, 2004, as cash dividends in the meeting on June 14, 2005.

Such cash dividends amounted to NT$4,814,746. The shareholders also resolved to

appropriate NT$606,694 from retained earnings and NT$1,004,816 from capital surplus for

a total of 161,151,000 new shares as stock dividends and employee bonus. The stock

issuance was authorized by and registered with the governmental authorities.

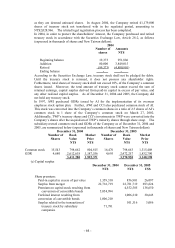

(b) Treasury stock

As of March 27, 2002, AI had repurchased its own stock amounting to NT$3,212,739,

representing 152,000,000 shares, for implementing its employee stock option plan in

accordance with SFC regulations. This treasury stock was converted into 60,800,000

shares of the Company’ s common stock issued for the merger. According to SFC

regulations, treasury stock for the purpose of the employee stock option plan should be

transferred to qualified employees within three years from the date of repurchase. The

Company should reregister those treasury shares not transferred within the regulated period,