Acer 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 67 -

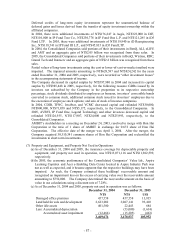

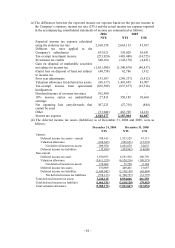

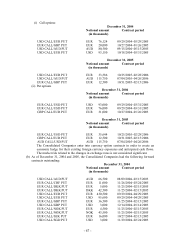

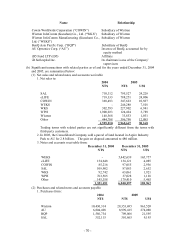

(i) Call options:

December 31, 2004

Notional amount Contract period

(in thousands)

USD CALL/EUR PUT EUR 76,124 09/29/2004~03/29/2005

EUR CALL/GBP PUT EUR 20,000 10/27/2004~01/26/2005

USD CALL/AUD PUT AUD 80,500 09/15/2004~05/15/2005

USD CALL/EUR PUT USD 93,150 10/18/2004~03/31/2005

December 31, 2005

Notional amount Contract period

(in thousands)

USD CALL/EUR PUT EUR 33,586 10/25/2005~02/28/2006

USD CALL/AUD PUT AUD 115,750 07/04/2005~04/26/2006

EUR CALL/GBP PUT EUR 12,500 10/31/2005~02/15/2006

(ii) Put options

December 31, 2004

Notional amount Contract period

(in thousands)

EUR CALL/USD PUT USD 93,000 09/29/2004~03/31/2005

EUR CALL/USD PUT EUR 76,000 09/29/2004~03/31/2005

GBP CALL/EUR PUT EUR 31,000 10/27/2004~01/26/2005

December 31, 2005

Notional amount Contract period

(in thousands)

EUR CALL/USD PUT EUR 35,644 10/25/2005~02/28/2006

GBP CALL/EUR PUT EUR 12,500 10/31/2005~02/15/2006

AUD CALL/USD PUT AUD 115,750 07/04/2005~04/26/2006

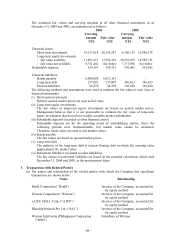

The Consolidated Companies enter into currency option contracts in order to create an

economic hedge for their existing foreign currency exposures and anticipated cash flows.

The market risk related to the changes in exchange rates is not considered significant.

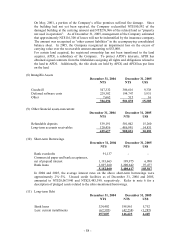

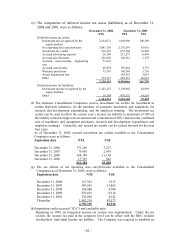

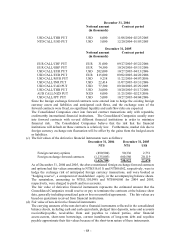

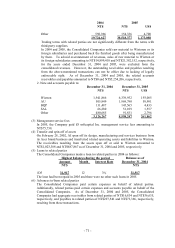

(b) As of December 31, 2004 and 2005, the Consolidated Companies had the following forward

contracts outstanding:

December 31, 2004

Notional amount Contract period

(in thousands)

USD CALL/AUD PUT AUD 66,500 08/09/2004~03/15/2005

EUR CALL/CHF PUT EUR 11,000 11/26/2004~03/24/2005

EUR CALL/DKK PUT EUR 5,000 11/25/2004~02/15/2005

EUR CALL/DKK PUT DKK 42,500 11/25/2004~02/15/2005

USD CALL/EUR PUT EUR 430,500 09/29/2004~04/29/2005

USD CALL/EUR PUT USD 95,600 09/29/2004~04/29/2005

EUR CALL/GBP PUT EUR 36,500 11/25/2004~02/15/2005

USD CALL/GBP PUT USD 3,000 12/14/2004~01/14/2005

EUR CALL/NOK PUT EUR 4,500 11/25/2004~02/15/2005

EUR CALL/NOK PUT NOK 43,500 11/25/2004~02/15/2005

EUR CALL/SEK PUT EUR 16,000 10/27/2004~02/15/2005

USD CALL/SGD PUT USD 3,000 11/29/2004~02/24/2005