Acer 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 62 -

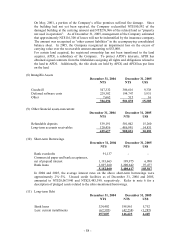

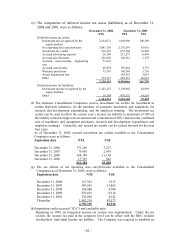

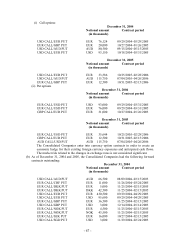

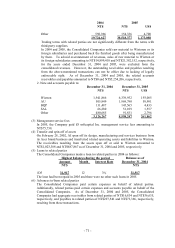

(e) The components of deferred income tax assets (liabilities) as of December 31,

2004 and 2005, were as follows:

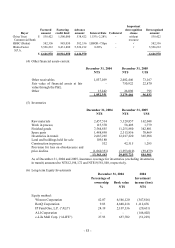

December 31, 2004 December 31, 2005

NT$ NT$ US$

Deferred income tax assets:

Investment loss recognized by the

equity method

2,414,671 3,492,996 106,380

Net operating loss carryforwards 3,081,156 2,755,395 83,916

Investment tax credits 910,351 633,306 19,288

Accrued advertising expense 36,189 213,277 6,495

Accrued sale discounts 220,669 104,361 3,178

Accrued non-recurring engineering

cost

71,641 - -

Accrued cost of sales 46,954 156,024 4,752

Warranty provisions 75,767 188,349 5,736

Assets impairment loss - 165,925 5,053

Other 372,717 885,233 26,961

7,230,115 8,594,866 261,759

Deferred income tax liabilities:

Investment income recognized by the

equity method

1,425,227 2,130,945 64,899

Other 39,304 479,175 14,593

1,464,531 2,610,120 79,492

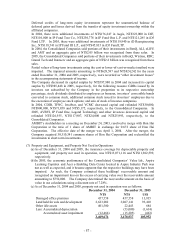

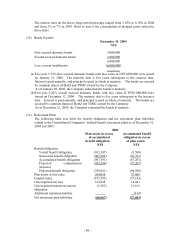

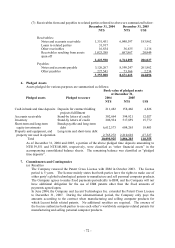

(f) The domestic Consolidated Companies receive investment tax credits for investment in

certain high-tech industries, for the purchase of automatic machinery and equipment, for

research and development expenditures, and for employee training. The investment tax

credits can be used to offset the current year’ s income tax liability (a maximum of 50% of

the liability related to high-tech investment and a maximum of 50% related to the combined

cost of machinery and equipment purchases, research and development expenditures and

employee training). Generally, any unused tax credits can be carried forward for the next

four years.

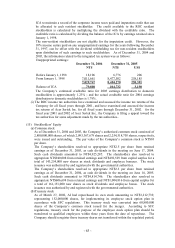

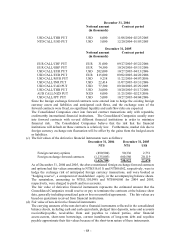

As of December 31, 2005, unused investment tax credits available to the Consolidated

Companies were as follows:

Expiration date NT$ US$

December 31, 2006 171,289 5,217

December 31, 2007 79,436 2,419

December 31, 2008 364,788 11,110

December 31, 2009 17,793 542

633,306 19,288

(g) The tax effects of net operating loss carryforwards available to the Consolidated

Companies as of December 31, 2005, were as follows:

Expiration date NT$ US$

December 31, 2006 115,341 3,513

December 31, 2007 507,681 15,462

December 31, 2008 154,460 4,704

December 31, 2009 279,693 8,518

December 31, 2010 136,002 4,142

Thereafter 1,562,218 47,577

2,755,395 83,916

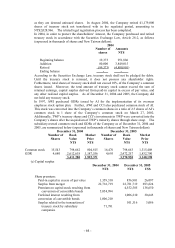

(h) Imputation credit account (“ICA”) and creditable ratio

Beginning in 1998, an integrated income tax system was implemented. Under the tax

system, the income tax paid at the corporate level can be offset with the ROC resident

stockholders’ individual income tax liability. The Company was required to establish an