Acer 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 69 -

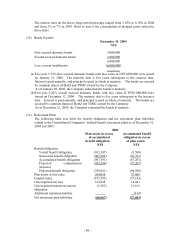

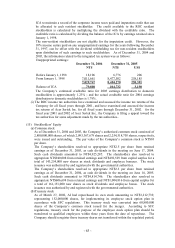

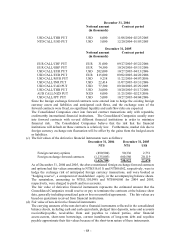

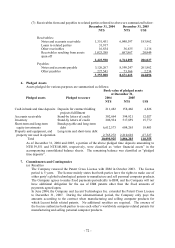

The estimated fair values and carrying amounts of all other financial instruments as of

December 31, 2004 and 2005, are summarized as follows:

2004 2005

Carrying

amount

Fair value

Carrying

amount

Fair value

NT$ NT$ NT$ NT$

Financial assets:

Short-term investments 16,157,618 20,559,287 6,160,138 10,546,378

Long-term equity investments

- fair value available 11,893,157 13,956,192 10,232,075 18,989,721

- fair value not available 8,751,442 See below 7,373,898 See below

Refundable deposits 539,191 539,191 501,042 501,042

Financial liabilities:

Bonds payable 6,000,000 6,027,391 - -

Long-term debt 257,007 257,007 146,623 146,623

Pension liabilities 94,270 94,270 103,620 103,620

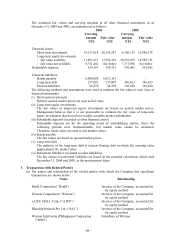

The following methods and assumptions were used to estimate the fair value of each class of

financial instruments:

(i) Short-term investments

Publicly quoted market prices are used as fair value.

(ii) Long-term equity investments

The fair values of long-term equity investments are based on quoted market prices.

Management believes that it is not practicable to estimate the fair value of long-term

equity investments that do not have readily available market information.

(iii) Refundable deposits (recorded as other financial assets)

Refundable deposits are for the operating needs of consolidating entities. Since the

collecting periods were undeterminable, fair market value cannot be estimated.

Therefore, book values are used as fair market values.

(iv) Bonds payable

The fair values are based on quoted market prices.

(v) Long-term debt

The majority of the long-term debt is interest floating debt in which the carrying value

approximates the market value.

(vi) Retirement liabilities (recorded as other liabilities):

The fair values of retirement liabilities are based on the actuarial calculation, which used

December 31, 2004 and 2005, as the measurement dates.

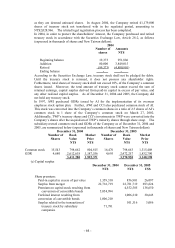

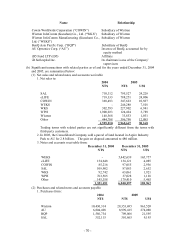

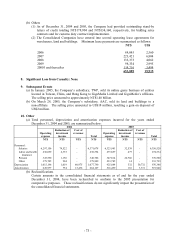

5. Transactions with Related Parties

(a) The names and relationship of the related parties with which the Company had significant

transactions are shown below:

Name Relationship

BenQ Corporation (“BenQ”) Investee of the Company, accounted for

by equity method

Wistron Corporation (“Wistron”) Investee of the Company, accounted for

by equity method

e-LIFE MALL Corp. (“eLIFE”) Investee of the Company, accounted for

by equity method

Bluechip Infotech Pty Ltd. (“SAL”) Investee of the Company, accounted for

by equity method

Wistron InfoComm (Philippines) Corporation

(“WPH”)

Subsidiary of Wistron