Acer 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 35 -

Note 3:

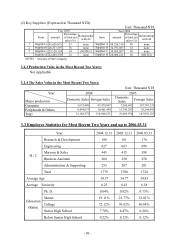

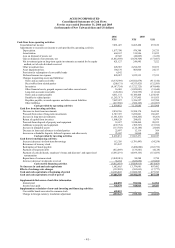

1.Financial Ratio

(1) Total liabilities to Total assets=Total liabilities /Total assets

(2) Long-term debts to fixed assets=Net equity+Long term debts/Net fixed assets

2.Ability to Pay off Debt

(1) Current ratio=Current Assets/Current liability

(2) Quick ratio=Current assets-Inventory-Prepaid expenses/Current liability

(3) Interest protection=Net income before income tax and interest expense/Interest

expense

3.Ability to Operate

(1) Account receivable (including account receivable and notes receivable from operation)

turnover=Net sales/the Average of account receivable (including account

receivable and notes receivable from operation) balance

(2) A/R turnover day=365/account receivable turnover

(3) Inventory turnover=Cost of Goods Sold/the average of inventory

(4) Account payable (including account payable and notes payable from

operation)turnover=Cost of goods sold/the average of account payableincluding

account payable and notes payable from operationbalance

(5) Inventory turnover day=365/Inventory turnover

(6) Fixed assets turnover=Net sales/Net Fixed Assets

(7) Total assets turnover=Net sales/Total assets

4.Earning Ability

(1) Return on assets=PAT+Interest expense×(1-interest rate)/the average of total

assets

(2) Return on equity=PAT/the average of net equity

(3) Net income ratio=PAT/Net sates

(4) EPS = PAT- Dividend from prefer stock/ weighted average outstanding shares

5.Cash Flow

(1) Cash flow ratio=Cash flow from operating activities/Current liability

(2) Cash flow adequacy ratio=Most recent 5-year Cash flow from operating activities/

Most recent 5-year (Capital expenditure+the increase of inventory+cash dividend)

(3) Cash investment ratio=Cash flow from operating activities-cash dividend /

(Gross fixed assets+long-term investment+other assets+working capital)

6. Leverage

(1) Operating leverage=(Nest revenue-variable cost of goods sold and operating

expense)/operating income

(2) Financial leverage=Operating income/(Operating income-interest expenses)