Acer 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 61 -

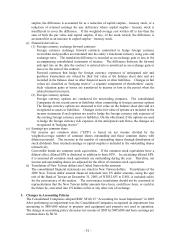

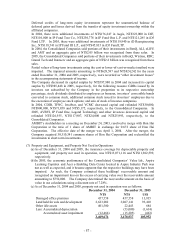

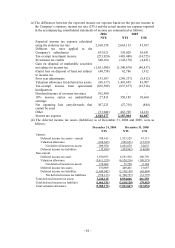

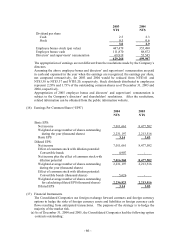

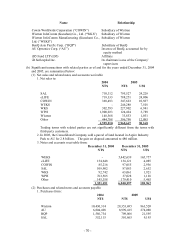

(c) The differences between the expected income tax expense based on the pre-tax income at

the Company’ s statutory income tax rate (25%) and the actual income tax expense reported

in the accompanying consolidated statements of income are summarized as follows:

2004 2005

NT$ NT$ US$

Expected income tax expense calculated

using the statutory tax rate

2,160,150

2,663,133

81,107

Different tax rates applied to the

Company’ s subsidiaries

633,921

330,029

10,051

Tax-exempt investment income (253,924) (483,488) (14,725)

Investment tax credits 540,184 (145,170) (4,421)

Gain on disposal of marketable securities

not subject to income tax

(1,611,090)

(1,340,876)

(40,837)

(Gain) loss on disposal of land not subject

to income tax

(40,758) 62,786 1,912

Prior year adjustments 153,107 (289,337) (8,812)

Valuation allowance for deferred tax assets (88,317) 1,441,695 43,907

Tax-exempt income from operational

headquarters

(838,590) (837,877) (25,518)

Dividend income of overseas investees 592,900 - -

10% income surtax on undistributed

earnings

27,413 350,145 10,664

Net operating loss carryforwards that

cannot be used

307,223 (27,701) (844)

Other (33,042) 463,705 14,123

Income tax expense 1,549,177 2,187,044 66,607

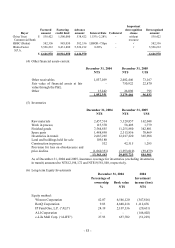

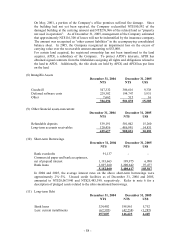

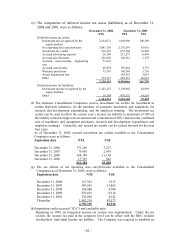

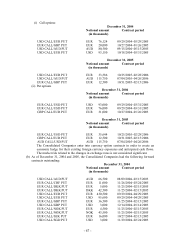

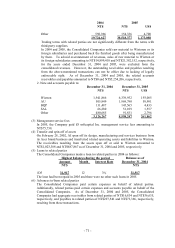

(d) The deferred income tax assets (liabilities) as of December 31, 2004 and 2005, were as

follows:

December 31, 2004 December 31, 2005

NT$ NT$ US$

Current:

Deferred income tax assets—current 768,613 1,553,529 47,313

Valuation allowance (168,643) (501,651) (15,278)

Net deferred income tax assets 599,970 1,051,878 32,035

Deferred income tax liabilities (15,489) (459,962) (14,008)

Non-current:

Deferred income tax asset 5,590,593 6,591,936 200,759

Valuation allowance (5,411,529) (6,520,216) (198,575)

Net deferred income tax assets 179,064 71,720 2,184

Deferred income tax assets 870,909 449,401 13,687

Deferred income tax liabilities (1,449,042) (2,150,158) (65,484)

Net deferred income tax liabilities (578,133) (1,700,757) (51,797)

Total deferred income tax assets 7,230,115 8,594,866 261,759

Total deferred income tax liabilities (1,464,531) (2,610,120) (79,492)

Total valuation allowance (5,580,172) (7,021,867) (213,853)