Acer 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

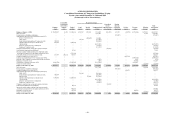

- 40 -

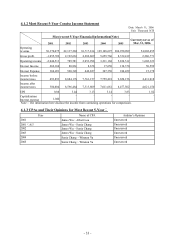

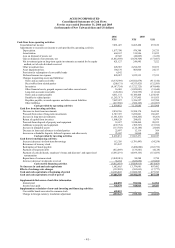

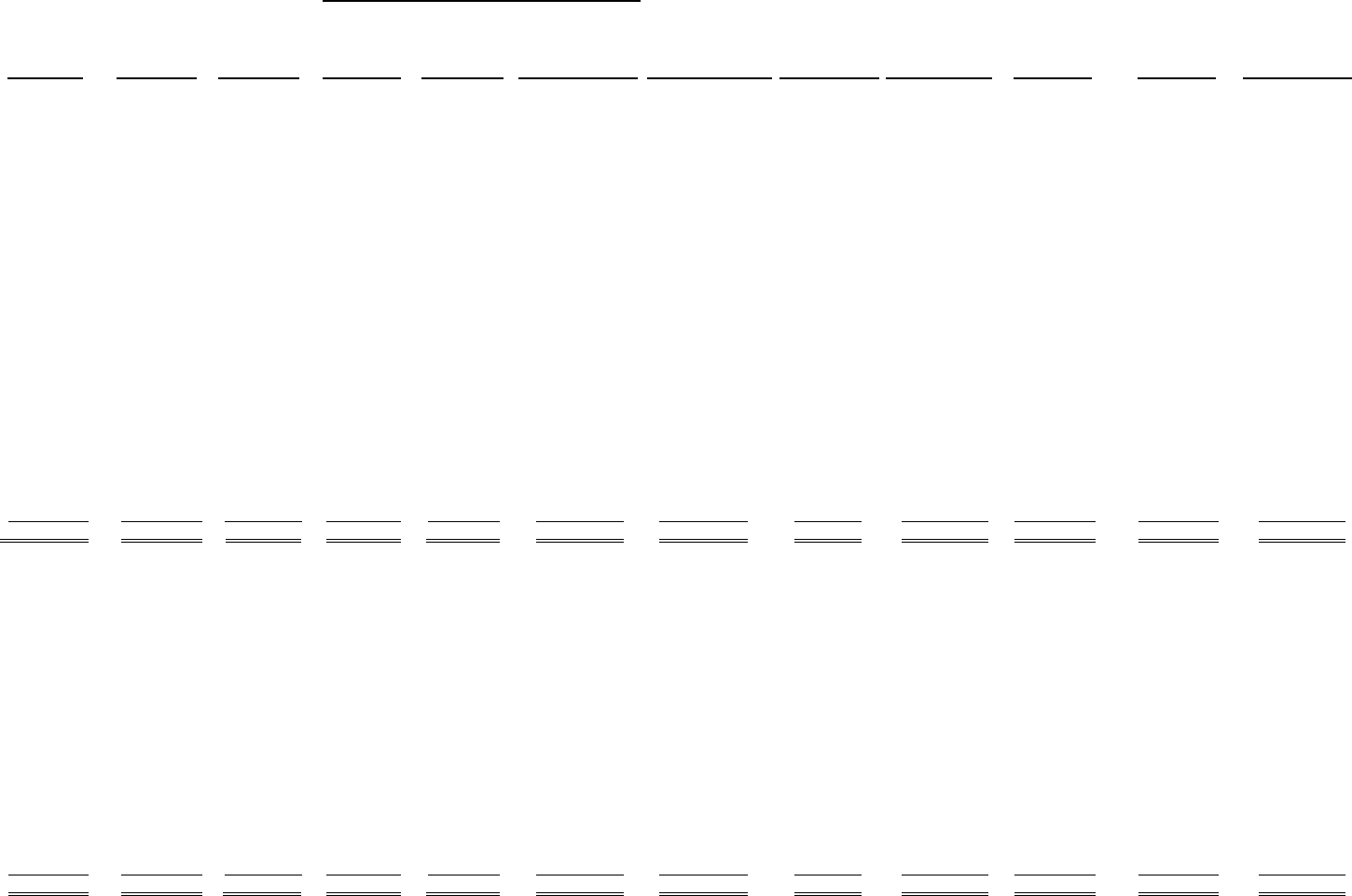

ACER INCORPORATED

Consolidated Statements of Changes in Stockholders’ Equity

For the years ended December 31, 2004 and 2005

(in thousands of New Taiwan dollars)

Convertible Retained earnings

Common

stock

bonds being

converted to

common

stock

Capital

surplus

Legal

reserve

Special

reserve

Unappropriated

earnings

Unrealized

loss on

long-term equity

investments

Foreign

currency

translation

adjustment

Hedging

reserve

Treasury

stock

Minority

interest

Total

stockholders’

equity

Balance at January 1, 2004 $ 20,650,877 86,121 33,347,630 4,188,567 1,671,291 9,512,855 (186,122) 491,763 (24,370) (6,730,384) 1,478,983 64,487,211

2004 net income - -

- - - 7,011,661 - - - - 79,762 7,091,423

Foreign currency translation adjustment - -

- - - - - (359,247) - - - (359,247)

Appropriation approved by the stockholders (note 4(15):

Reverse of special reserve -

-

- - (409,440) 409,440 - - - - - -

Legal reserve -

-

- 731,382 - (731,382) - - - - - -

Stock dividends and employees’ bonuses in stock 940,008 -

- - - (940,008) - - - - - -

Capital surplus transferred to common stock 492,529 - (492,529) - - - - - - - - -

Cash dividends -

-

- - - (4,925,285) - - - - - (4,925,285)

Directors’ and supervisors’ remuneration -

-

- - - (69,919) - - - - - (69,919)

Employees’ bonuses in cash -

-

- - - (111,870) - - - - - (111,870)

Change in unrealized loss on long-term equity investment - -

- - - - (28,692) - - - - (28,692)

Cash dividends distributed to subsidiaries - - 71,783 - - - - - - - - 71,783

Decrease in capital surplus resulting from long-term equity

investments accounted for by the equity method (note 4(6)) -

- (597,980) - - - - - - - - (597,980)

Convertible bonds converted into common stock 255,787 (86,121) 515,357 - - - - - - - - 685,023

Change in hedging reserve (note 4(17)) - -

- - - - - - (492,241) - - (492,241)

Common stock repurchased by the Company (note 4(15)) - -

- - - - - - - (3,849,015) - (3,849,015)

Disposal of the Company’ s common stock held by subsidiaries - -

- - - (2,872) - - - 2,202 - (670)

Reissuance of treasury stock - -

- - - (803) - - - 336,050 - 335,247

Cancellation of treasury stock (note 4(15)) (1,405,524) - (2,302,293) - - (3,122,050) - - - 6,829,867 - -

Change in minority interest - - - - - - - - - - (18,049) (18,049)

Balance at December 31, 2004 $ 20,933,677 - 30,541,968 4,919,949 1,261,851 7,029,767 (214,814) 132,516 (516,611) (3,411,280) 1,540,696 62,217,719

2005 net income - -

- - - 8,477,502 - - - - (12,014) 8,465,488

Foreign currency translation adjustment - -

- - - - - (359,322) - - - (359,322)

Change in hedging reserve (note 4(17)) - -

- - - - - - 582,673 - - 582,673

Appropriation approved by the stockholders (note 4(15)): -

-

- - - - - - - - - -

Legal reserve -

-

- 701,166 - (701,166) - - - - - -

Stock dividends and employees’ bonuses in stock 606,694 -

- - - (606,694) - - - - - -

Special reserve -

-

- - 755,968 (755,968) - - - - - -

Capital surplus transferred to common stock 1,004,816 - (1,004,816) - - - - - - - - -

Cash dividends -

-

- - - (4,814,746) - - - - - (4,814,746)

Directors’ and supervisors’ remuneration -

-

- - - (55,545) - - - - - (55,545)

Employees’ bonuses in cash -

-

- - - (88,872) - - - - - (88,872)

Change in unrealized loss on long-term equity investments -

-

- - - - 214,360 - - - - 214,360

Cash dividends distributed to subsidiaries - - 68,318 - - - - - - - - 68,318

Increase in capital surplus resulting from long-term equity

investments accounted for by the equity method (note 4(6))

-

- 985,448

-

-

-

-

-

-

-

- 985,448

Reissuance of treasury stock - - (38,785) - - - - - - 140,360 - 101,575

Change in minority interest - - - - - - - - - - (67,645) (67,645)

Balance at December 31, 2005 $ 22,545,187 - 30,552,133 5,621,115 2,017,819 8,484,278 (454) (226,806) 66,062 (3,270,920) 1,461,037 67,249,451