Acer 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

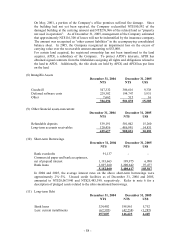

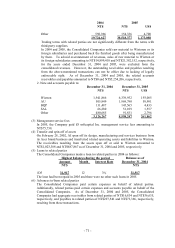

- 68 -

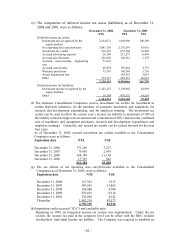

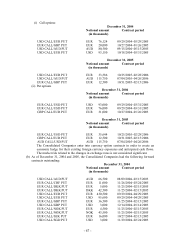

December 31, 2004

Notional amount Contract period

(in thousands)

USD CALL/THB PUT USD 6,000 11/08/2004~02/25/2005

NTD CALL/USD PUT USD 3,000 12/20/2004~01/03/2005

December 31, 2005

Notional amount Contract period

(in thousands)

EUR CALL/CHF PUT EUR 31,000 09/27/2005~05/22/2006

EUR CALL/GBP PUT EUR 74,500 10/24/2005~03/31/2006

USD CALL/EUR PUT USD 202,000 10/27/2005~04/13/2006

USD CALL/EUR PUT EUR 815,000 09/02/2005~04/28/2006

USD CALL/MYR PUT USD 9,238 11/22/2005~04/07/2006

USD CALL/INR PUT USD 22,414 11/07/2005~03/31/2006

USD CALL/CAD PUT USD 77,500 09/20/2005~05/29/2005

USD CALL/THB PUT USD 34,000 10/20/2005~01/17/2006

AUD CALL/NZD PUT NZD 8,000 11/25/2005~02/23/2006

USD CALL/JPY PUT USD 5,000 10/27/2005~04/04/2006

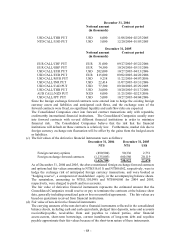

Since the foreign exchange forward contracts were entered into to hedge the existing foreign

currency assets and liabilities and anticipated cash flows, and the exchange rates of the

forward contracts were fixed, no significant liquidity and cash flow risks are expected.

The Consolidated Companies enter into forward contract transactions only with reputable,

creditworthy international financial institutions. The Consolidated Companies usually enter

into forward contracts with several different financial institutions in order to minimize

financial risk. The Consolidated Companies believe that the risk that the financial

institutions will default on these contracts is relatively low. Furthermore, market risk due to

foreign currency exchange rate fluctuation will be offset by the gains from the hedged assets

or liabilities.

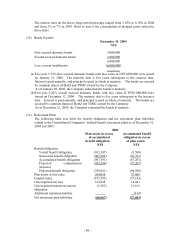

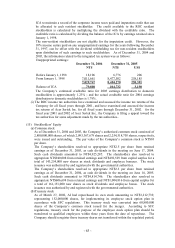

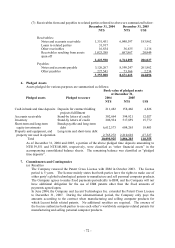

(c) The fair values of the derivative financial instruments were as follows:

December 31, 2004 December 31, 2005

NT$ NT$ US$

Foreign currency options (490,904) 90,336 2,751

Foreign exchange forward contracts (1,135,805) 660,586 20,119

(1,626,709) 750,922 22,870

As of December 31, 2004 and 2005, the above-mentioned foreign exchange forward contracts

and options had fair values amounting to NT$(516,611) and NT$66,062, respectively, were to

hedge the exchange risk of anticipated foreign currency transactions, and were booked as

“hedging reserve”, a component of stockholders’ equity, in the accompanying balance sheets.

The remainders, amounting to NT$(1,110,098) and NT$684,860 for 2004 and 2005,

respectively, were charged to profit and loss accounts.

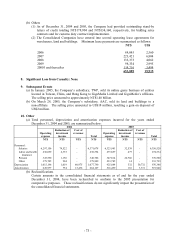

The fair value of derivative financial instruments represents the estimated amount that the

Consolidated Companies would receive or pay to terminate the contracts at the balance sheet

date, generally including unrealized gain or loss on unsettled agreements. The fair values are

based on quotations received from financial institutions.

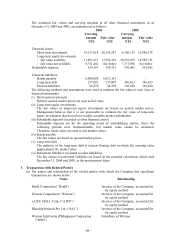

(d) Fair value of non-derivative financial instruments

The carrying amounts of the non-derivative financial instruments reflected in the consolidated

balance sheets, including cash and cash equivalents, pledged time deposits, notes and accounts

receivable/payable, receivables from and payables to related parties, other financial

assets-current, short-term borrowings, current installments of long-term debt and royalties

payable approximate their fair values because of the short-term nature of these instruments.