Acer 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 52 -

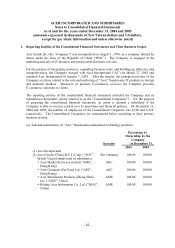

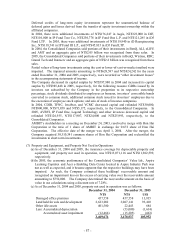

4. Significant Account Disclosures

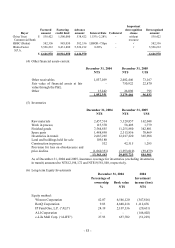

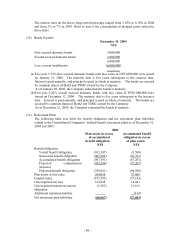

(1) Cash and Cash Equivalents

December 31, 2004 December 31, 2005

NT$ NT$ US$

Cash on hand 142,501 2,741,698 83,499

Cash in banks 13,931,443 19,229,592 585,643

Time deposits 1,607,884 6,278,692 191,220

Investments in short-term commercial

paper and repurchased government bonds

4,877

232,671

7,086

15,686,705 28,482,653 867,448

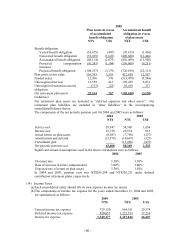

(2) Short-term Investments

December 31, 2004 December 31, 2005

NT$ NT$ US$

Equity securities 6,143,802 2,932,957 89,324

Mutual funds 9,924,298 3,227,473 98,294

Bonds 104,429 - -

Allowance for decline of short-term

investment

(14,911) (292) (9)

16,157,618 6,160,138 187,609

In 2005, the Consolidated Companies recognized a decline in value of part of its equity

securities amounting to NT$1,470,051 as the fair value of such equity securities has been

continually decreased to some extent and for some periods. The losses were recorded as

“other investment losses” in the accompanying statements of income.

In 2004 and 2005, the Consolidated Companies disposed of portions of short-term investments

and recognized a gain on disposal of investments of NT$3.35 billion and NT$3.43 billion,

respectively, in the accompanying consolidated statements of income.

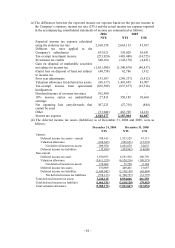

(3) Notes and Account Receivables

December 31, 2004 December 31, 2005

NT$ NT$ US$

Notes and accounts receivables 34,759,499 64,717,484 1,970,991

Allowance for doubtful accounts (820,383) (855,489) (26,054)

33,939,116 63,861,995 1,944,937

In 2004 and 2005, the Consolidated Companies sold raw material to Taiwan ODMs or their

foreign subsidiaries and purchased back the finished goods after being manufactured by them.

To advoid overstatement of revenues, sales of raw material to OEMs amounting to

NT$53,875,498 and NT$103,324,407, respectively, for the years ended December 31, 2004

and 2005, were excluded from the consolidated revenues. However, the outstanding

receivables and payables resulting from the above-mentioned transactions can not be offset

due to lacking of legally enforceable right. As of December 31, 2004 and 2005, the related

accounts receivables and payables amounted to NT$7,328,797 and NT$16,171,226,

respectively.

As of December 31, 2005, the factored accounts receivable which conformed to the

derecognition criteria were as follows: