Acer 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 64 -

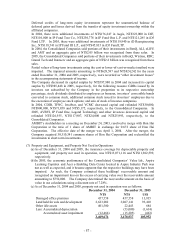

as they are deemed unissued shares. In August 2004, the Company retired 41,179,000

shares of treasury stock not transferred with in the regulated period, amounting to

NT$2,028,966. The related legal registration process has been completed.

In 2004, in order to protect the shareholders’ interest, the Company purchased and retired

treasury stock in accordance with the Securities Exchange Law, Article 28-2, as follows

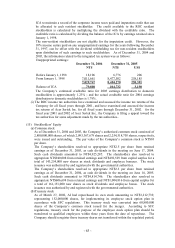

(expressed in thousands of shares and New Taiwan dollars):

2004

Number of Amounts

shares NT$

Beginning balance 19,373 951,886

Addition 80,000 3,849,015

Retired (99,373) (4,800,901)

Ending balance - -

According to the Securities Exchange Law, treasury stock shall not be pledged for debts.

Until the treasury stock is reissued, it does not possess any shareholder rights.

Furthermore, total shares of treasury stock shall not exceed 10% of the Company’ s common

shares issued. Moreover, the total amount of treasury stock cannot exceed the sum of

retained earnings, capital surplus derived from paid-in capital in excess of par value, and

any other realized capital surplus. As of December 31, 2004 and 2005, the Company did

not hold any treasury stock.

In 1997, AWI purchased GDRs issued by AI for the implementation of its overseas

employee stock option plan. Further, AWI and CCI also purchased common stock of AI.

This stock was converted into the Company’ s common shares in a ratio of 2.5 shares of AI’ s

common stock to l share of the Company’ s common stock on March 27, 2002.

Additionally, TWP’ s treasury shares and CCI’ s investments in TWP were converted into the

Company’ s shares after the acquisition of TWP’ s minority shares through share swap. The

subsidiary-owned common stock and GDRs of the Company as of December 31, 2004 and

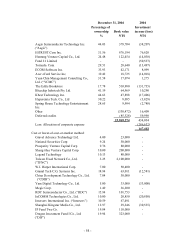

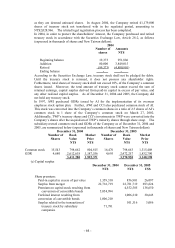

2005, are summarized below (expressed in thousands of shares and New Taiwan dollars):

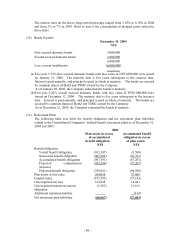

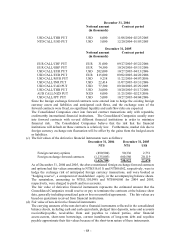

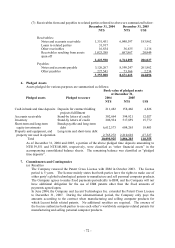

December 31, 2004 December 31, 2005

Number of

Shares

Book

Value

Market

Price

Number of

Shares

Book

Value

Market

Price

NT$ NT$ NT$ NT$

Common stock 15,543 798,662 804,815 16,476 798,663 1,315,408

GDR 4,680 2,612,618 1,187,556 4,695 2,472,257 1,832,790

3,411,280 1,992,371 3,270,920 3,148,198

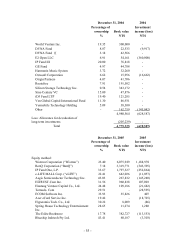

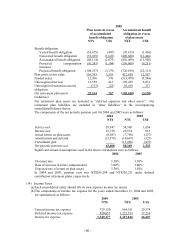

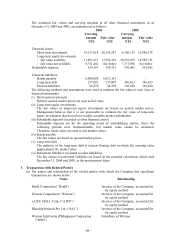

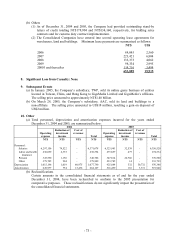

(c) Capital surplus

December 31, 2004 December 31, 2005

NT$ NT$ US$

Share premium:

Paid-in capital in excess of par value 1,359,310 856,901 26,097

Surplus from merger 22,781,719 22,781,719 693,824

Premium on capital stock resulting from

conversion of convertible bonds

5,054,994

4,552,585 138,650

Forfeited interest resulting from

conversion of convertible bonds

1,006,210

1,006,210 30,645

Surplus related to the transaction of

treasury stock by subsidiary

companies

71,781

101,316 3,086