Acer 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 57 -

Deferred credits of long-term equity investments represent the unamortized balance of

deferred gains and losses derived from the transfer of equity investment ownership within the

affiliated companies.

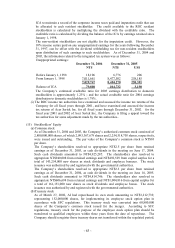

In 2004, there were additional investments of NT$176,247 in Aegis, NT$323,000 in DIF,

NT$110,000 in IP Fund Two Co., NT$230,778 in IP Fund One L.P. and NT$121,285 in iD5

Fund LTP. In 2005, there were additional investments of NT$119,940 in iD Reengineering

Inc., NT$118,541 in IP Fund III L.P., and NT$45,835 in iD5 Fund LTP.

In 2004, the Consolidated Companies sold portions of their investments in BenQ, ALI, eLIFE

and AMT and an aggregate gain of NT$2.05 billion was recognized from these sales. In

2005, the Consolidated Companies sold portions of their investments in BenQ, Wistron, RDC,

Granal Tech and Interserv and an aggregate gain of NT$2.2 billion was recognized from these

sales.

Partial values of long-term investments using the cost or lower-of-cost-or-market method were

impaired. The impaired amounts amounting to NT$628,587 and NT$824,242 for the years

ended December 31, 2004 and 2005, respectively, were recorded as “other investment losses”

in the accompanying statements of income.

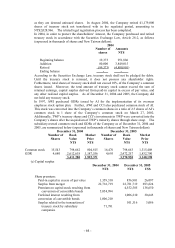

The Company decreased its capital surplus by NT$597,980 in 2004 and increased its capital

surplus by NT$985,448 in 2005, respectively, for the following reasons: GDRs issued by its

investees not subscribed by the Company in the proportion to its respective ownership

percentage, stock dividends distributed to employees as bonuses, investees’ convertible bonds

converted to common stock, additional common stock issued to investees’ employees due to

the execution of employee stock options; and sale of stock of investee companies.

In 2004, CDIB, TFNC, InveStar, and YCMC decreased capital and refunded NT$30,000,

NT$900,000, NT$71,858 and NT$5,175, respectively, to the Consolidated Companies. In

2005, AVBVI, IP Fund One, Legend Technology and other investees decreased capital and

refunded NT$126,935, NT$117,907, NT$24,000 and NT$25,993, respectively, to the

Consolidated Companies.

AMBIT’ s stockholders in a meeting on December 24, 2003, resolved to merge with Hon Hai

Corporation at the ratio of 1 share of AMBIT in exchange for 0.672 share of Hon Hai

Corporation. The effective date of the merger was April 1, 2004. After the merger, the

Company acquired 30,310,341 common shares of Hon Hai Corporation and reclassified the

investments to short-term investments.

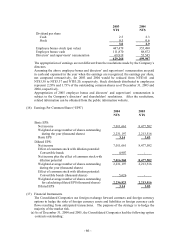

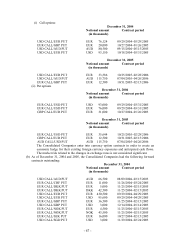

(7) Property and Equipment, and Property Not Used in Operations

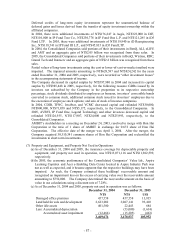

(a) As of December 31, 2004 and 2005, the insurance coverage for depreciable property and

equipment, and property not used in operation, was NT$13,071,116 and NT$11,962,599,

respectively.

(b) In 2005, the economic performance of the Consolidated Companies’ Value lab., Aspire

Learning Copmlex and Acer e-Enabling Data Center located in Aspire Industry Park was

not as well as expected, and it became apparent that the respective buildings may have been

impaired. As such, the Company estimated these buildings’ recoverable amount and

recognized an impairment loss on the excess of carrying value over the recoverable amount

amounting to $752,000. The Company determined the recoverable amount on the basis of

value in use calculations using a discount rate of 7.28%.

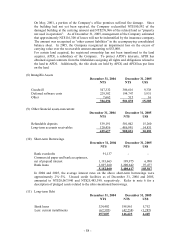

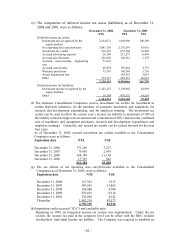

(c) As of December 31, 2004 and 2005, property not used in operation was as follows:

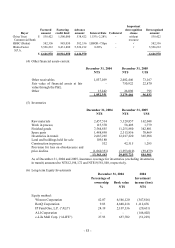

December 31, 2004 December 31, 2005

NT$ NT$ US$

Damaged office premises 457,558 457,558 13,935

Land held for sale and development 2,623,082 3,067,141 93,410

Other idle assets 401,500 22,443 684

Less: Accumulated depreciation - (53,000) (1,614)

Accumulated asset impairment (12,466) (15,205) (463)

3,469,674 3,478,937 105,952