Abercrombie & Fitch 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

69

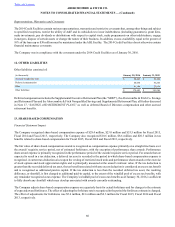

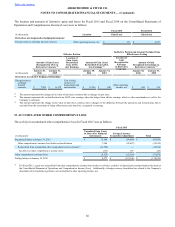

19. CONTINGENCIES

The Company is a defendant in lawsuits and other adversary proceedings arising in the ordinary course of business. Legal costs

incurred in connection with the resolution of claims and lawsuits are generally expensed as incurred, and the Company establishes

reserves for the outcome of litigation where losses are deemed probable and reasonably estimable. The Company’s assessment of

the current exposure could change in the event of the discovery of additional facts with respect to legal matters pending against

the Company or determinations by judges, juries, administrative agencies or other finders of fact that are not in accordance with

the Company’s evaluation of claims. As of January 30, 2016, the Company had accrued charges of approximately $19 million for

certain legal contingencies. In addition, there are certain claims and legal proceedings pending against the Company for which

accruals have not been established. Actual liabilities may exceed the amounts reserved, and there can be no assurance that final

resolution of these matters will not have a material adverse effect on the Company’s financial condition, results of operations or

cash flows.

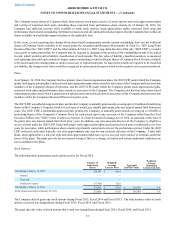

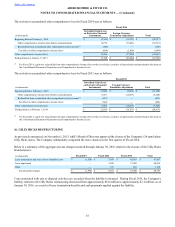

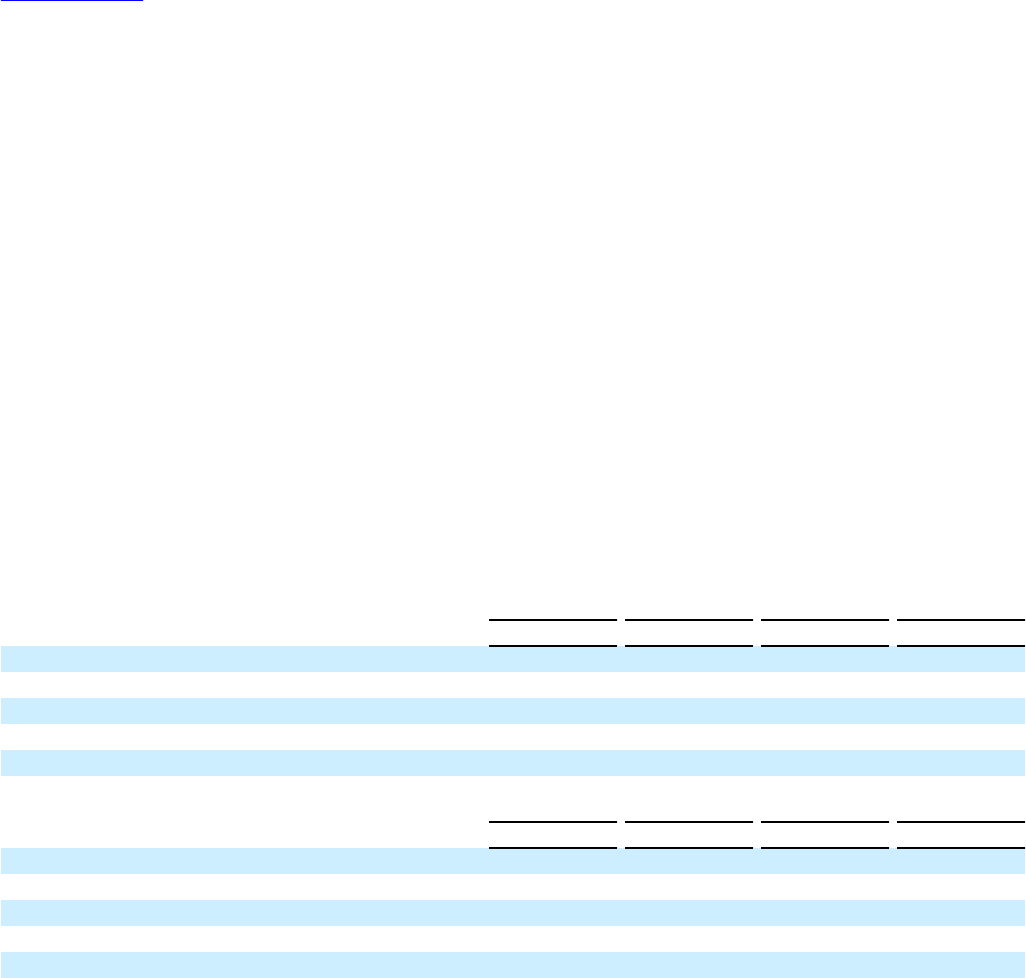

20. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized unaudited quarterly financial results for Fiscal 2015 and Fiscal 2014 are presented below. See “RESULTS OF

OPERATIONS,” in “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS,” of this Annual Report on Form 10-K for information regarding items included below that could

affect comparability between quarter results.

(in thousands, except per share amounts)

Fiscal Quarter 2015 First Second Third Fourth

Net sales $ 709,422 $ 817,756 $ 878,572 $ 1,112,930

Gross profit $ 411,549 $ 509,862 $ 559,787 $ 676,345

Net income (loss) $ (63,246) $ 612 $ 42,285 $ 58,908

Net income (loss) attributable to A&F(2)(4) $ (63,246) $ (810) $ 41,891 $ 57,741

Net income (loss) per diluted share attributable to A&F(1) $ (0.91) $ (0.01) $ 0.60 $ 0.85

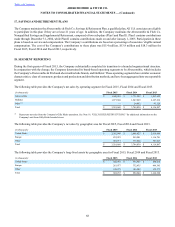

(in thousands, except per share amounts)

Fiscal Quarter 2014 First Second Third Fourth

Net sales $ 822,428 $ 890,605 $ 911,453 $ 1,119,544

Gross profit $ 511,659 $ 552,956 $ 567,070 $ 681,885

Net income (loss) $ (23,671) $ 12,877 $ 18,227 $ 44,388

Net income (loss) attributable to A&F(3)(5) $ (23,671) $ 12,877 $ 18,227 $ 44,388

Net income (loss) per diluted share attributable to A&F(1) $ (0.32) $ 0.17 $ 0.25 $ 0.63

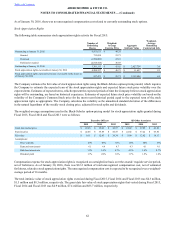

(1) Net income (loss) per diluted share for each of the quarters was computed using the weighted average number of shares outstanding during the quarter

while the full year is computed using the average of the weighted average number of shares outstanding each quarter; therefore, the sum of the quarters

may not equal the total for the year.

(2) Net income (loss) attributable to A&F for Fiscal 2015 included certain items related to inventory write-down, asset impairment, legal settlement

charges, store fixture disposal, the Company’s profit improvement initiative, lease termination and store closure costs and restructuring. These items

adversely impacted in net income (loss) attributable to A&F by $26.1 million, $9.4 million and $16.0 million for the first, second and fourth quarters

of Fiscal 2015, respectively, and increased net income attributable to A&F by $9.0 million for the third quarter of Fiscal 2015.

(3) Net income (loss) attributable to A&F for Fiscal 2014 included certain items related to asset impairment, the Company’s profit improvement initiative,

lease termination and store closure costs, restructuring and corporate governance matters. These items adversely impacted net income (loss) attributable

to A&F by $10.7 million, $1.2 million, $12.2 million and $36.4 million for the first, second, third and fourth quarters of Fiscal 2015, respectively.

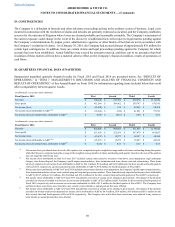

(4) Net income (loss) attributable to A&F for Fiscal 2015 included the correction of certain errors relating to prior periods. The impact of the amounts

recorded out-of-period resulted in a decrease in net income attributable to A&F of $2.6 million and $1.9 million for the second and fourth quarters of

Fiscal 2015, respectively, and an increase in net income attributable to A&F of $1.2 million for the third quarter of Fiscal 2015. The Company does

not believe these corrections were material to any current or prior interim or annual periods that were affected.

(5) Net income (loss) attributable to A&F for Fiscal 2014 included the correction of certain errors relating to prior periods. The impact of the amounts

recorded out-of-period adversely impacted net income (loss) attributable to A&F by $0.9 million, $0.9 million, $0.8 million and $0.1 million for the

first, second, third and fourth quarters of Fiscal 2014, respectively. The Company does not believe these corrections were material to any current or

prior interim or annual periods that were affected.