Abercrombie & Fitch 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

38

Policy Effect if Actual Results Differ from Assumptions

Income Taxes

The provision for income taxes is determined using the asset

and liability approach. Tax laws often require items to be

included in tax filings at different times than the items are being

reflected in the financial statements. A current liability is

recognized for the estimated taxes payable for the current year.

Deferred taxes represent the future tax consequences expected

to occur when the reported amounts of assets and liabilities are

recovered or paid. Deferred taxes are adjusted for enacted

changes in tax rates and tax laws. Valuation allowances are

recorded to reduce deferred tax assets when it is more likely

than not that a tax benefit will not be realized.

The Company does not expect material changes in the

judgments, assumptions or interpretations used to calculate the

tax provision for Fiscal 2015. However, changes in these

judgments, assumptions or interpretations may occur and could

have a material impact on the Company’s income tax provision.

As of the end of Fiscal 2015, the Company had recorded

valuation allowances of $1.6 million.

A provision for U.S. income tax has not been recorded on

undistributed net income of our non-U.S. subsidiaries earned

through October 31, 2015, which the Company has determined

to be indefinitely reinvested outside the U.S. Following a

corporate restructuring to support omnichannel growth, the

Company has provided deferred U.S. income taxes for net

income generated after October 31, 2015 from its non-U.S.

subsidiaries.

If the Company’s intention or U.S. and/or international tax law

changes in the future, there may be a material impact on the

provision for income taxes in the period the change occurs. The

amount of indefinitely reinvested net income that would be

subject to U.S. income tax upon repatriation and for which no

U.S. income taxes have been provided is $126.6 million as of

January 30, 2016.

The Company records uncertain tax positions in accordance

with ASC 740 on the basis of a two-step process in which (1)

we determine whether it is more likely than not that the tax

positions will be sustained on the basis of the technical merits

of the position and (2) for those tax positions that meet the more-

likely-than-not recognition threshold, we recognize the largest

amount of tax benefit that is more than 50 percent likely to be

realized upon ultimate settlement with the related tax authority.

Uncertain tax positions are adjusted periodically based on

currently available evidence. Changes will impact the income

tax provision and the effective tax rate in the period in which

an adjustment is made. The Company recognizes accrued

interest and penalties related to uncertain tax positions as a

component of tax expense.

Of the total amount accrued for uncertain tax positions, it is

reasonably possible that $1.25 million to $1.75 million could

change in the next 12 months due to audit settlements, expiration

of statutes of limitations or other resolution of uncertainties.

Due to the uncertain and complex application of tax laws and/

or regulations, it is possible that the ultimate resolution of audits

may result in amounts which could be different from the amount

estimated. In such case, the Company will record an adjustment

in the period in which such matters are effectively settled.

Legal Contingencies

The Company is a defendant in lawsuits and other adversarial

proceedings arising in the ordinary course of business. Legal

costs incurred in connection with the resolution of claims and

lawsuits are expensed as incurred, and the Company establishes

reserves for the outcome of litigation where it is probable that

a loss has been incurred and such loss is estimable. Significant

judgment may be applied in assessing the probability of loss

and in estimating the amount of such losses.

Actual liabilities may exceed or be less than the amounts

reserved, and there can be no assurance that the final resolution

of these matters will not have a material adverse effect on the

Company’s financial condition, results of operations or cash

flows.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

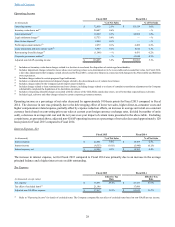

Investment Securities

The Company maintains its cash equivalents in financial instruments, primarily money market funds and U.S. treasury bills, with

original maturities of three months or less.

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match respective funding obligations

to participants in the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan I, the Abercrombie &

Fitch Co. Nonqualified Savings and Supplemental Retirement Plan II and the Supplemental Executive Retirement Plan. The Rabbi

Trust assets primarily consist of trust-owned life insurance policies which are recorded at cash surrender value. The change in

cash surrender value of the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $3.1 million,

$3.2 million and $2.6 million for Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively, recorded in interest expense, net on the

Consolidated Statements of Operations and Comprehensive Income (Loss).