Abercrombie & Fitch 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

48

Costs incurred to physically move merchandise to stores is recorded in cost of sales, exclusive of depreciation and amortization

in the Company's Consolidated Statements of Operations and Comprehensive Income (Loss).

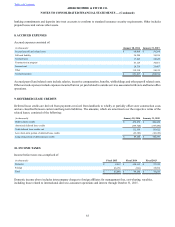

Marketing, general & administrative expense

Marketing, general and administrative expense includes: photography and social media; store marketing; home office compensation,

except for those departments included in stores and distribution expense; information technology; outside services such as legal

and consulting; relocation; recruiting; samples; and travel expenses.

Restructuring charge

Restructuring charge consists of exit costs and other costs associated with the reorganization of the Company's operations, including

employee termination costs, lease contract termination costs, impairment of assets, and any other qualifying exit costs. Costs

associated with exit or disposal activities are recorded when the liability is incurred or when such costs are deemed probable and

estimable and represent the Company's best estimates.

Other operating income, net

Other operating income, net included income of $2.2 million, $10.2 million and $9.0 million related to insurance recoveries for

Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively; and income of $4.7 million, $5.8 million and $8.8 million for Fiscal 2015,

Fiscal 2014 and Fiscal 2013, respectively, related to gift card balances whose likelihood of redemption has been determined to be

remote.

Advertising costs

Advertising costs are comprised of in-store photography, e-mail distribution and other digital direct advertising and other media

advertising and are reported on the Consolidated Statements of Operations and Comprehensive Income (Loss). Advertising costs

related specifically to direct-to-consumer operations are expensed as incurred as a component of stores and distribution expense.

The production of in-store photography and signage are expensed when the marketing campaign commences as a component of

marketing, general and administrative expense. All other advertising costs are expensed as incurred as a component of marketing,

general and administrative expense. The Company recognized $80.7 million, $84.6 million and $68.1 million in advertising expense

in Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively.

Leased facilities

The Company leases property for its stores under operating leases. Lease agreements may contain construction allowances, rent

escalation clauses and/or contingent rent provisions.

Annual store rent is comprised of a fixed minimum amount and/or contingent rent based on a percentage of sales. For construction

allowances, the Company records a deferred lease credit on the Consolidated Balance Sheets and amortizes the deferred lease

credit as a reduction of rent expense on the Consolidated Statements of Operations and Comprehensive Income (Loss) over the

term of the lease. For scheduled rent escalation clauses during the lease term, the Company records minimum rental expense on

a straight-line basis over the term of the lease on the Consolidated Statements of Operations and Comprehensive Income (Loss).

The difference between rent expense and the amounts paid under the lease, less amounts attributable to the repayment of construction

allowances recorded as deferred rent, is included in accrued expenses and other liabilities on the Consolidated Balance Sheets.

The term over which the Company amortizes construction allowances and minimum rental expenses on a straight-line basis begins

on the date of initial possession, which is generally when the Company enters the space and begins construction.

Certain leases provide for contingent rents, which are determined as a percentage of gross sales. The Company records a contingent

rent liability in accrued expenses on the Consolidated Balance Sheets, and the corresponding rent expense on the Consolidated

Statements of Operations and Comprehensive Income (Loss) on a ratable basis over the measurement period when it is determined

that achieving the specified levels during the fiscal year is probable. In addition, most leases require payment of real estate taxes,

insurance and certain common area maintenance costs in addition to future minimum lease payments.