Abercrombie & Fitch 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

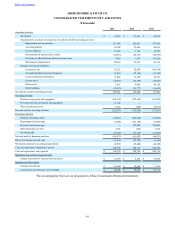

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

53

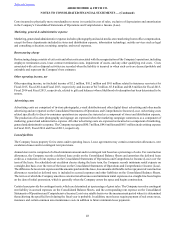

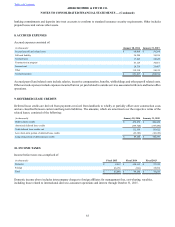

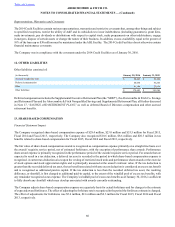

4. INVENTORIES, NET

Inventories, net consisted of:

(in thousands) January 30, 2016 January 31, 2015

Inventories $ 466,918 $ 484,865

Less: Lower of cost or market reserve (19,616) (12,707)

Less: Shrink reserve (10,601) (11,364)

Inventories, net $ 436,701 $ 460,794

The inventory balance, net of reserves, included inventory in transit from vendors of $71.7 million and $56.1 million at January 30,

2016 and January 31, 2015, respectively. Inventory in transit is considered to be merchandise owned by the Company that has not

yet been received at a Company distribution center.

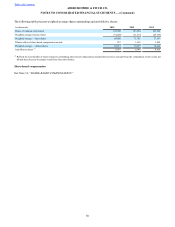

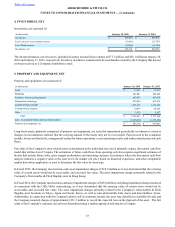

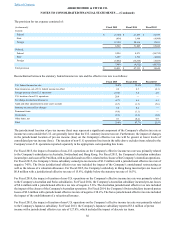

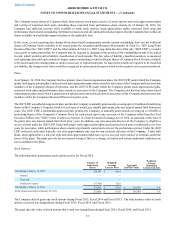

5. PROPERTY AND EQUIPMENT, NET

Property and equipment, net consisted of:

(in thousands) January 30, 2016 January 31, 2015

Land $ 37,451 $ 37,473

Buildings 287,081 286,820

Furniture, fixtures and equipment 682,013 653,929

Information technology 479,269 427,879

Leasehold improvements 1,283,613 1,338,206

Construction in progress 19,875 49,836

Other 3,135 3,107

Total $ 2,792,437 $ 2,797,250

Less: Accumulated depreciation and amortization (1,898,259) (1,830,249)

Property and equipment, net $ 894,178 $ 967,001

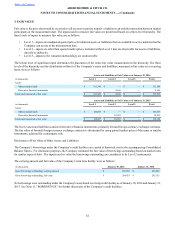

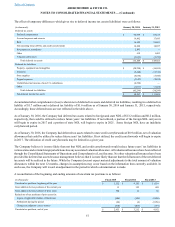

Long-lived assets, primarily comprised of property and equipment, are tested for impairment periodically or whenever events or

changes in circumstances indicate that the carrying amount of the assets may not be recoverable. Factors used in the evaluation

include, but are not limited to, management’s plans for future operations, recent operating results, and undiscounted projected cash

flows.

Fair value of the Company's store-related assets is determined at the individual store level, primarily using a discounted cash flow

model that utilizes Level 3 inputs. The estimation of future cash flows from operating activities requires significant estimates of

factors that include future sales, gross margin performance and operating expenses. In instances where the discounted cash flow

analysis indicates a negative value at the store level, the market exit price based on historical experience, and other comparable

market data where applicable, is used to determine the fair value by asset type.

In Fiscal 2015, the Company incurred non-cash asset impairment charges of $18.2 million as it was determined that the carrying

value of certain assets would not be recoverable and exceeded fair value. The asset impairment charges primarily related to the

Company's Abercrombie & Fitch flagship store in Hong Kong.

In Fiscal 2014, the Company incurred non-cash asset impairment charges of $45.0 million, excluding impairment charges incurred

in connection with the Gilly Hicks restructuring, as it was determined that the carrying value of certain assets would not be

recoverable and exceeded fair value. The asset impairment charges primarily related to the Company's Abercrombie & Fitch

flagship store locations in Tokyo, Japan and Seoul, Korea, as well as nine abercrombie kids stores and nine Hollister stores.

Additionally, in connection with the Company's plan to sell its corporate aircraft, the asset was classified as available-for-sale and

the Company incurred charges of approximately $11.3 million to record the expected loss on the disposal of the asset. The fair

value of the Company's corporate aircraft was determined using a market approach utilizing level 2 inputs.