Abercrombie & Fitch 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

54

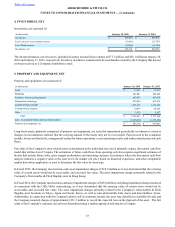

In Fiscal 2013, the Company incurred non-cash asset impairment charges of $46.7 million, excluding impairment charges incurred

in connection with the Gilly Hicks restructuring, as a result of the impact of sales trends on the profitability of a number of stores

identified in the third quarter of Fiscal 2013 as well as fiscal year-end review of store-related long-lived assets. The non-cash asset

impairment charges primarily related to 23 Abercrombie & Fitch stores, four abercrombie kids stores, and 70 Hollister stores. In

addition, the Company incurred charges of $37.9 million related to the Gilly Hicks restructuring.

The Company had $37.3 million and $40.1 million of construction project assets in property and equipment, net at January 30,

2016 and January 31, 2015, respectively, related to the construction of buildings in certain lease arrangements where the Company

is deemed to be the owner of the construction project.

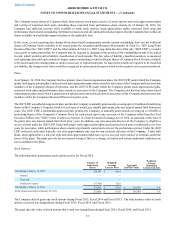

6. RABBI TRUST ASSETS

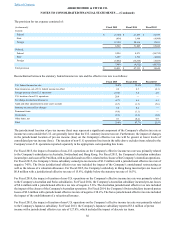

Investments of Rabbi Trust assets consisted of the following:

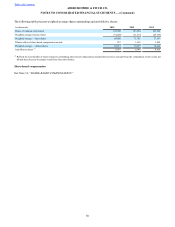

(in thousands) January 30, 2016 January 31, 2015

Rabbi Trust assets:

Trust-owned life insurance policies (at cash surrender value) $ 96,567 $ 93,424

Money market funds 23 24

Total Rabbi Trust assets $ 96,590 $ 93,448

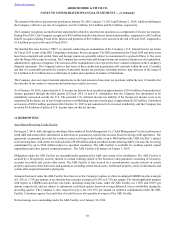

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match respective funding obligations

to participants in the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan I, the Abercrombie &

Fitch Co. Nonqualified Savings and Supplemental Retirement Plan II and the Supplemental Executive Retirement Plan. The Rabbi

Trust assets primarily consist of trust-owned life insurance policies which are recorded at cash surrender value. The change in cash

surrender value of the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $3.1 million, $3.2

million and $2.6 million for Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively, recorded in interest expense, net on the

Consolidated Statements of Operations and Comprehensive Income (Loss).

The Rabbi Trust assets are included in other assets on the Consolidated Balance Sheets and are restricted in their use as noted

above.

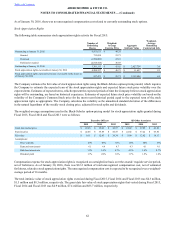

7. OTHER ASSETS

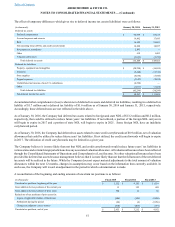

Other assets consisted of:

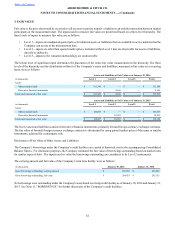

(in thousands) January 30, 2016 January 31, 2015

Rabbi Trust $ 96,590 $ 93,448

Deferred tax assets 89,677 96,999

Long-term deposits 64,098 64,415

Intellectual property 28,057 27,943

Long-term supplies 25,475 31,565

Restricted cash 20,581 14,835

Prepaid income tax on intercompany items 7,344 9,968

Other 28,059 34,021

Other assets $ 359,881 $ 373,194

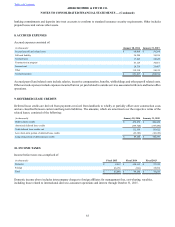

Long-term supplies include, but are not limited to, hangers, frames, sign holders, security tags, back-room supplies and construction

materials. Intellectual property primarily includes trademark assets associated with the Company's international operations,

consisting of finite-lived and indefinite-lived intangible assets of approximately $14.4 million and $13.7 million, respectively, as

of January 30, 2016, and finite-lived and indefinite-lived intangible assets of approximately $15.3 million and $12.6 million,

respectively, as of January 31, 2015. The Company's finite-lived intangible assets are amortized over a useful life of 10 to 20

years. Restricted cash includes various cash deposits with international banks that are used as collateral for customary non-debt